A Kansas City, Missouri-based venture capital firm has had its eyes on Houston since fall of last year, and it's not letting the pandemic slow down its immersion into the local startup ecosystem.

Flyover Capital focuses on tech startups based in the middle of the country — from Denver to Atlanta, and the Twin Cities down to Houston. Usually funding seed to series A rounds, Flyover's thesis is geared at "creating the next generation of tech success stories outside traditional tech hubs," says Dan Kerr, principal at the firm.

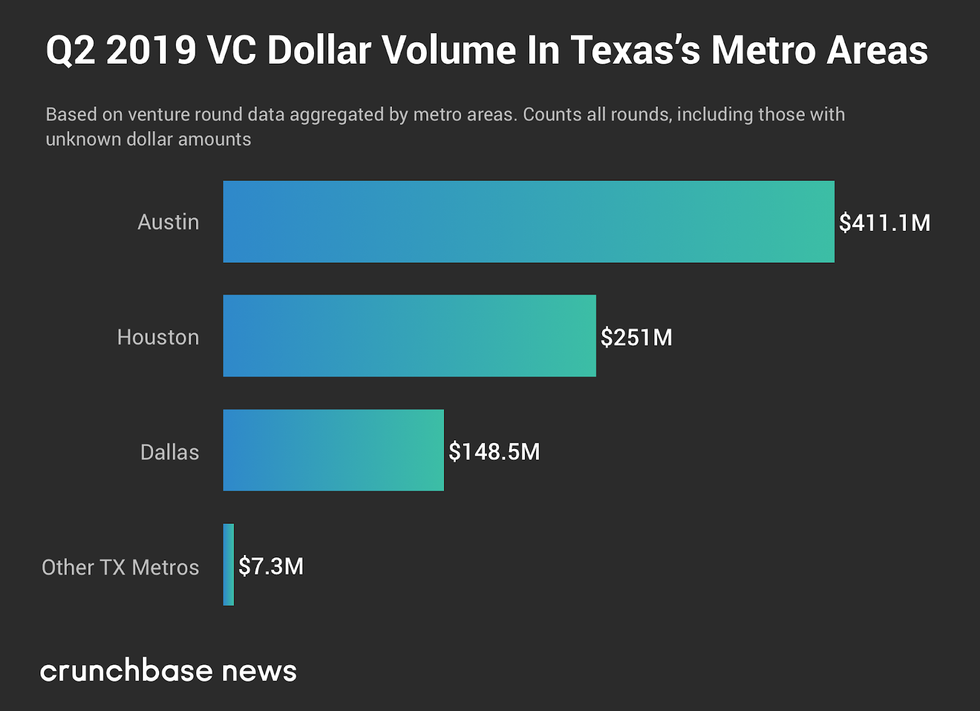

This region, which Crunchbase dubbed "The Mighty Middle" in a recent report, has seen a growth in venture capital invested over the past decade. Annual investment grew from $5.8 billion invested in 2010 to $20.2 billion in 2019 alone, according to the report, and Texas is leading the pack. The Lone Star State accounted for $24 billion of the region's $92.6 billion venture capital invested in the past decade, per the report.

Flyover Capital, which was founded in 2014, has connected a couple dozen Houston startups in the past six months, Kerr says, and the firm is keeping up with several of those to this day. He predicts the firm will "dive in deeper" into some of those companies in the next six months.

Houston is "one of the cities among those that fall in our region where we plan to spend a significant amount of time," Kerr tells InnovationMap. "We cover a lot of ground, but there are certain cities were we try to get there quarterly. Houston is definitely one of those places."

Kerr says his first impression of Houston was its strength as a B2B — especially as that pertains to its entrepreneurs.

"There are a lot of people who are experienced in their career, maybe with a technical background, and are looking to build a business going after some problem that they see," Kerr says.

In a similar vein, Houston's corporate involvement with its startup ecosystem has been a big indicator of opportunity.

"One of the things we've identified as a strength in a lot of the middle America ecosystems is if they get the corporations involved, then that is a good marker for success, especially if you have some of the other ingredients involved," Kerr says.

Houston Exponential, which Kerr says has been helpful in allowing Flyover to tap into the ecosystem — especially in times like these — has also demonstrated Houston's strength as a B2B community with deep corporate connections.

And Flyover isn't the only VC firm that HX has seen interest from recently. This month, HX has planned more immersion days — where it connects VCs to startup development organizations and startups across town — than it's ever had in a single month, says Harvin Moore, president of HX. The immersion days will be happening completely online.

"It's clear from the indication that we get from VCs and angel networks that people are saying, 'Okay, we need to be looking for new deals,'" Moore says.

For Flyover Capital, Kerr describes the VC as "active, but of course cautious" when it comes to investing in new deals in the current economic environment.

"We're not alone in saying we're actively investing," Kerr says. "I think I've seen some surveys that 60 or so percent of investors are saying they're staying the course."

In fact, finding a positive spin, Kerr says the pandemic has had a "moderating effect" to the investment environment. "Rounds were happening in some cases in a crazy manner," he says of pre-COVID conditions.

Plus, while he hasn't seen a huge change to valuations, the economic conditions caused by COVID-19 could correct some of the over-valuations on the coasts.

"As unfortunate as these times are for lots of people, this is where many companies ultimately find their footing and success," Kerr says.

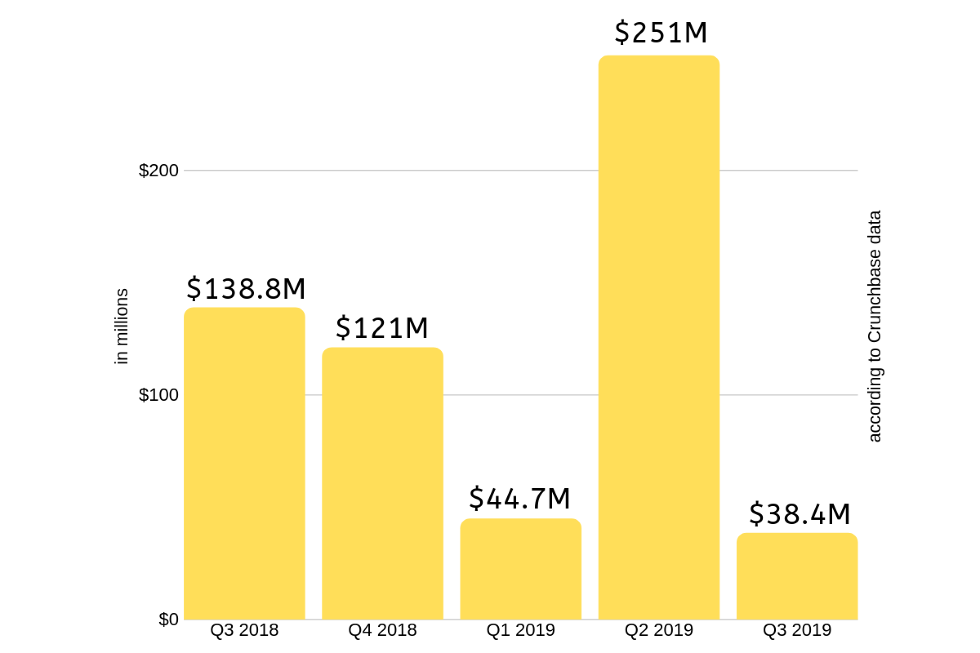

Chart via InnovationMap using Crunchbase data.

Chart via InnovationMap using Crunchbase data.

Chart via

Chart via