Editor's note: As 2019 comes to a close, InnovationMap is looking back at the year's top stories in Houston innovation. When it came to the money raised in Houston, five stories of new funds and closed rounds trended among readers.

These 7 Houston startups closed millions in funding in September

Seven Houston startups are beginning October with fresh funding. Photo by Tim Leviston/Getty Images

September was a busy month for several Houston startups. Seven companies closed rounds throughout the month and are now beginning the fourth quarter of 2019 with fresh funds.

InnovationMap has rounded up these seven deals based on previous stories as well as new information. Scroll through to see which Houston startups are catching the eyes — and cashing the checks — of investors. To continue reading this top story, click here.

3 TMCx companies have raised funds while completing the Houston accelerator

Three companies in TMCx's current cohort are leaving the program with new funds. Courtesy of TMCx

The Texas Medical Center's accelerator program is wrapping up its Digital Health cohort this week with the culmination of its TMCx Demo Day, and, while all of the companies have something to celebrate, three have announced that they are leaving the program with fresh funds.

Meru, Roundtrip, and Sani Nudge have raised over $10 million between the three companies. All three will be presenting at the TMCx Digital Health Demo Day on June 6 with the 16 other companies in the cohort. To continue reading this top story, click here.

5 Houston startups beginning 2019 with new capital

These five companies are starting 2019 out with some cash, and here's what they plan on doing with it. Getty Images

Finding growing Houston startups is as easy as following the money, and a few local companies are starting 2019 strong with a recent round of funding closed. InnovationMap has rounded up a few recent raises to highlight heading into the new year. To continue reading this top story, click here.

Exclusive: Houston-based stadium ordering app closes near $1.3 million Seed round with plans to scale

Houston-based sEATz has closed a funding round and plans to reach more fans than ever this football season. Courtesy of sEATz

Fans across the country are headed to football stadiums this weekend to cheer on their teams, but only a few will have the luxury of ordering food, beer, and even merchandise from the comfort of their seats.

Houston-based sEATz has created a platform where fans can order just about anything their stadium has from an app. Much like any other ordering app, once the order is placed, a runner will pick up the food and deliver it to the customer for a small fee and a tip.

The startup is now preparing to scale up from seven venues to 10 before the year is over as well as launching a new version of the app thanks to an oversubscribed near $1.3 million Seed round led by Houston-based Valedor Partners. Houston-based Starboard Star Venture Capital also contributed to the round. SEATz has plans to launch its Series A round before the new year. To continue reading this top story, click here.

Female-led venture capital firm launches in Houston to move the needle on investment in women-owned companies

A new venture capital firm launched in Houston to focus on female-led startups. Courtesy of The Artemis Fund

Three powerhouse investment minds have teamed up to launch a female-focused seed and series A venture capital firm in Houston.

In its first $20 million fund, The Artemis Fund will invest in around 30 women-led companies, and will award a $100,000 investment prize at the Rice Business Plan Competition, which takes place April 4 through 6. According to the company's press release, The Artemis Fund is the first of its kind — being female-led and female-focused — in Houston.

"There is a wealth of female leadership in the Houston innovation ecosystem, and we would like to see the same representation in the investor the investor community to help female founders thrive," says Stephanie Campbell, co-founder and principal of The Artemis Fund. To continue reading this top story, click here.

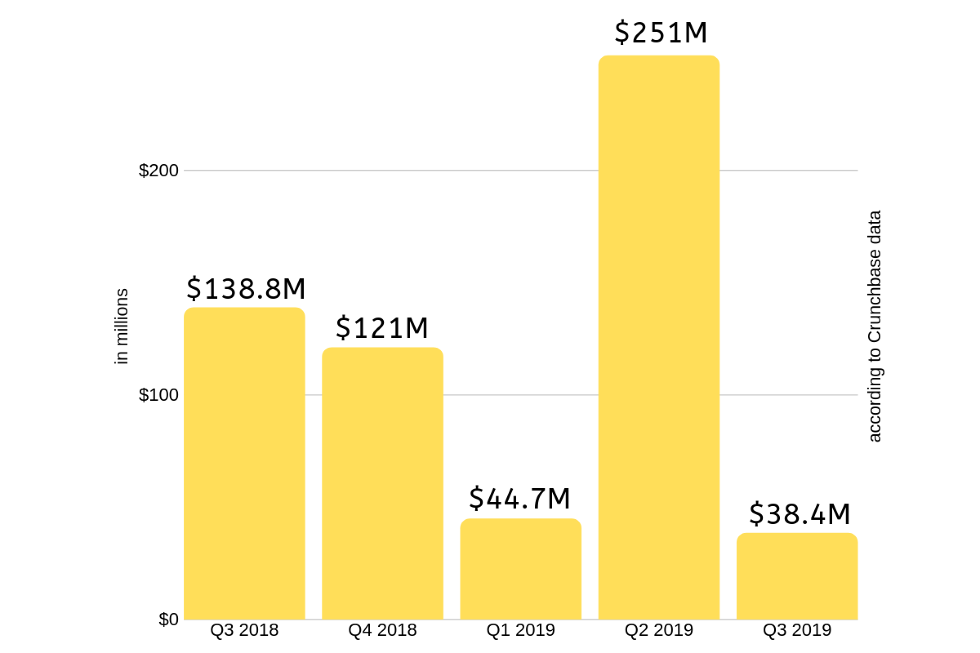

Chart via InnovationMap using Crunchbase data.

Chart via InnovationMap using Crunchbase data. Houston-based Galen Data is growing its clientbase and just formed two new partnerships with medical device companies. Photo via galendata.com

Houston-based Galen Data is growing its clientbase and just formed two new partnerships with medical device companies. Photo via galendata.com

Cemvita Factory

Cemvita Factory It might not be surprising to discover that the energy capital of the world is a hub for energy startups. Getty Images

It might not be surprising to discover that the energy capital of the world is a hub for energy startups. Getty Images