Editor's note: As 2020 comes to a close, InnovationMap is looking back at the year's top stories in Houston innovation. When it came to the money raised in Houston, these five startups raised the most, according to reporting done by InnovationMap.

Preventice Solutions' $137M series B

![]()

Preventice Solutions reportedly raised $137 million to grow its medical device business. Photo via Getty Images

Houston-based Preventice Solutions, a medical device company, raised a $137 million series B in July. The round was led by Palo Alto-based Vivo Capital along with support from existing investors, including Merck Global Health Innovation Fund, Boston Scientific, and the Samsung Catalyst Fund.

The funds were raised in order "to accelerate investment in salesforce expansion, technology and product innovation and further development of clinical evidence supporting its flagship solution," according to the news release.

"We are pleased to have Vivo Capital and Novo Holdings as new investors, and with this funding we are poised to further accelerate our growth," says Jon P. Otterstatter, CEO of Preventice Solutions, in a press release. "We are setting a new standard for monitoring of cardiac arrythmia patients. Our robust and growing success with physicians and payers accentuates the compelling value proposition of using novel technology to improve diagnosis, while also increasing the efficiency of healthcare delivery."

HighRadius's $125M series B

![]()

Houston-based HighRadius has reported reaching unicorn status following a $125 million raise. Photo via highradius.com

High Radius started out 2020 strong, reportedly reaching unicorn status with the closing of a $125 million series B round.

The Houston startup, an artificial intelligence-powered fintech software company, announced the round was led by ICONIQ Capital, with participation from existing investors Susquehanna Growth Equity and Citi Ventures, according to a news release from the company.

"Today marks an important milestone for HighRadius and we're thrilled to have ICONIQ join us in our vision to modernize the Order to Cash space," says Sashi Narahari, founder and CEO of HighRadius, in a news release. "ICONIQ combines patient capital with a long-term vision of investing in category-defining businesses, and the firm has worked with some of the world's most successful tech entrepreneurs. We are building HighRadius into a self-sustaining, long-term category leader, and ICONIQ is a great partner for us in this journey."

The company, which offices in West Houston, was founded in 2006 founded in 2006 and employs more than 1,000 people in North America, Europe, and Asia. In November, HighRadius opened an office in Amsterdam. According to the news release, the company will use the funds to further expand its global footprint.

GoExpedi's $25M series C

![]()

Tim Neal, CEO of Houston-based GoExpedi, shares how his company plans to scale following its recent series C closing. Photo by Colt Melrose for GoExpedi

In September, GoExpedi announced it had raised $25 million in series C funding led by San Francisco-based Top Tier Capital Partners with participation from San Jose Pension Fund, Houston-based CSL Ventures, San Francisco-based Crosslink Capital and Hack VC, New York-based Bowery Capital, and more. Last year, GoExpedi raised $25 million in a series B round — also led by Top Tier Capital — and $8 million in a series A just a few months before.

"This new injection of capital will help us advance our digital platform for MRO and supply chain systems and accelerate the rollout of our new robotics operations, as well as deepen our technology team to help us meet new, insatiable demand," says Tim Neal, CEO of GoExpedi, in a news release. "Leveraging our intuitive, customer-focused, and interactive intelligence platform is a no-brainer for companies seeking to modernize their respective supply chains.

Founded in 2017, the e-commerce, supply chain, and analytics company, is using the funds to expand beyond energy into adjacent markets and further develop its machine learning software, robotics, and advanced analytics technologies. According to the release, the company also plans to hire.

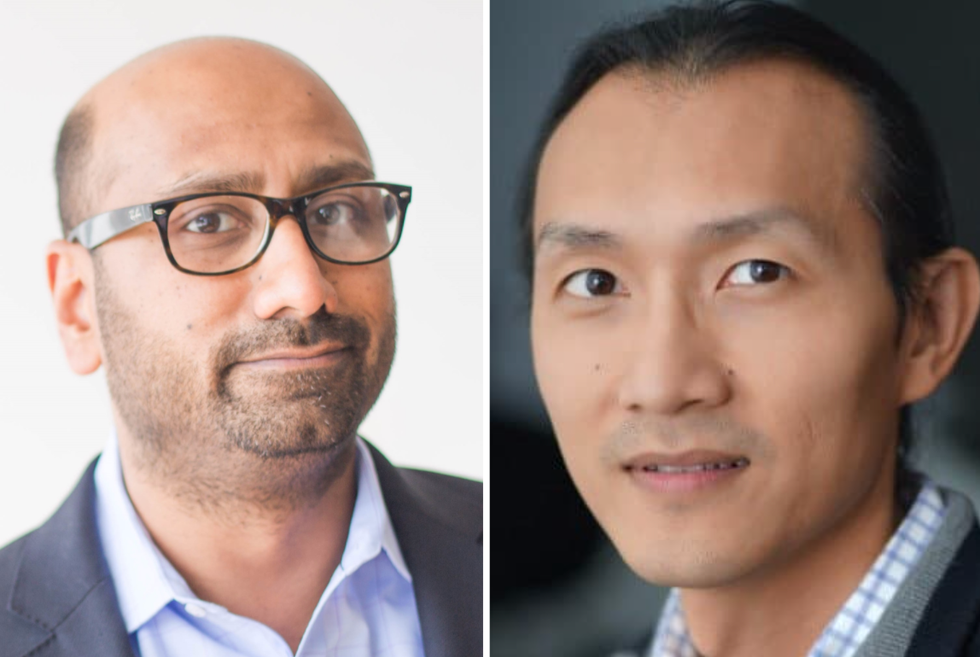

Liongard's $17M series B

![]()

Houston-based SaaS company, Liongard, has closed its recent fundraising round led by one of HX Venture Fund's portfolio funds. Getty Images

Houston-based, fast-growing software-as-a-service company, Liongard, closed its $17 million round in May round in May. It was led by Updata Partners with contribution by TDF Ventures, Integr8d Capital, and private investors. With customers in 20 countries, Liongard saw triple-digit customer growth and doubled its staff over the past 18 months, according to a news release.

Liongard's CEO, Joe Alapat, who co-founded the company with COO Vincent Tran in 2015, says that the new funds will continue to support its Roar platform — a software product that creates a single dashboard for all data systems and allows automation of managed service providers, or MSPs, for auditing and security within a company's IT.

"Since the launch of Liongard, the platform's adoption and popularity with MSPs has grown rapidly, transforming Liongard into a highly recognized brand in the MSP ecosystem," Alapat says in the release. "This new investment and the continued confidence of our investors will fuel our growth by giving us the means to further advance our solution's capabilities and serve our customers at an even better level."

Liongard's total funding now sits at over $20 million. Last year, the company raised a $4.5 million series A round following a $1.3 million seed round in 2018. TDF Ventures and Integr8d Capital have previously invested in the company.

Lead investor, Updata Partners, is based in Washington D.C. and invests in SaaS, tech-enabled service providers, and digital media and e-commerce. The HX Venture Fund, a fund-of-funds under Houston Exponential, has invested in Updata Partner's recent fund.

Ambyint's $15M series B

![]()

Ambyint, which has offices in Calgary and Houston, has secured funding from Houston venture capital firms. Photo courtesy of Ambyint

In February, Ambyint, which has an office in Houston, closed its $15 million series B funding round with support from local investors. Houston-based Cottonwood Venture Partners led the round, and Houston-based Mercury Fund also contributed — as did Ambyint's management team, according to a news release. The money will be used to grow both its Houston and Calgary, Alberta, offices and expand its suite of software solutions for wells and artificial lift systems.

"This funding round is an important milestone for Ambyint, and we're pleased to benefit from unwavering support among our investors to boost Ambyint to its next phase of growth," says Alex Robart, CEO of Ambyint, in the news release. "It is also a proof point for our approach of combining advanced physics and artificial intelligence, deployed on a scalable software infrastructure, to deliver 10 to 20 percent margin gains in a market where meaningful improvements have been hard to achieve."

Ambyint's technology pairs artificial intelligence with advanced physics and subject matter expertise to automate processes on across all well types and artificial lift systems.

Auto Driving Smart Car image

Auto Driving Smart Car image

good intestine health intestine Food for bowel Health

good intestine health intestine Food for bowel Health

Photo via ambyint.com

Photo via ambyint.com Apple doubles down on Houston with new production facility, training center Photo courtesy Apple.

Apple doubles down on Houston with new production facility, training center Photo courtesy Apple.