Houston health tech startup scores $30,000 prize at annual pitch competition

big winner

A Houston biotech company has won the Texas A&M New Ventures Competition (TNVC). Taurus Vascular took home $30,000 for its first-place victory.

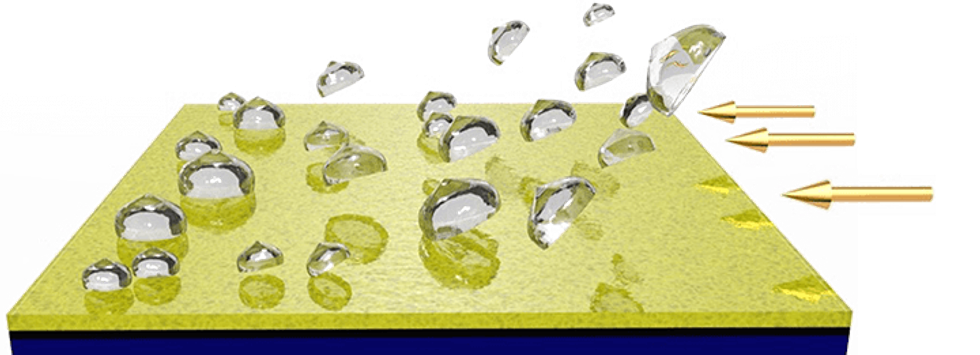

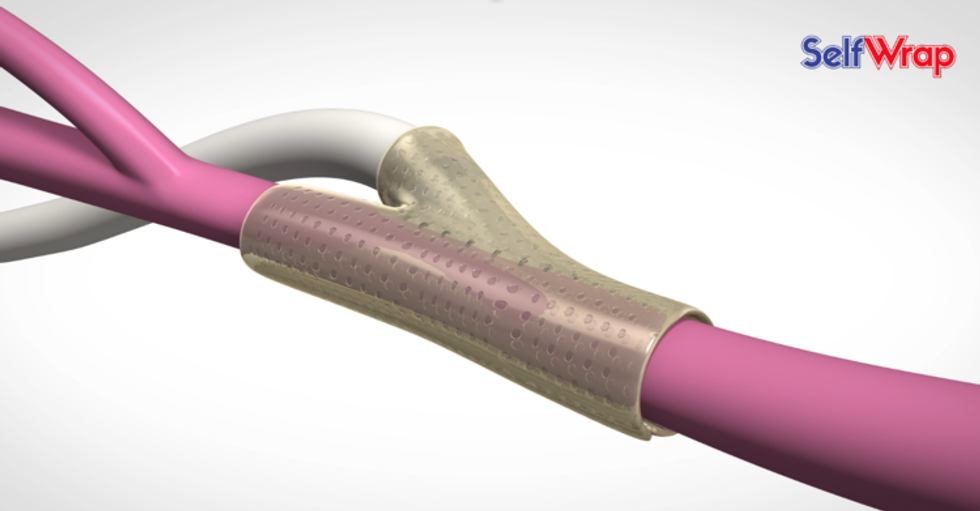

Taurus Vascular is working on a new solution to stopping abdominal aortic aneurysms (AAA) before they rupture and become potentially fatal. The company arose out of the TMC Innovation Biodesign Program. Fellows Matthew Kuhn and Melanie Lowther had a year to bring a company to fruition. The highly qualified team can boast of Kuhn’s more than 40 patents and Lowther’s former role as director of entrepreneurship and innovation at Texas Children’s Hospital.

The competition’s intense process included presenting to commercialization experts across several rounds. In fact, vetting takes four months and includes coaching to help competitors thrive in their pitches.

“As we celebrate the tenth year of the Texas A&M New Ventures Competition, we recognize the significant economic impact these startups have across Texas and their worldwide societal contributions,” says Chris Scotti, TNVC chair, in a news release. “Looking ahead, we are excited to continue fostering innovation and supporting science and engineering-based companies that drive progress and create lasting change.”

In its decade of competitions, TNVC has awarded almost $4 million prizes to startups. This year alone, 27 awards were distributed. Those included investment capital, consulting, legal and engineering services, and other types of support tailored to the winners’ needs.

“We are honored to have won first place at the Texas New Ventures Competition. Competing alongside so many outstanding companies and talented founders makes this recognition even more meaningful and reflects the dedication and hard work of our team at Taurus Vascular,” Kuhn says in a press release. “The financial support and increased visibility from this win will be pivotal for our growth, unlocking new opportunities and partnerships.

"This award strengthens our belief in our mission of reducing endoleak risks in endovascular aortic aneurysm repair and making a positive impact on patient care," he continues. "We are also grateful to Biotex for choosing us as a recipient for their sponsored prize and eagerly anticipate collaborating with them in the next phase of our technology’s development.”

Fewer than 20 percent of patients whose AAAs rupture survive. Kuhn told InnovationMap last year that he hopes to commercialize his technology by 2030. This competition brings patients closer to one day having far better odds when contending with a AAA.

- TMC Innovation names 9 companies to its latest bootcamp ›

- Looking for a job? These 2023 Houston Innovation Awards finalists are hiring ›

- Houston universities reveal teams for summer accelerators ›

- Houston startups dominate ‘most-promising’ companies announcement at annual event ›

- 3 Houston innovators to know this week ›

- Houston biodesign innovators ready to spin out startup with life-saving vascular tech ›