VC roundup: Here's what Houston startups raised funds last quarter

money moves

October means several things — postseason baseball, pumpkins everywhere, and the last quarter of the year.

Before Q4 firmly takes its hold, let's talk about the 10 Houston companies that raised over $526 million between July and September, according to previous reporting from InnovationMap.

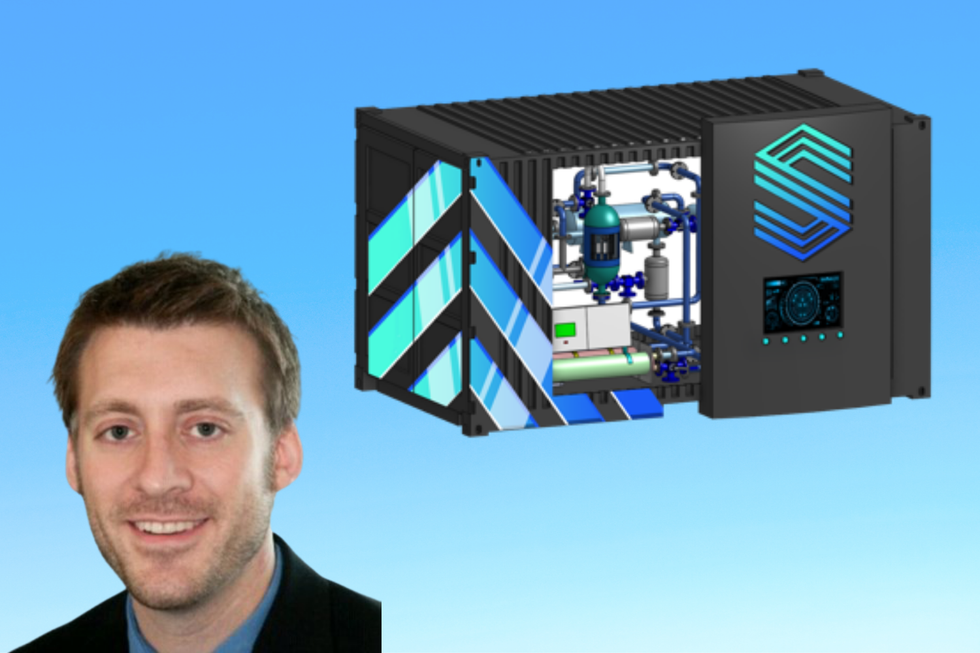

Houston chemicals company raises $357M, claims unicorn status

Solugen closed its Series C funding round at $357 million to grow its chemical products. Photo via Getty Images

Houston-based Solugen, a startup that specializes in combating carbon dioxide emitted during the production of chemicals, has hauled in $357 million in a Series C funding round. That amount eclipses the size of any Houston VC funding round this year or last year.

The Series C round lifts Solugen's pre-money valuation to $1.5 billion, according to the Axios news website. This gives Solugen "unicorn" status as a startup with a valuation of at least $1 billion.

Singapore-based GIC and Edinburgh, Scotland-based Baillie Gifford led the round, with participation from Temasek Holdings, affiliates of BlackRock, Carbon Direct Capital Management, Refactor Capital, and Fifty Years.

Since its founding in 2016, Solugen has raised more than $405 million in venture capital, according to Crunchbase.

"Solugen's vision for cleaner chemicals through synthetic biology has the potential to be a fundamental shift in how chemicals are made, to help tackle the environmental challenges we face globally. The chemical market itself is colossal, and Solugen is just getting started," Kirsty Gibson, investment manager at Baillie Gifford, says. Click here to continue reading.

Rapidly scaling Houston e-commerce software startup raises $98M series B

Houston-based Cart.com, which equips e-commerce businesses with a suite of software services, has raised $140 million in venture capital investment since its founding last year. Photo via cart.com

After closing a sizable series A round in April, a Houston tech startup has closed another round of funding — this time a near $100 million one.

Cart.com, an end-to-end e-commerce software startup and Amazon competitor, closed its series B round at $98 million. The investment announcement follows the company's series A in the spring and, according to a news release, brings Cart.com's total funding to $140 million since it launched eight months ago.

"At Cart.com, we believe e-commerce brands should be free to scale up without having to juggle countless outside vendors, and without compromising their unique vision for their brand," says Omair Tariq, CEO of Cart.com, in the release. "Our one-stop platform supports sellers across the full range of e-commerce functionality, empowering them to efficiently scale up and reach new markets using proven, best-of-breed services and technologies." Click here to continue reading.

AI-backed SaaS company based in Houston secures $30M series B funding

Imubit uses artificial intelligence for optimization at manufacturing plants. The company closed its series B at $30 million. Photo via imubit.com

Houston-based Imubit, whose AI-powered technology provides process optimization for refiners' and chemical operators' manufacturing plants, has raised $30 million in venture capital.

Zeev Ventures led the $30 million Series B round alongside Insight Partners, with participation from existing investors Spider Capital and UpWest. Since its founding in 2016, the company has raised $50 million.

"Imubit's goal is to transcend the industry beyond the decades old process control and optimization software hierarchy. … Today, we are solving previously unsolvable problems that are worth millions of dollars in annual margin to our clients," Gil Cohen, Imubit's co-founder and CEO, says in an August 16 news release. Click here to continue reading.

Houston-based medical device company snags $12.8M in series B

Saranas closed its series B round this week. Photo courtesy of Saranas

A Houston company that's changing the game when it comes to early bleed detection has raised its next round of funding.

Saranas Inc. announced that it closed a $12.8 million series B investment led by Wisconsin-based Baird Capital, the venture capital and global private equity arm of Baird, a global company with a location in Houston. Austin-based S3 Ventures also supported the round.

The company will use the funds to continue its clinical trials, per a news release.

"We are pleased to announce this round of funding led by Baird Capital," says Saranas President and CEO James Reinstein in the release. "It underscores the importance of real-time monitoring of bleeding complications and our opportunity to accelerate the commercialization of Early Bird. We look forward to expanding our clinical evidence through prospective clinical trials and launching next generation products, including Bird on a Wire, to address a much broader range of endovascular procedures." Click here to continue reading.

Houston health tech company raises $7.85M series A led by local VC

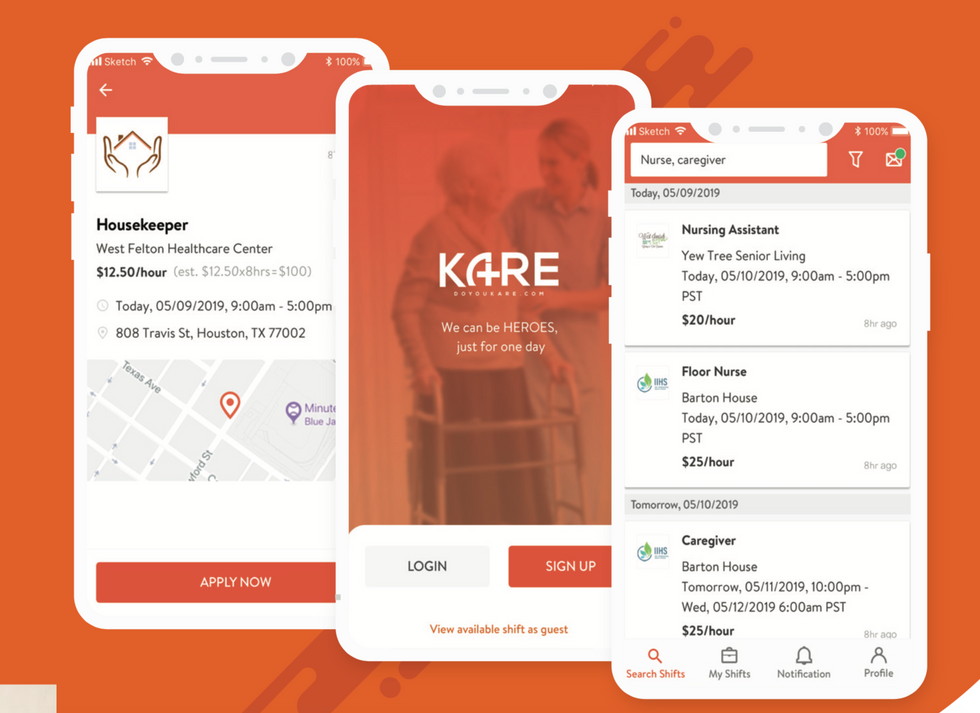

Houston-based Kare Technologies has raised fresh funds to spur its national expansion. Image courtesy of Kare

A Houston-based health tech company has scored fresh funds from a Houston venture group to fuel its growth and to expand nationally.

KARE Technologies, a digital labor marketplace for health care workers, raised a $7.85 million series A investment round led by Houston-based Golden Section Ventures.

"The KARE team are well known in senior care and the caring industry at large," says Dougal Cameron, general partner at GSV, in a news release. "They are experts in their field and know this problem well. Their care for the industry and knowledge in the space clearly shows in the company's rapid adoption. They are providing a needed solution to an extremely important industry for our society." Click here to continue reading.

Houston energy blockchain company announces $7.7M in funding, plans to expand to the Middle East

Data Gumbo, founded and led by Andrew Bruce, has announced its latest funding. Photo courtesy of Data Gumbo

A Houston-based tech company has announced another round of funding to support its blockchain network growth as well as to establish a presence in the Middle East.

Data Gumbo has closed its series B funding round totaling $7.7 million with follow-on investments led by Equinor Ventures. The round includes participation from Saudi Aramco Energy Ventures and Bay Area and Houston-based venture firm L37. The round's first close was announced in September 2020 at $4 million. The additional funds to close the Series B will be used to scale Data Gumbo to serve demand for GumboNet™ and GumboNet™ ESG. Additionally, Data Gumbo plans to establish a presence in the Middle East to cover expected demand growth in the region.

"The successful close of our series B is continued proof of the efficacy and booming interest in our ability to capture critical cost savings, deliver trust and provide transparency across commercial relationships," says Andrew Bruce, founder and CEO of Data Gumbo, in a news release. "Compounded by the growing demand for transparent, accurate sustainability data and the launch of our automated ESG measurement solution, GumboNet™ ESG, Data Gumbo's trajectory is well-positioned to serve our growing customer base by ensuring economic productivity and value. This infusion of capital will support our expansion efforts as we bring more international users to our network." Click here to continue reading.

Houston artificial intelligence startup raises $6M in seed funding

This Houston startup has a game-changing technology for deep learning. Photo via Getty Images

A computer science professor at Rice University has raised seed funding last month in order to grow his company that's focused on democratizing artificial intelligence tools.

ThirdAI, founded by Anshumali Shrivastava in April, raised $6 million in a seed funding round from three California-based VCs — Neotribe Ventures and Cervin Ventures, which co-led the round with support from Firebolt Ventures.

Shrivastava, CEO, co-founded the company with Tharun Medini, a recent Ph.D. who graduated under Shrivastava from Rice's Department of Electrical and Computer Engineering. Medini serves as the CTO of ThirdAI — pronounced "third eye." The startup is building the next generation of scalable and sustainable AI tools and deep learning systems.

"We are democratizing artificial intelligence through software innovations," says Shrivastava in a news release from Rice. "Our innovation would not only benefit current AI training by shifting to lower-cost CPUs, but it should also allow the 'unlocking' of AI training workloads on GPUs that were not previously feasible." Click here to continue reading.

Houston construction tech company raises $4M round

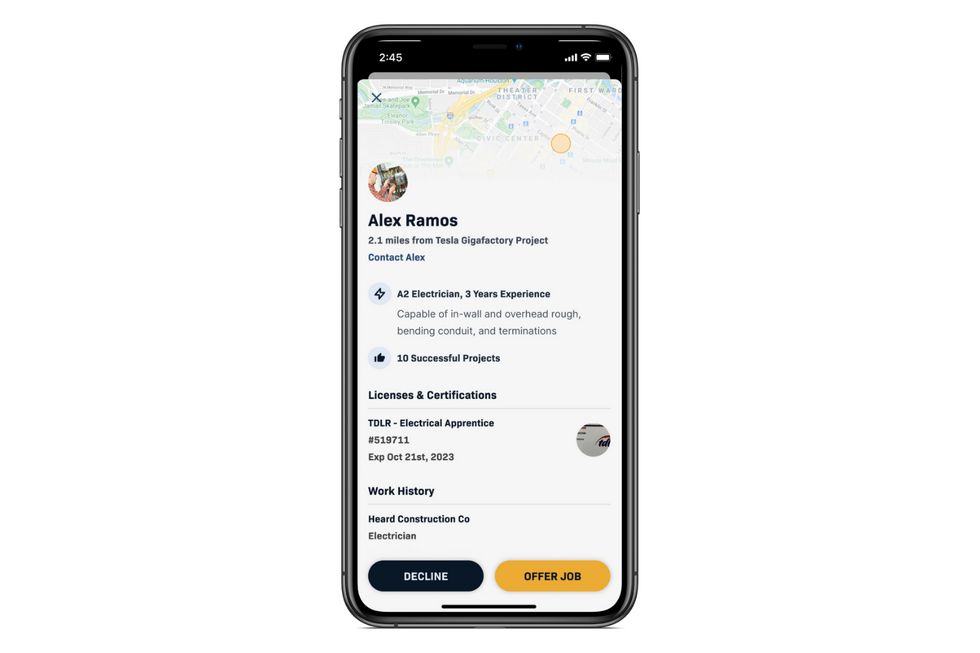

Buildforce is an app that can connect contractors with construction experts. Photo courtesy of Buildforce

A locally founded company that's focusing on changing the construction labor game has raised a round of institutional funding.

Buildforce, which splits its headquarters between Houston and Austin, closed its latest round of funding at $4 million. The round was led by Maryland-based TDF Ventures, with participation from existing investor Houston-based Mercury Fund and Austin-based S3 Ventures.

The company uses construction staffing and management software to more efficiently connect contractors to skilled workers across trades — electrical, mechanical, plumbing, flooring, concrete, painting, and more.

"Contractors depend on skilled and reliable tradespeople to meet project timelines," says Moody Heard, co-founder and CEO of Buildforce, in a news release. "Our key insight is that by optimizing the user experience for skilled tradespeople seeking higher pay and job security, we are able to help meet contractors' needs. We're thrilled to have become the partner of choice for the top contractors in our current markets looking to connect with this workforce." Click here to continue reading.

Houston startup raises $1.75M round with support from local female-focused investor

Ampersand and Curate Capital are working together to move the needle on the future of work. Photo courtesy of Curate Capital

A Houston-based startup focused on upskilling young professionals has closed its latest round of funding with support from a local investor.

Ampersand Professionals Inc. raised $1.75 million in pre-seed funding led by Curate Capital, a Houston-based, female-focused venture capital fund. Carrie Colbert, Curate's founding and general partner, will join Ampersand's advisory board.

Ampersand — founded in 2020 by Allie Danziger with Co-Founders Kathrin Applebaum and Scott Greenberg — has developed a platform for businesses to easily implement internship programs. The program also upskills and educates young professionals, providing them career development and job skills training.

"Ampersand's mission to democratize access to career-building opportunities for young professionals, ties in nicely with Curate's mission to empower women, says Colbert in a news release. "The company's platform will have a direct positive impact on young women (and others) as they begin their professional careers." Click here to continue reading.

Houston digital health platform raises $1.2M seed round

DocSpace was founded by Chief Product Officer Miles Montes (left) and CEO Mario Amaro, a physician and U.S. Navy Veteran. Photo courtesy of DocSpace

A Houston-based software company providing clinicians a turn-key platform for their practice has announced the close of its seed funding round.

DocSpace raised $1.2 million in seed funding led by Slauson & Co. with participation by Precursor Ventures, Acrew Capital's Scout Fund, and SputnikATX Ventures. The company's angel investors Nathan and Sonia Baschez, Nikhil Krishnan, and Eliana Murillo. The company was founded by CEO Mario Amaro, a physician and U.S. Navy Veteran, and Chief Product Officer Miles Montes, an expert in platform product management previously at ADP and ShopLatinx.

"Existing practice management software requires clinicians to manually self-navigate the expensive and complicated business formation process before they're able to utilize any of their product services," says Amaro in a news release. "When you require clinicians to do all the hard work of starting a new business then force them to purchase expensive software, it's no surprise that fewer clinicians have the opportunity to build new businesses in their communities." Click here to continue reading.

Apple doubles down on Houston with new production facility, training centerPhoto courtesy Apple.

Apple doubles down on Houston with new production facility, training centerPhoto courtesy Apple.