Houston Exponential has announced a leadership change, according to a statement from the organization.

Harvin Moore, who has served as president of HX since June 2019, has announced his resignation to the chair of the organization, Barbara Burger, vice president of innovation at Chevron and president of Chevron Technology Ventures. In the statement, Burger says Moore is resigning to devote more time to working with growth-stage companies as a mentor, adviser, and investor.

Serafina Lalany, vice president of operations at HX, will act as interim executive director.

"In a rapidly growing and evolving landscape like this one, we must ensure resources are leveraged for greatest impact," Burger says. "The HX executive committee believes now is an appropriate time re-strategize with the HX organization to ensure it is aligned with the current needs of the innovation ecosystem. While changes may be called for to place resources where they can do the most good, there remains a need for a broad ecosystem champion and HX will continue to serve in that role."

Moore — who followed Russ Capper, the inaugural executive director of HX — has a 20-year career in tech and startups in Houston. He is a principal at an early-stage investment firm, Frontera Technology Ventures, and before that served as COO for Space Services Holdings Inc. According to his LinkedIn profile, he's also the director of Industrial Tech Acquisitions Inc., a blank check company, or SPAC.

"Under Harvin's leadership over the last two years, HX has maintained its successful trajectory and achieved important milestones," Burger continues in the statement. "I wish him well in his future endeavors."

According to the statement, all other Houston Exponential staff will remain in place during this review period to support ongoing activities.

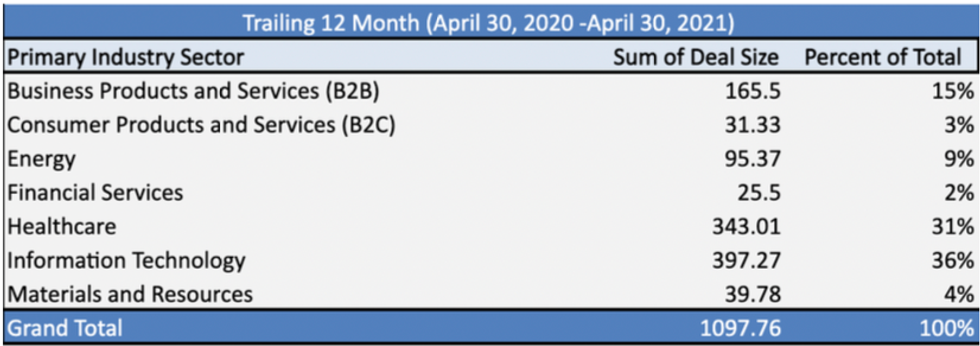

Source: Pitchbook and Houston Exponential

Source: Pitchbook and Houston Exponential  Source: Pitchbook and Houston Exponential

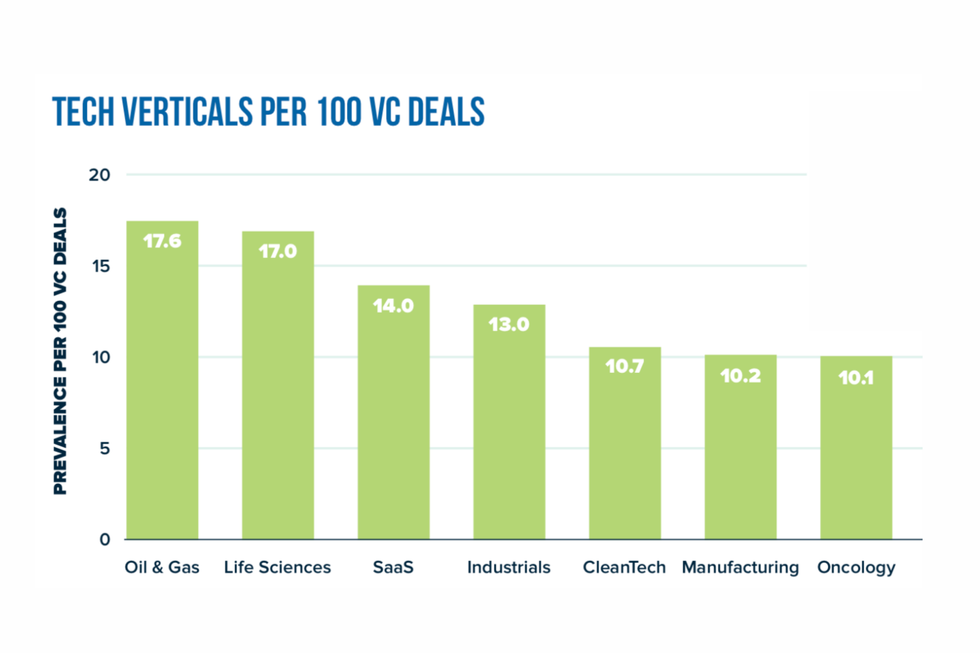

Source: Pitchbook and Houston Exponential Graphic via the Houston Tech Report by the GHP

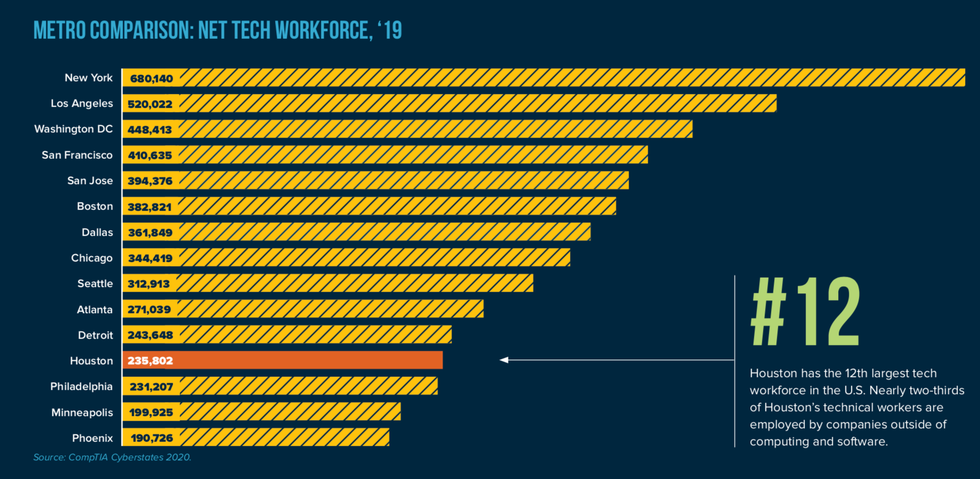

Graphic via the Houston Tech Report by the GHP Graphic via the Houston Tech Report by the GHP

Graphic via the Houston Tech Report by the GHP