Houston startups ended 2023 with a flurry of funding news — from several seeds and series As to series C rounds and extensions.

Here are nine Houston startups that secured funding in the fourth quarter of last year, according to reporting by InnovationMap. For further reading, here were 2023's top rounds raised.

Amperon Holdings Inc. closed its $20 million series B in October

It's payday for a startup that's improving analytics for its energy customers. Photo via Getty Images

A Houston startup has raised $20 million in its latest round of funding in order to accelerate its energy analytics and grid decarbonization technology.

Amperon Holdings Inc. announced today that it closed its series B round at $20 million. Energize Capital led the round and the D. E. Shaw group, Veriten, and HSBC Asset Management, an existing investor, joined in on the round. Additionally, two of Amperon's early customers, Ørsted and another strategic utility partner, participated in the series B, which brought Amperon’s total funding to $30 million.

“The energy transition is creating unprecedented market volatility, and Amperon is uniquely positioned to help market participants better navigate the transitioning grid – both in the U.S. and as we expand globally,” Sean Kelly, CEO and co-founder of Amperon, says in the release. Read more.

Velostics raised nearly $2M additional seed funding in October

Velostics has raised additional funding to grow its logistics software. Photo via velostics.com

A Houston company that's providing innovative unified scheduling software for the logistics industries has raised additional seed funding.

Houston-based Velostics Inc. raised $1.95 million, the company announced this week. The additional seed round follows a $2.5 million round announced in 2021. The Velostics platform optimizes scheduling for inbound and outbound trucks, saving companies money across the supply chain and resulting in fewer emissions from idling trucks.

“Scheduling is a major headache for all parties focused on reducing cost and delivering on high customer expectations — our cloud based solution is designed to go live in one day with no apps required,” Gaurav Khandelwal, founder and CEO of Velostics, says in a news release. Read more.

Konect.ai secured $5.5M seed funding in October

Konect.ai is using AI and natural language processing within the automotive retail industry. Image via Getty Images

A Houston startup that's using artificial intelligence and natural language processing to disrupt the retail automotive industry has raised seed funding.

Konect.ai announced a $5.5 million seed investment from Austin-based Silverton Partners. The funding will support the company's development of its software, which hopes to advance communications between auto dealerships and auto tech companies and customers.

"This investment from Silverton Partners is a strong validation of our vision and the hard work of our talented team. With this support, we are poised to accelerate our growth and continue to innovate, bringing the most advanced conversational AI products to the automotive retail industry," Cole Kutschinski, president and CEO of Konect.ai, says in a news release. Read more.

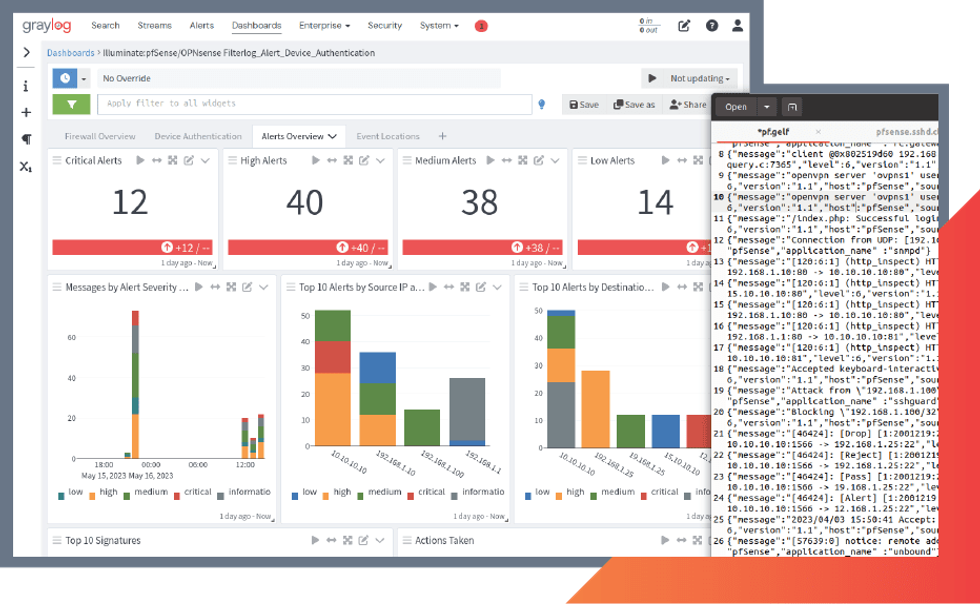

Graylog closed $9M in a series C extension round and $30M in financing in October

Graylog, a Houston SaaS company, has new fuel to scale and develop its product. Photo via Getty Images

A Houston software-as-a-service company has secured $39 million in financing and announced its latest upgrade to its platform.

Graylog, which has created an innovative platform for cybersecurity and IT operations, raised equity funding with participation from new investor Silver Lake Waterman and existing investors Piper Sandler Merchant Banking and Harbert Growth Partners leading the round.

“The growth we are seeing globally is a response to our team’s focus on innovation, a superior user experience, low total cost of ownership, and strong execution from our Go-To-Market and Customer Success teams,” Andy Grolnick, CEO of Graylog, says in a news release. “We expect this momentum to continue as Graylog expands its reach and raises its profile in the security market.” Read more.

RepeatMD raised $50M series A in November

Fresh off a win at the Houston Innovation Awards, RepeatMD has raised funding. Photo by Emily Jaschke/InnovationMap

Just nine months after its seed round, a Houston startup with a software platform for the aesthetic and wellness industry has secured $40 million in venture capital and $10 million in debt facility.

RepeatMD, a SaaS platform, announced today that it's secured $50 million, which includes a $10 million debt facility from Silicon Valley Bank. The round was co-led by Centana Growth Partners and Full In Partners with participation from PROOF and Mercury Fund, which also contributed to the seed round earlier this year.

“Even though the aesthetics and wellness industry has continued to innovate a growing range of life-changing treatments, practices continue to face challenges selling treatments and services that are new and unfamiliar to patients,” Phil Sitter, CEO of RepeatMD, says in the release. Read more.

Kahuna Workforce Solutions secures $21M series B in November

Kahuna Workforce Solutions, which provides HR software solutions, announced it has closed a $21 million series B. Photo via Getty Images

A Houston company with a software platform to enhance skills management operations has raised its series B.

Kahuna Workforce Solutions announced it has closed a $21 million series B funding round led by Baltimore-based Resolve Growth Partners. Kahuna's platform provides its users — which come the from health care, energy, field service, and manufacturing industries — with effective assessment, training and development, and staffing and deployment initiatives.

“We are thrilled to work with Resolve as Kahuna begins the next growth phase. Their expertise in enterprise software, and commitment to innovation and continuous improvement fully aligns with our mission, vision, and goals for Kahuna,” Jai Shah, CEO of Kahuna Workforce Solutions, says in a news release. Read more.

Allganize closed $20 million series B in November

Allganize recently closed a $20 million series B round of funding, bringing its total amount raised to $35 million. Graphic via allganize.ai

A Houston tech startup with an artificial intelligence technology has announced it's raised two rounds of funding as it plans to continue developing its product and IPO in Japan.

Allganize recently closed a $20 million series B round of funding, bringing its total amount raised to $35 million, according to the company. Allganize developed Alli, an all-in-one platform for enabling large language models, that's used by over 200 enterprise and public companies globally, including Sumitomo Mitsui Banking Corporation, Nomura Securities, Hitachi, Fujitsu, and KB Securities.

"This investment accelerates our journey towards global expansion and achieving a milestone of listing on the Japanese stock exchange by 2025," Changsu Lee, CEO of Allganize, says in a news release. Read more.

EndoQuest Robotics Inc. announced $42 million series C in December

Houston-based EndoQuest has closed a $42 million round. Photo via Getty Images

A Houston medical device company that's tapping into robotics technology for the operating room has just announced a major chunk of fresh funding.

EndoQuest Robotics Inc. announced that it has closed a $42 million series C to advance its robot technology that's targeting endoluminal and gastrointestinal minimally invasive procedures. Returning investors, CE Ventures Limited and McNair Interests, and new investor, Puma Venture Capital, led the round of funding.

"Our investors share our vision of leveraging robotics to redefine the possibilities in minimally invasive procedures," Kurt Azarbarzin, CEO of EndoQuest Robotics, says in a press release. Read more.

Digital Wildcatters announced $2.5M seed in December

Digital Wildcatters just raised $2.5 million in funding. Image courtesy

With $2.5 million in fresh funding, Digital Wildcatters is on its way to keep empowering the evolving energy workforce.

Digital Wildcatters, a Houston company that's providing a community for the next generation of energy professionals, has closed its seed plus funding round at $2.5 million. The round by energy industry veteran Chuck Yates, who also hosts his podcast "Chuck Yates Needs a Job" on the Digital Wildcatters' podcast network.

"Our industry's survival depends on recruiting the next generation of energy workers. We must adapt to their digital, content-rich world, as we currently lag behind, like a VHS tape in a Netflix world. Digital Wildcatters is our path to modernization," Yates says. Read more.

Houston-based Graylog announced new financing as well as a new version of its software this week. Photo via graylog.org

Houston-based Graylog announced new financing as well as a new version of its software this week. Photo via graylog.org Spencer Randall, principal and co-founder of CryptoEQ, joins the Houston Innovators Podcast to discuss how his company has grown alongside the cryptocurrency industry. Photo courtesy of CryptoEQ

Spencer Randall, principal and co-founder of CryptoEQ, joins the Houston Innovators Podcast to discuss how his company has grown alongside the cryptocurrency industry. Photo courtesy of CryptoEQ

Andy Grolnick is CEO of Graylog. Photo courtesy

Andy Grolnick is CEO of Graylog. Photo courtesy