While much of the city's news — along with the rest of the country — has been focused on COVID-19, headlines are starting to resemble some sense of normalcy again.

For this roundup of short stories within Houston innovation, there's a mix of news items pertaining to the coronavirus, as well as news items outside of the pandemic — from a new minor program at Rice University to Baylor College of Medicine testing for a COVID treatment.

Rice University introduces entrepreneurship minor

![]()

Rice University plans to offer undergraduate students an opportunity to minor in entrepreneurship. Courtesy of Rice University

Three of Rice University's programs — the Liu Idea Lab for Innovation and Entrepreneurship, Jones Graduate School of Business, and Brown School of Engineering — are teaming up to provide undergraduate students an opportunity to minor in entrepreneurship.

"Entrepreneurship and the creation of new businesses and industries are critical to Houston and Texas' future prosperity and quality of life," says Yael Hochberg, Rice finance professor who leads Lilie, in a release. "Rice students continuously seek to lead change and build organizations that can have real impact on our world. In today's new and uncertain world, the skills and frameworks taught in the new minor are particularly important."

According to a news release, the minor's curriculum will provide students with professional skills within entrepreneurship, such as problem solving, understanding customers and staff, communication, and more. The program will be housed in Lilie, which features a coworking space, graduate and undergraduate entrepreneurship courses, the annual H. Albert Napier Rice Launch Challenge, and other courses.

Houston named No. 12 for tech jobs

![]()

Houston's tech jobs are growing — just not at an impressive rate, according to a new report. Christina Morillo/Pexels

CompTIA has released its Cyberstates 2020 report that identifies Houston as No. 12 in the country for tech jobs. However, the Bayou City was ranked No. 38 for job percent growth. Austin and Dallas appear in the top 10 of each of the Cybercities rankings.

According to the report, Houston has a net total of 235,802 tech jobs, an increase of 826 jobs between 2018 and 2019. This figure means a growth of 25,904 jobs between 2019 and 2010. The full report is available online.

While Houston misses the top 10 metros, Texas ranks No. 2 for net tech employment and net tech employment growth. The Lone Star State came in at No. 4 for projected percent change in the next decade. The state was also recognized as No. 2 for number of tech businesses.

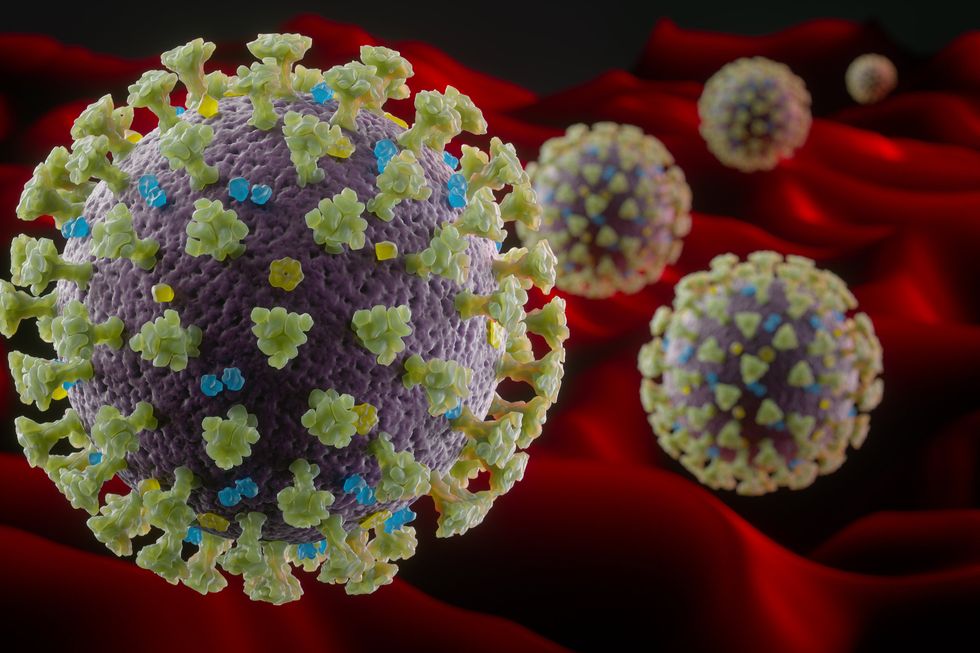

Baylor College of Medicine tests existing drug for COVID-19 cure

![]()

A Houston institution is looking into an existing vaccine for coronavirus treatment. Andriy Onufriyenko/Getty Images

Baylor College of Medicine researchers — along with colleagues at four other institutions — are testing to see if the bacille Calmette-Guerin vaccine, known as BCG, can work against COVID-19.

"Epidemiological studies show that if you're BCG vaccinated, you have a decreased rate of other infections," says Dr. Andrew DiNardo, assistant professor of medicine – infectious diseases at Baylor, in a news release.

The vaccine has been found to help protect against yellow fever and influenza, and, according to DiNardo, the vaccine could show 30 to 50 percent improvement in immune response in patients with the coronavirus. The team is currently looking for subjects to participate in a clinical trial to test the vaccine.

While research is preliminary, the theory is that BCG changes the way the body responds to a pathogen, according to the release.

"Think of DNA like a ball of yarn," DiNardo explains in the release. "Some pieces of the ball of yarn are open and able to be expressed. Other pieces are wrapped up tight and hidden away, and those genes are repressed. It's a normal way for cells to turn certain genes on and off. BCG opens up certain parts of this ball of yarn and allows the immune system to act quicker."

Plug and Play announces physical space in Houston

![]()

Plug and Play Tech Center's local team will work out of the Ion. Courtesy of Rice University

Since entering the Houston market last year, Silicon Valley's Plug and Play Tech Center has hosted numerous events, named its first cohort, and hired Payal Patel to lead the local operations. However, the local operations still, until recently, lacked a plan for a physical space in town.

"Plug and Play intends to set up its permanent office in Houston in Rice's Ion development," says Patel in a statement. "We have engaged in preliminary discussions with Rice Management Company to secure office space for the building's expected Q1 2021 opening."

Until then, says Patel, who is director of corporate partnerships for Plug and Play in Houston, the Plug and Play team will have its base at Station Houston, which recently merged with Austin-based Capital Factory. At present, the local team is hiring to build up its team and has five open jobs on HTX Talent, a job portal for Houston tech.

UH professor named a Guggenheim fellow

![]()

A University of Houston professor has been honored with a prestigious award. Photo courtesy of University of Houston

A University of Houston mechanical engineer has been selected for a Guggenheim Fellowship. Pradeep Sharma is the only recipient in the engineering category.

The M.D. Anderson Chair Professor of mechanical engineering and chairman of the department, Sharma uses mathematics and technology to breakdown physical phenomena across a number of disciplines.

The Guggeinheim Foundation has funded more than $375 million in fellowships to over 18,000 individuals since its inception in 1925. This year, the organization selected 173 individuals.

"It's exceptionally encouraging to be able to share such positive news at this terribly challenging time," Sharma says in a news release from UH. "The artists, writers, scholars and scientific researchers supported by the fellowship will help us understand and learn from what we are enduring individually and collectively."

Houston health system to participate in coronavirus plasma study

![]()

HCA Houston Healthcare is participating in a plasma treatment program. Getty Images

HCA Healthcare Gulf Coast Division has announced that it will be participating in a national study to see if plasma from recovered COVID-19 patients can help current COVID patients in severe conditions.

"We are proud to take part in this important study. We are asking for the help of our community to spread awareness about plasma donation for patients facing COVID-19 not only in Houston, South Texas and Corpus Christi, but also around the world," says Mujtaba Ali-Khan, chief medical officer at HCA Healthcare Gulf Coast Division, in a news release.

Per the study, the following HCA Healthcare Gulf Coast Division Hospitals will be participating:

- HCA Houston Healthcare Clear Lake

- HCA Houston Healthcare Conroe

- HCA Houston Healthcare Kingwood

- HCA Houston Healthcare Southeast

- HCA Houston Healthcare West

- HCA Houston Healthcare Tomball

- HCA Houston Healthcare North Cypress

- HCA Houston Healthcare Northwest

- HCA Houston Healthcare Mainland

- HCA Houston Healthcare Medical Center

- Corpus Christi Medical Center

- Rio Grande Regional Hospital

- Valley Regional Medical Center

"This trial is just the first step, but hopefully it will help us determine if plasma transfusions can be a treatment for critically ill patients with COVID-19," says Carlos Araujo-Preza, MD, critical care medical director at HCA Houston Healthcare Tomball, in the release.

Dr. Araujo-Preza safely discharged his first plasma patient last week. The patient is recovering from home following their treatment.

The hospital system is looking for eligible volunteers to donate plasma via the American Red Cross to help treat current patients.

Early stage energy venture firm calls for startups

![Industrial software]()

BBL Ventures is looking for energy companies to pitch. Getty Images

Houston-based BBL Ventures, which looks to connect tech startups to industrial and energy corporations, is seeking energy tech startups to pitch.

"Digital transformation, automation, emerging technologies and sustainability have never been more important to these industries than in this challenging macro environment," says Patrick Lewis, founding managing partner of BBL Ventures, in an email. "We are launching a 6-week challenge campaign to find BEST in class solutions to BIG pain points in the energy and industrial sectors."

In the email, Lewis lists over a dozen challenges or pain points from the organization's corporate partners. The goal would be to find startups with to solutions to any of these identified pain points. Winners of the pitch competition are eligible for POCs, pilots, and funding.

For more information and to submit a pitch, visit BBL's website. BBL is also introducing the program with a virtual kick-off panel on May 21 at 2 pm. Registration is available online.

Andrew Bruce, CEO of Data GumboAndrew bruce's growing Houston blockchain startup has raised $4 million to go toward supporting sales. Photo courtesy of Data Gumbo

Andrew Bruce, CEO of Data GumboAndrew bruce's growing Houston blockchain startup has raised $4 million to go toward supporting sales. Photo courtesy of Data Gumbo