ones to watch

Rice Alliance pitch event identifies 8 most-promising energy tech startups

In honor of CERAWeek, the Rice Alliance for Technology and Entrepreneurship hosted its annual Energy Venture Day.

After over 50 startup pitches and more than 300 meetings, venture investors identified eight startups that are the most-promising companies on a path to innovate and disrupt the energy ecosystem.

The 2023 Energy Venture Day's Most-Promising Startup winners were:

AeroShield Materials

Graphic via aeroshield.tech

Hyde Park, Massachusetts-based AeroShield Materials is creating thermally insulating transparent inserts. The inserts are only four millimeters of AeroShield's material and, when placed inside a double-pane window, provides 65 percent more energy efficiency.

Columbia Power Technologies (C-Power)

Image via cpower.co

C-Power, based in Charlottesville, Virgina, has a technology that harnesses the power of the ocean.

"C-Power delivers this renewable energy resource to the world, both through low-power solutions that bring energy and the cloud to the sea and large-scale solutions that help decarbonize terrestrial grids," the company's website reads.

EarthEn

Graphic via earthen.energy

Chandler, Arizona-based EarthEn is focused on long duration energy storage solutions that use CO2 in a closed loop to store 4 to 100 hours of energy at a low cost. The SaaS tools — with artificial intelligence and machine learning — optimize peak demand pricing and use predictive analysis to enable grid resiliency.

Group1

Photo via Twitter

Group 1, based in Austin, is focused on the commercialization of potassium-ion batteries. The core technology originates from the labs of University of Texas at Austin professor JB Goodenough, co-inventor of the lithium-ion battery.

Ionada Carbon Solutions

Photo via ionada.com

Houston-based Ionada, a member of Halliburton Labs, has created a technology that can remove up to 99 percent of the carbon dioxide emissions for the energy, marine, and e-fuels, according to the company.

"Our engineers have more than a century of combined expertise in reducing emissions for the power generation, chemical, road, rail, air and marine industries. We are here to help you find the best sustainable solution to reduce your emissions," reads the website.

H Quest Vanguard

Photo courtesy of Halliburton

Another Halliburton Labs member H Quest Vanguard, headquartered in Pittsburgh, has developed an electrically powered chemical conversion platform that leverages Microwave Plasma Pyrolysis to liberate zero-CO2 hydrogen from natural gas using only a quarter of energy required by electrolysis, while coproducing a high-value carbon or petrochemical coproduct.

Pressure Corp

Photo by Anton Petrus/Getty

Houston-based Pressure Corp is developing waste pressure power systems to help midstream gas companies solve how they reduce emissions by providing the technology, capital and expertise required to achieve their environmental, social and governance goals.

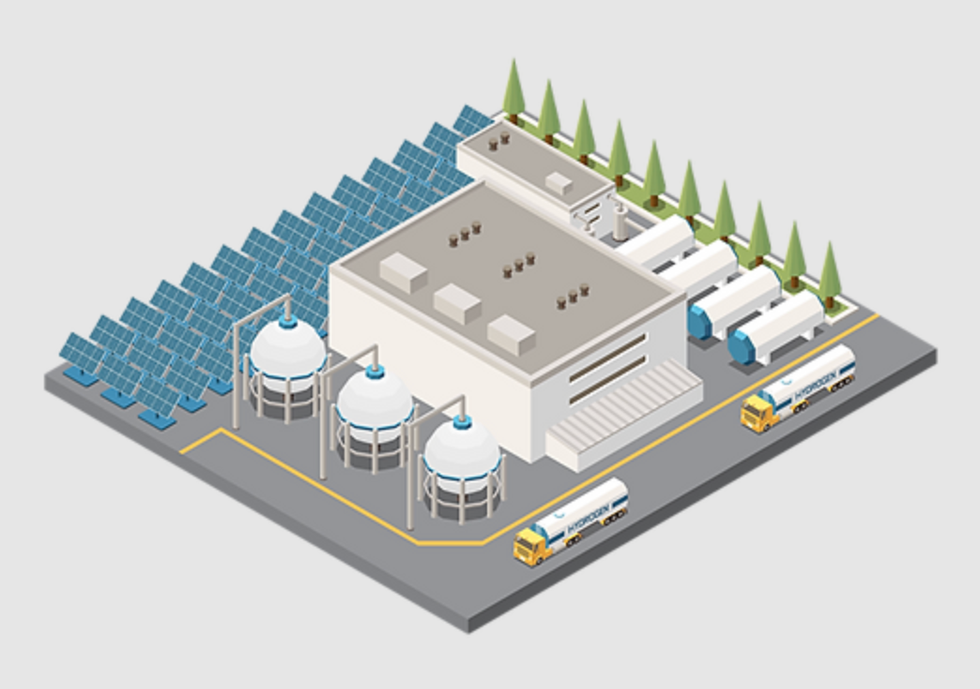

STARS Technology

Photo via starsh2.com

Based in Richland, Washington, STARS Technology Corp. is commercializing advanced micro-channel chemical process technology that originally was designed for NASA and the Department of Energy. The company's reactors and heat exchangers are compact, energy-efficient, and more.