Overheard: Here's what experts say on the future of startup investment in Houston

eavesdropping in houston

Last week, over 2,500 people registered to Venture Houston to talk about startups and venture capital in Houston for two full days.

The two-day conference, which was put on by HXVF, the Houston Angel Network, the Rice Alliance, and Houston Exponential, took place February 4th and 5th and brought together startups, investors, corporations, and anyone who cares to advance the Houston tech ecosystem.

Click here to see what companies won big in the event's startup pitch competition.

Throughout the various panels and keynote addresses, Houston innovation leaders sounded off on what the future of Houston looks like in terms of venture activity. Missed the discussion or just want a refresher on on the highlights? Here are some significant overheard moments from the virtual conference.

“The way I look at it, Houston has an opportunity to really emerge as one of the leading startup cities in the country.”

— Steve Case, chairman and CEO of Revolution Ventures and co-founder of AOL.

He makes a reference to the iconic line "Houston, we have a problem" — which now is defined by a time of opportunity. Case adds that his VC fund, Revolution, which has invested in Houston-based GoodFair, is looking for new investments in Houston.

“We were behind. We were slow to start, but in typical Houston fashion, now we are escalating with real momentum."

— Amy Chronis, Houston managing partner of Deloitte and 2021 Greater Houston Partnership board chair.

Chronis notes on the fact that VC activity in Houston is up 250 percent since 2016, and in that time the city has focused on diversifying its business. Now, the city touts its active corporate community, global diversity, and more.

"In Houston, companies and talent are looking at ways to change the world," she adds.

“I see there being a significant amount of seed capital taking off.”

— Stephanie Campbell, managing director of the Houston Angel Network and The Artemis Fund.

Campbell calls out new funds to Houston, like Golden Section Ventures and her own fund, Artemis. She adds that with over $700 million invested in Houston deals last year, the city is in a good place, and she is anticipating more angel activity.

"While this is really exciting progress, there's still a lot of work to be done in terms of seed and early-stage funding," she continues.

“I see there being billion-dollar venture funds here in Houston on the life science front over the next decade.”

— John "JR" Reale, managing director of Integr8d Capital.

Reale, who's also the executive in residence at TMC Innovation, says he's seen the growth and potential of the life science industry in Houston.

"You can see the intentionality of the infrastructure that's being built that's going to attract diverse founders and all talent," he says.

“What I really see is the trajectory for Houston has been changing over the last couple years.”

— Brad Burke, managing director for the Rice Alliance for Technology and Entrepreneurship.

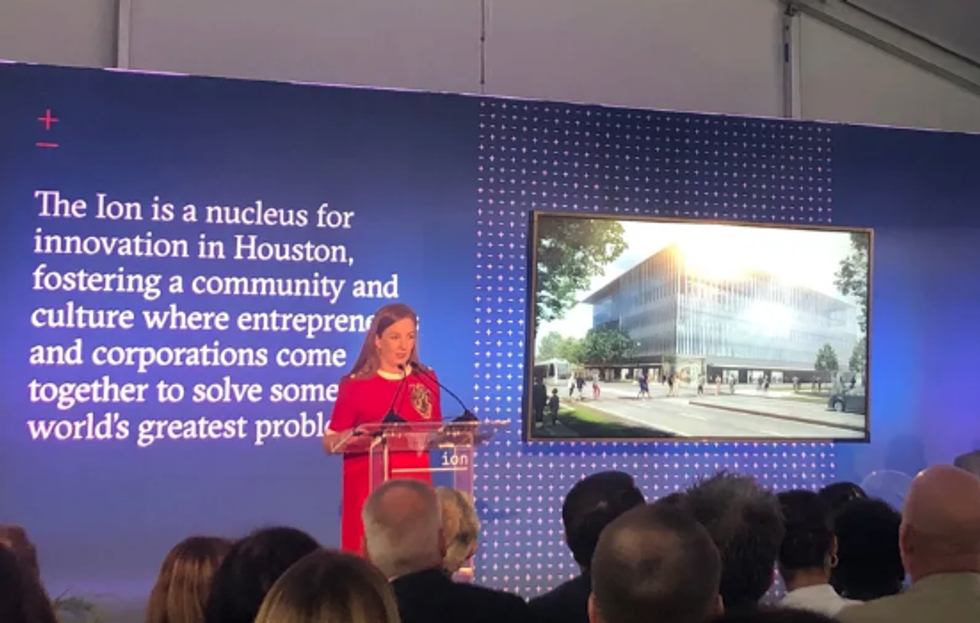

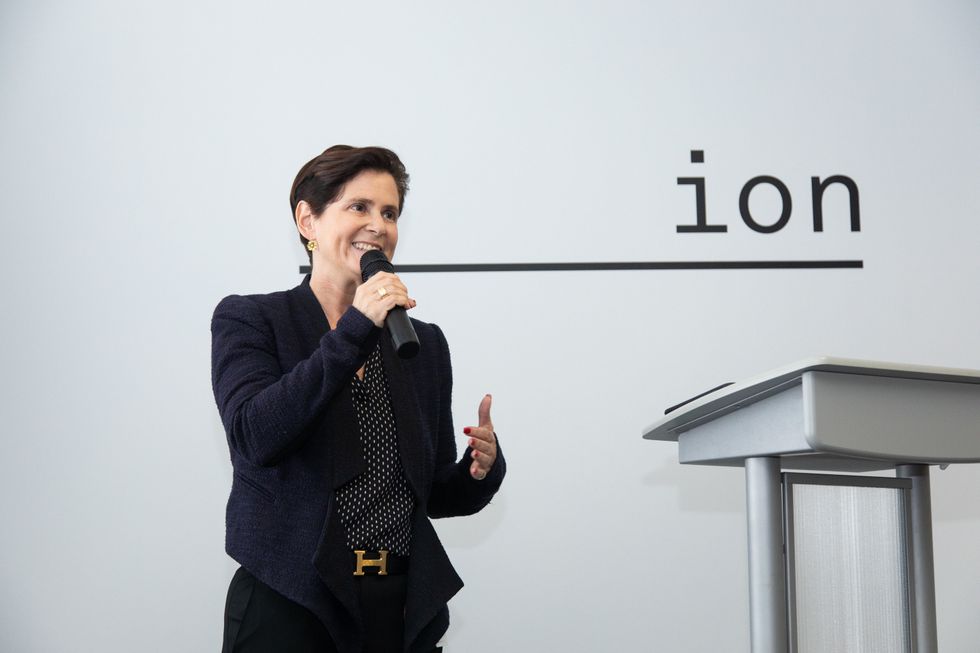

Burke points to three things that have really moved the needle on Houston's progress as an innovative city. The first was the Texas Medical Center establishing its Innovation Institute a few years back, and the next is how Houston's top energy companies are making big moves to support the energy transition. Finally, he says, The Ion, which is set to open this year, is the third reflection point for progress.

“The Houston startup scene is a very special place. It’s a community I actively choose to be a part of, and it activates me every day.”

— Rakesh Agrawal, CEO and founder of SnapStream.

“We’ve got a really incredible story to tell.”

— Susan Davenport, senior vice president of economic development for the GHP.

Davenport adds that this is exactly what the GHP is doing — making Houston's story known. And she says they have talked to global business leaders and they describe the city as a modern, cosmopolitan, truly global city.

ION Accelerator ribbon cutting event, with Mayor Sylvester Turner and business partners.

ION Accelerator ribbon cutting event, with Mayor Sylvester Turner and business partners.

SnapStream's technology is a TV broadcast monitoring software used by CBS, MLB, The Daily Show, and more.Courtesy of SnapStream

SnapStream's technology is a TV broadcast monitoring software used by CBS, MLB, The Daily Show, and more.Courtesy of SnapStream