5 emerging energy tech companies in Houston revolutionizing the industry

The Future is Now

If you thought Houston's wildcatter days were exciting, just you wait. Houston has an emerging ecosystem of tech startups across industries — from facial recognition devices used at event check in to a drone controller that mimics movement in space.

A somewhat obvious space for Houston entrepreneurs is oil and gas. While the energy industry might have a reputation of being slow to adapt new technologies, these five Houston startups are developing the future of the industry — one device at a time.

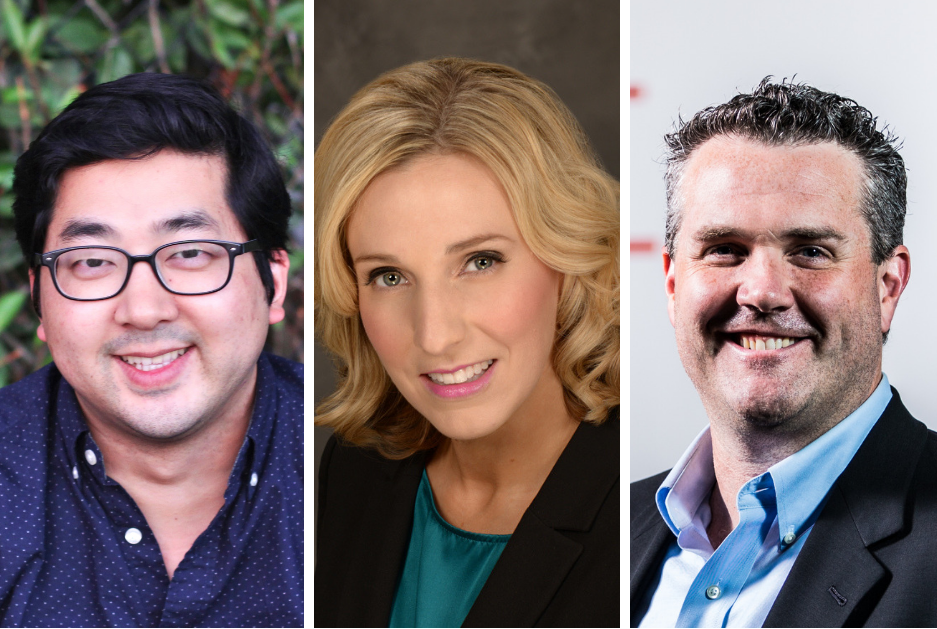

Future Sight AR

Lori-Lee Emshey's Future Sight AR is revolutionizing antiquated construction tools using augmented reality. Courtesy of Future Sight AR

Working on an oil and gas construction site is like constructing a really large puzzle — one that, if constructed incorrectly, could have dangerous and costly consequences. On her first job in the industry, Lori-Lee Emshey was required to move through the site with a pen and a clipboard to mark down any issues or problems, only to later log that information into a computer. It was a slow process, and she felt frustrated by that.

"I was really shocked at how much work they were doing with such little technology," Emshey says. "I thought, 'there's so much room for innovation here.'"

She created Future Sight AR that uses artificial reality technologies on a smart device so that technicians can instantly see instructions and solutions for the hardware they are constructing on the site. Read more about Future Sight AR here.

Nesh

Nesh's digital assistant technology wants to make industry information more easily accessible for energy professionals. Photo courtesy of Thomas Miller/Breitling Energy

Access to information is endless in the digital age, but Sidd Gupta wanted to create a digital assistant that specifically focused on the energy industry. Nesh is an information bot that users can chat questions to. Think: Siri or Alexa, but with an engineering degree.

"We created Nesh as something super-simple to use," Gupta says. "There's no learning curve, no technical knowledge required, you just need to speak plain English."

Nesh has the potential to change productivity and hiring requirements in various energy companies. Read more about Nesh here.

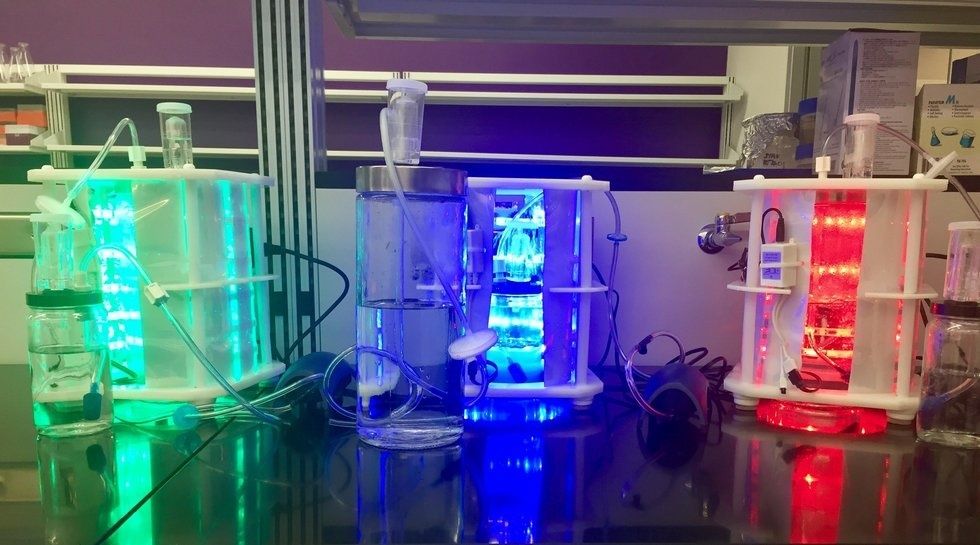

Cemvita Factory

The Karimi siblings have created a way to synthetically convert CO2 into glucose, and they are targeting the energy and aerospace industries for their technology. Courtesy of Cemvita Factory

Energy companies are getting more and more pressure to create a sustainable solution for the carbon dioxide refineries produce on a daily basis. Houston-based Cemvita Factory has a solution. The company has a patented technology that can convert CO2 into glucose — just like plants do in the photosynthesis process.

"We go to these companies and say, 'What do you want to convert CO2 into?,'" Moji Karimi, co-founder of Cemvita, says. "Then, we do a quick pilot in six months in our lab, and we show them the metrics. They decide if they want to scale it up."

The company also has big plans for making an impact on the aerospace industry too. Read more about Cemvita here.

NatGasHub.com

Jay Bhatty looked at how pipeline data reached traders and thought of a better way. Getty Images

Information around natural gas pipelines — such as whether a pipeline has capacity issues that could trigger a spike in prices — has, for years, been scattered across the web. Now, Houston-based NatGasHub.com aggregates pipeline data from dozens upon dozens of websites.

Jay Bhatty, a veteran of the natural-gas-trading business, founded the Houston-based NatGasHub.com platform, which runs on cloud-based software, launched in late 2017. The company is already profitable and hasn't taken any outside funding. Read more about NatGasHub.com here.

Arundo Analytics

This growing Houston company is providing industrial industries with smart analytics. Courtesy of Arundo

While information can be slow and siloed between energy companies, energy professionals come across the same problem within their own organization. Arundo Analytics is developing software to help connect the dots within an energy company's operations.

Stuart Morstead, co-founder and chief operating officer of Arundo, says that most industrial companies that encounter issues with operations such as equipment maintenance "lack the data science and software capabilities to drive value from insights into their daily operations." Read more about Arundo Analytics here.