Houston-based digital business resource launches minority-focused, celebrity-backed grant program

in the minority

A Houston-based startup that provides digital resources for entrepreneurs has introduced a new initiative to support minority-owned businesses — and the program has attracted some celebrity support.

Hello Alice has launched Business for All, which will provide funding and mentorship to small business owners. According to a news release, half of new businesses have a minority founder and these startups have only received 2 percent of annual venture capital.

"As entrepreneurs ourselves, my co-founder Elizabeth Gore and I know how valuable it is to have a network of people and resources in your corner when trying to turn a small business dream into reality," says founder and CEO of Hello Alice, Carolyn Rodz, in the release. "All businesses start small, and through Business for All, we will provide 100,000 owners with the opportunity to receive grants and mentorship through Hello Alice."

Business For All will distribute up to $200,000 in grants sized between $10,000 and $50,000. The startups will be selected through a nomination process and will focus on founders who are women, people of color, LGBTQ+ entrepreneurs, military affiliated business owners, and entrepreneurs with disabilities, according to the release.

Support for the program has come in the way of volunteer mentorship from celebs by the likes of Kristen Bell, Jean Case, Rebecca Minkoff, Phyllis Newhouse, Gwyneth Paltrow, Lisa Price, Zaw Thet, and more.

"I believe we should give every small business owner the tools they need to succeed. Business for All provides a combined voice, grants and mentorship to ensure success for every entrepreneur no matter their background," says Kristen Bell, entrepreneur, actress, and advocate, in the release.

Those entrepreneurs selected to receive grants will be invited to the inaugural Business for All Summit in fall 2020 for networking, mentorship, and business-focused programing.

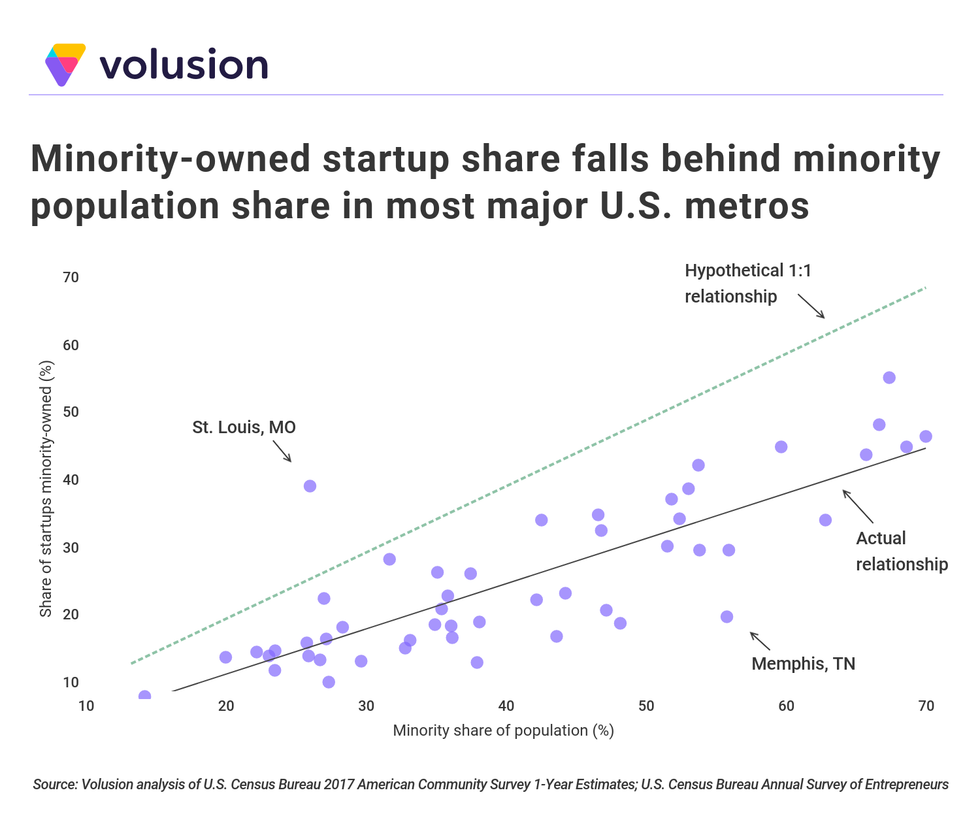

According to Volusion's report, the national trend is disproprotionate when you compare the markets' population diversity to its minority-owned startups. Chart via Volusion

According to Volusion's report, the national trend is disproprotionate when you compare the markets' population diversity to its minority-owned startups. Chart via Volusion