When it comes to Houston's tech startups, it's as diverse as Houston's population. There are software-as-a-service companies, new mobile technology, and even virtual reality startups that all call Houston home.

Here's a roundup of these Houston companies that you need to keep an eye on.

Hamper

Houston-based Hamper, which makes dry cleaning convenient, won the Rockets and BBVA Compass' LaunchPad competition. Courtesy of Hamper

Despite working most summers in his family's dry cleaning shop, Safir Ali wasn't thinking about taking over his family business. He was living his young professional life with a freshly minted degree from Texas A&M University and a corporate job. However, when he started thinking of all the modern conveniences available now — RedBox, ridesharing, delivery apps — he couldn't help but think of how antiquated dry cleaning was compared.

Ali and his brother hope to upgrade dry cleaning with their startup, Hamper. Ali describes it as "the Red Box of dry cleaning." Customers can deposit their dry cleaning in a kiosk in their office building, and it will be delivered straight to their suite. Originally, Safir thought the kiosks could be stand-alones, but it proved to be easier to partner with high-traffic office spaces, like those in the busy Galleria or over in Williams Tower.

The company has gained some traction — and even some prize money. Hamper won first place in the 2019 LaunchPad Contest, which was sponsored by the Houston Rockets and BBVA Compass. The win brought in a $10,000 prize, along with a consultation with Rockets and BBVA Compass executives and a host of other prizes.

Pandata Tech

Houston-based Pandata Tech uses its machine learning technology to advance oil and gas operations. Photo courtesy of Pandata Tech

Drilling data can be muddled and hard to use, but Houston-based Pandata Tech has developed the technology to clean and automate data collection for its oil and gas clients. But Gustavo Sanchez, co-founder and CEO of the company, is looking to take his technology into other industries.

The Pandata team is now expanding to fields like defense and healthcare, which also generate hundreds of thousands of data points that need it be checked. The unique challenges of working with large drilling rigs have translated well to working with aircrafts. And the healthcare field is similar — with the Texas Medical Center, Houston's medical research centers can benefit from hastening the process of data validation.

"There's so much data, and it's so noisy, that it's hard to know whether the data can be trusted or not," Sanchez says.

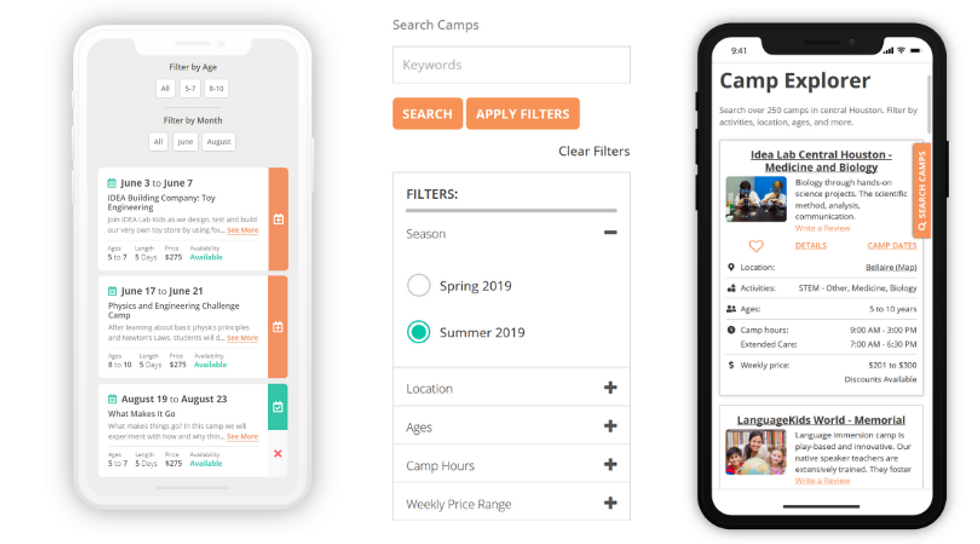

Camppedia

Camppedia, a Houston-based startup, can help match kids to summer camps all around town. Photos courtesy of Camppedia

Probably the least fun thing about summer camp is finding and booking the summer camp. Of course, this responsibility falls on the busy adults' to-do lists. Two Houston parents, Tudor Palaghita and his sister Ana, wanted to create a solution for the overwhelming process.

"We're working parents, we're strapped on time, but we want to make sure we give our kids enriching experiences," explains Ana. "One spring, we were going through the [camp search] process, and we talked about how difficult it was. And the next spring, we said, there's something here. We feel this pain, our friends feel this pain, and no one is helping us. Why don't we solve our problem ourselves?"

And that's exactly what they did. The duo used their business and technology backgrounds — Ana has an MBA from Northwestern University and built a successful career in a major financial institution, and Tudor has his Ph.D. in aerospace engineering from Georgia Tech — to launch Camppedia.com. The site is intended to be a one-stop shop for parents looking for camps for their children.

The tool launched in March of 2019, coinciding with spring break. Currently, it offers options throughout central Houston. Parents can select camps for their children based on interests, their ZIP codes, cost or even those that offer extended hours for moms and dads with full-time jobs.

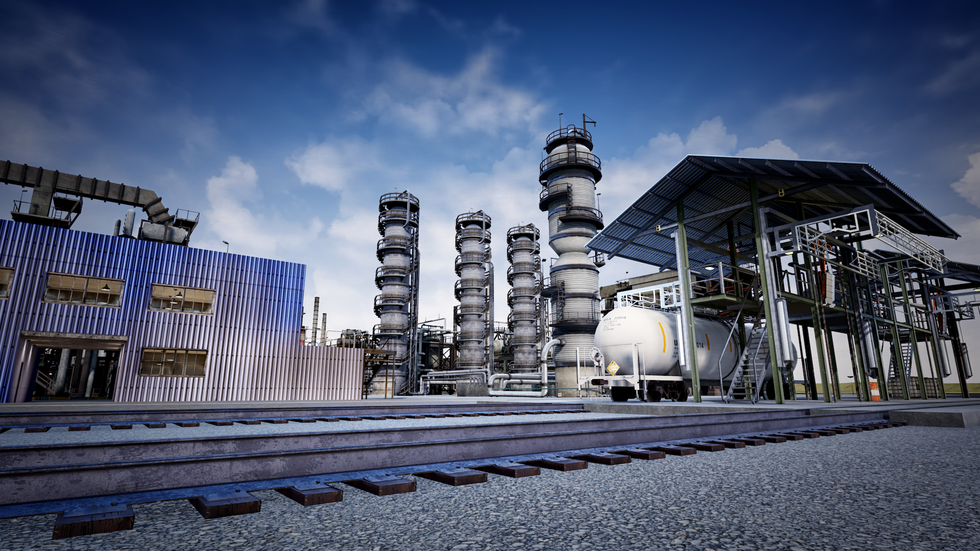

HTX Labs

VR training startup, HTX Labs, recently brought on Houston-based Solvay GBU Peroxides North America as a client. Trainees can work on a digitized version of the plant that looks as real as could be. Courtesy of HTX Labs

Virtual and augmented reality training in industrial settings is on the rise as the process and technology allows for quicker training and minimized risk. Houston-based startup HTX Labs LLC is one of the tech companies at the forefront of the VR-infused modernization of workplace training. Among its customers are the United States Air Force, Mastercard, Rackspace, and Houston-based Solvay GBU Peroxides North America, a maker of hydrogen peroxide.

At its core, the company's VR training zeroes in on the trainee, providing engaging, interactive experiences that stress "learning by doing," Scott Schneider, founder and CEO of HTX Labs, says. Training programs that have been around for decades are "designed for trainers, not necessarily for trainees," he says.

Lodgeur

Lodgeur provides its guests with hotel luxury with room to breathe. Courtesy of Lodgeur

Travelers are usually faced with a decision to make: Privacy and homeliness of an apartment rental or style and class of a hotel room. Houston-based Lodgeur hopes to exist to have the best of both worlds. With Houston's busy business travel industry, founcer Sébastien Long knew he was starting in a good market.

"We're roughly split between leisure guests and business travelers," Long says. "They want to feel like they're staying in a home away from home."

The first guests arrived in mid-April. Long wanted to open by managing just a few properties, to make sure the company could ensure great guest experiences.