Money talks: Top Houston innovation grant and gift news of 2025

Year in Review

Editor's note: As 2025 comes to a close, we're looking back at the stories that defined Houston innovation in 2025. Below, we recap the biggest Houston innovation grant funding and gift news of the year:

Houston scores $120M in new cancer research and prevention grants

The Cancer Prevention and Research Institute of Texas has doled out 73 more grants to health care systems and companies in the state. Carter Smith/Courtesy of MD Anderson

In November 2025, the Cancer Prevention and Research Institute of Texas granted more than $120 million to Houston organizations and companies as part of 73 awards issued statewide. The funds were part of nearly $154 million approved by the CPRIT's governing board earlier that month, bringing the organization's total investment in cancer prevention and research to more than $4 billion since its inception.

TMC lands $3M grant to launch cancer device accelerator

Recent funding from CPRIT will help launch the new Accelerator for Cancer Medical Devices. Photo via TMC

In September 2025, a new business accelerator at Houston’s Texas Medical Center received a nearly $3 million grant from the Cancer Prevention and Research Institute of Texas. The CPRIT grant, awarded to the Texas Medical Center Foundation, will help launch the Accelerator for Cancer Medical Devices. The accelerator will support emerging innovators in developing prototypes for cancer-related medical devices and advancing them from prototype to clinical trials.

Houston foundation grants $27M to support Texas chemistry research

Houston's Welch Foundation has awarded more than 80 grants to support chemical research and careers in Texas for 2025. Photo via Getty Images

Houston-based The Welch Foundation doled out $27 million in its June 2025 round of grants for chemical research, equipment and postdoctoral fellowships. $25.5 million was allocated for the foundation's longstanding research grants, which provide $100,000 per year in funding for three years to full-time, regular tenure or tenure-track faculty members in Texas. The foundation made 85 grants to faculty at 16 Texas institutions for 2025.

Houston Methodist receives $25M gift, renames department of medicine

Houston Methodist will rename its department of medicine the Houston Methodist Charles W. Duncan Jr. Department of Medicine. Photo courtesy Houston Methodist.

In August 2025, Houston-based nonprofit The Duncan Fund awarded a $25 million gift to Houston Methodist's department of medicine to establish new endowed fellowships, streamline complex care and bring artificial intelligence into the fold to develop more personalized treatment plans. In turn, the health care system announced that it would rename the department the Houston Methodist Charles W. Duncan Jr. Department of Medicine.

Houston foundation doles out $700K for Texas chemical research

The Welch Foundation has awarded funding through two of its newest grant programs. Photo via Getty Images.

Houston-based The Welch Foundation issued $700,000 in additional funding in August 2025 to support chemical research through two of its newest grant programs. The foundation named the recipients of its Welch eXperimental (WelchX) Collaboration Retreat and Pilot Grants and the Welch Postdoctoral Fellows of the Life Sciences Research Foundation Grants. The WelchX grants were awarded to teams of two Texas researchers who presented "innovative and collaborative ideas" addressing challenges in the clean energy space, according to the foundation.

CPRIT grants $22M to bring top cancer researchers to Houston

CPRIT recently granted $93 million to 61 organizations and scientists, including many in Houston, to advance cancer research. Carter Smith/Courtesy of MD Anderson

In June 2025, it was announced that several prominent cancer researchers would be coming to the Houston area thanks to $22 million in grants awarded by the Cancer Prevention and Research Institute of Texas (CPRIT). The biggest CPRIT recruitment grant — $6 million — went to genetics researcher Jean Gautier. Gautier, a professor of genetics and development at Columbia University’s Institute for Cancer Genetics, joined the University of Texas MD Anderson Cancer Center to continue his research.

Baylor, Rice win $500,000 to launch humanities-driven health AI center

A new center being developed by Baylor College of Medicine and Rice University aims to develop ethically responsible and trustworthy AI for health care. Photo via Getty Images.

In August 2025, Baylor College of Medicine and Rice University announced they had been awarded a $500,000 grant from the National Endowment for the Humanities (NEH) to create the Center for Humanities-based Health AI Innovation (CHHAIN).

Baylor center receives $10M NIH grant to continue rare disease research

BCM's Center for Precision Medicine Models has received funding that will allow it to study more complex diseases. Photo via Getty Images

Baylor College of Medicine’s Center for Precision Medicine Models received a $10 million, five-year grant from the National Institutes of Health in November 2025, which will allow it to continue its work studying rare genetic diseases. The Center for Precision Medicine Models creates customized cell, fly and mouse models that mimic specific genetic variations found in patients, helping scientists to better understand how genetic changes cause disease and explore potential treatments.

Houston billionaire benefactors will donate almost entire fortune to charity

Pictured: Nancy and Richard Kinder. Photo by Michelle Watson/Catchlight Group

Houston billionaires Rich and Nancy Kinder announced plans to donate an astounding 95% of their multi-billion-dollar wealth to charities. The news came as the Kinder Foundation announced an $18.5 million expansion project for Emancipation Park in the heart of Third Ward. That historic park was founded by slaves in 1872.

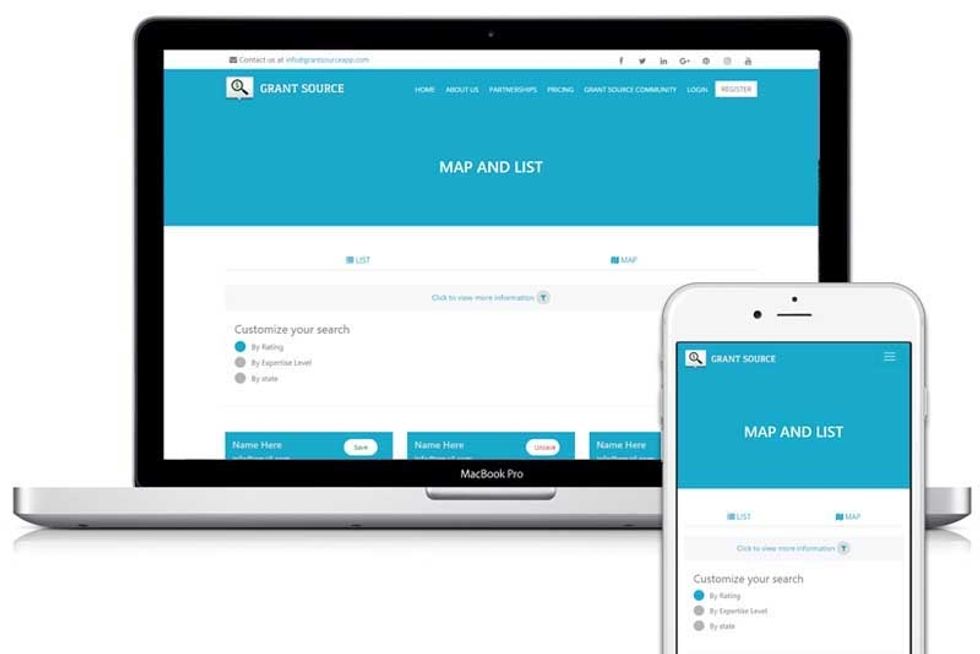

Grant Source has created a database and a suite of resources for companies looking for grants. Photo via grantsource.com

Grant Source has created a database and a suite of resources for companies looking for grants. Photo via grantsource.com