Houston health tech startup secures $20M series A, NIH grant amid clinical trials

fresh funding

A clinical-stage Houston health tech company with a novel therapeutic device has raised venture capital funding and secured a grant from the National Institutes of Health.

VenoStent Inc., which is currently in clinical trials with its bioabsorbable perivascular wrap, announced the closing of a $20 million series A round co-led by Good Growth Capital and IAG Capital Partners. The two Charleston, South Carolina-based firms also led VenoStent's 2023 series A round that closed last year at $16 million.

Additionally, the company secured a $3.6 million Small Business Innovation Research (SBIR) Phase II Grant from NIH, which will help fund its multi-center, 200-patient, randomized controlled trial in the United States.

Tim Boire, VenoStent CEO and co-founder, describes 2024 so far as "a momentous year" so far for his company.

"In the span of a few months, we initiated our first clinical sites, enrolled the first patients in our large RCT and closed our Series A with Norwest," Boire says in a news release. "We also received the NIH grant, which enables us to execute our trial with the highest degree of quality and rigor to make it as scientifically robust and impactful to patients as possible.

'Each of these are major company milestones that collectively represent many years of intensive and fruitful R&D and collaboration," he continues. "These recent milestones will propel our company forward to an exciting next phase."

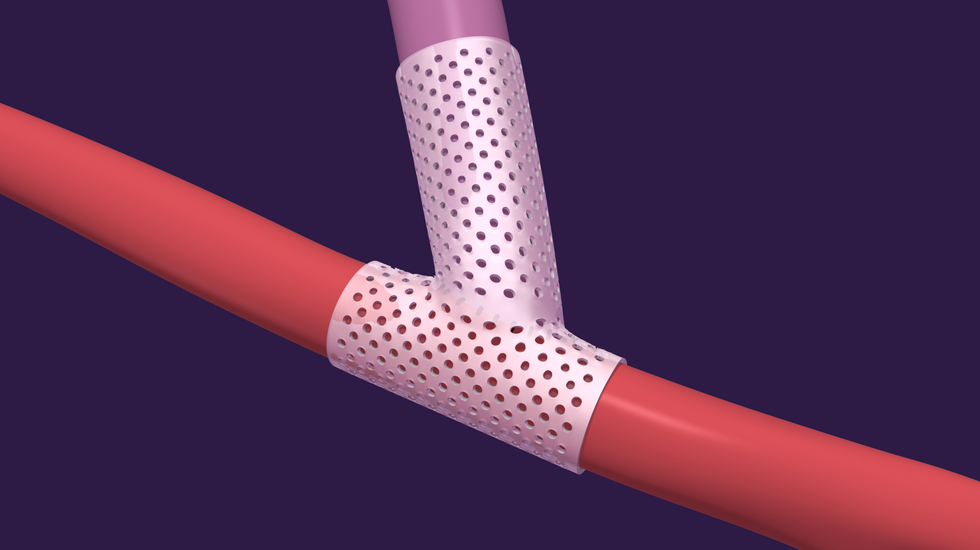

The company's innovation, the SelfWrap, goes around arteriovenous (AV) access sites at the time of AV fistula creation surgery. The device is intended "to accelerate the usability and increase the durability of the fistula sites for chronic kidney disease (CKD) patients requiring hemodialysis," reads the release, "mimicking the arterial environment in veins, which experience a 10x increase in pressure and flow during AV creation and causes the veins to become unusable in dialysis."

Along with the investment, VenoStent announced two new board observers. Norwest General Partner Dr. Zack Scott and Investor Dr. Ehi Akhirome are bringing their expertise to the growing company.

"Norwest's investment is tremendous validation for VenoStent, and we are thrilled to have both Zack and Ehi joining the company's board," VenoStent COO and Co-Founder Geoffrey Lucks adds in the release. "Zack and Ehi have extensive knowledge in our space, and their added value will match the capital and cache of Norwest dollar-for-dollar."

Last year at the same time VenoStent announced its last funding round, the SelfWrap was approved by the U.S. Food and Drug Administration to begin its U.S. Investigational Device Exemption (IDE) study.

"Over half a million people in the U.S. rely on hemodialysis to survive and require an arteriovenous fistula creation surgery in order to receive the treatment. However, the AV fistula procedure has a one-year failure rate of more than 60 percent, which significantly impacts patients' survival rates and quality of life," Scott says in the release. "VenoStent's groundbreaking technology for AV fistula formation, SelfWrap, has the potential to significantly improve these odds. We look forward to working with the VenoStent team as it proves the efficacy of this breakthrough technology in order to improve the lives of hundreds of thousands of CKD patients."

Last summer, Boire told InnovationMap on the Houston Innovators Podcast that he's looking to launch the product in 2026.

- 3 Houston innovators to know this week ›

- Rice Alliance names most promising life science companies at annual forum ›

- This Houston medical device innovator plans to lead a 'paradigm shift' in vascular surgery ›

- Houston startup with unique vascular innovation enrolls subjects in new trial ›

- Houston health tech startup secures $16M series A, prepares for first U.S. clinical trials ›

VenoStent's novel therapeutic medical device is a bioabsorbable wrap. Image courtesy of VenoStent

VenoStent's novel therapeutic medical device is a bioabsorbable wrap. Image courtesy of VenoStent Tim Boire is the CEO of VenoStent. Photo via LinkedIn

Tim Boire is the CEO of VenoStent. Photo via LinkedIn