These 7 Houston startups closed millions in funding last month

Venture adventures

September was a busy month for several Houston startups. Seven companies closed rounds throughout the month and are now beginning the fourth quarter of 2019 with fresh funds.

InnovationMap has rounded up these seven deals based on previous stories as well as new information. Scroll through to see which Houston startups are catching the eyes — and cashing the checks — of investors.

Galen Data

Houston-based Galen Data is growing its clientbase and just formed two new partnerships with medical device companies. Photo via galendata.com

Houston-based Galen Data is growing its clientbase and just formed two new partnerships with medical device companies. Photo via galendata.comTexas Halo Fund led a Houston startup's seed round last month. Galen Data, which uses its cloud-based software to connect medical devices, closed a $1 million seed round thanks to the fund's $250,000 investment. Kevin King, one of Texas Halo Fund's managing director, has also been named to the startup's board of directors.

According to the release, the Texas Halo Fund based its decision for the investment "on the large and growing addressable market of connected medical devices, the company's impressive management team, and post revenue status."

Galen Data's emergence comes as the market for internet-connected mobile health apps keeps growing. One forecast envisions the global space for mobile health exceeding $94 billion by 2023.

"We want to be at the forefront of that technology curve," DuPont tells InnovationMap in a previous interview. "We might be six months early, we might be a year early, but it's starting to happen."

Earlier this year, Galen Data formed strategic partnerships with medical device companies. Click here to read more about those.

SurfEllent

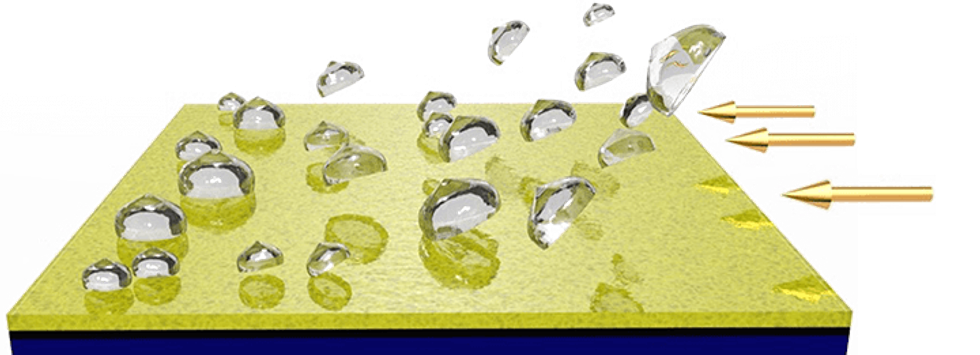

Photo via surfellent.com

SurfEllent, an anti-icing coating technology startup founded out of the University of Houston has raised $470,000 in funding. The company won the second place award and a total of $45,000 at the Texas A&M New Ventures competition before receiving an anonymous investment of $350,000 in seed funding. SurfEllent also received two grants: a $50,000 Small Business Innovation Research grant and a $24,999 Small Business Technology Transfer grant.

"Ice is a problem that will exist as long as we live on the earth. It impacts a wide range of things, including aircraft wings and engines, automobiles, buildings and bridges, ships and vessels, and power transmission systems," says SurfEllent Co-Founder Hadi Ghasemi, a Bill D. Cook Associate professor of mechanical engineering at the UH Cullen College of Engineering, says in a news release.

SurfEllent's product can be used in the de-icing of cars and airplane engines.

"The end goal is to improve the quality of human life," Ghasemi says in the release. "This recognition is another proof of the critical need for advanced anti-icing coating technologies and opens opportunities for collaboration with various industries and business partners."

Cemvita Factory

Cemvita Factory

Cemvita FactoryIn August, Occidental Petroleum's Oxy Low Carbon Ventures LLC invested in Houston-based Cemvita Factory, and in September, BHP followed suit. While Cemvita Factory isn't able to disclose how much money its raised through these partnerships, the company confirms it has closed its round of funding.

Cemvita Factory is run by a brother-sister team. Moji and Tara Karimi built the company off of Tara's research into mimicking photosynthesis. The process is able to help reduce energy company's carbon emissions.

"We have an ambitious goal to take one gigaton of CO2 out of the carbon cycle in the next decade and are very excited about being a part of Occidental's journey to become a carbon-neutral company," says Tara, co-founder and chief scientist, in a news release.

The investments will help Cemvita Factory continue to develop its biomimicry technology for oil and gas applications to reduce the volume of greenhouse gas emissions.

Sourcewater

It might not be surprising to discover that the energy capital of the world is a hub for energy startups. Getty Images

It might not be surprising to discover that the energy capital of the world is a hub for energy startups. Getty ImagesHouston-based Sourcewater Inc., which specializes in oilfield water intelligence, closed its series A round at $7.2 million. Bison Technologies, Marubeni Corp., and major energy family offices in Houston, Midland, Dallas, and Oklahoma City contributed to the round. The funds will go toward further developing the company's technology.

"For every barrel of oil produced in the Permian Basin there are more than ten barrels of associated water that are sourced, recycled, transported, and disposed of," says Joshua Adler, founding chief executive of Sourcewater, in a news release. "When America became the world's leading energy producer last year, it also became the world's leading water producer, times ten. Water management is now the majority of upstream energy production cost, and water sourcing, recycling and disposal capacity is the primary constraint on America's energy future."

SEATz

Houston startup sEATz has created a platform where fans can order just about anything their stadium has from an app. Much like any other ordering app, once the order is placed, a runner will pick up the food and deliver it to the customer for a small fee and a tip.

The startup is now preparing to scale up from seven venues to 10 before the year is over as well as launching a new version of the app thanks to an oversubscribed near $1.3 million seed round led by Houston-based Valedor Partners. Houston-based Starboard Star Venture Capital also contributed to the round. SEATz has plans to launch its Series A round before the new year.

"We're building enterprise-level, scalable in-seat ordering, delivery, and pick-up software. We'll have all the data and validation we need this fall to really start to push that out," says CEO and co-founder Aaron Knape.

Syzygy

Earlier this year, Trevor Best, CEO of Syzygy Plasmonics, walked away from EarthX $100,000 richer. Now, he has an even bigger check to cash. Photo via LinkedIn

Using research that came out of Rice University, Syzygy Plasmonics has developed a hydrogen fuel cell technology that produces a cheaper source of energy that releases fewer carbon emissions.

The company just closed a $5.8 million Series A round led by MIT's The Engine and Houston-based The GOOSE Society of Texas. Evok Innovations, a previous investor in the company, and angel investors from the Creative Destruction Lab also contributed to the round.

"We're starting to solidify relationships and get customers ready," CEO Trevor Best tells InnovationMap.

Topl

Houston-based Topl can track almost anything using its blockchain technology. Getty Images

Houston-based Topl, a blockchain network with applications across industries, closed a 20 percent oversubscribed $700,000 seed round.

"Every investor that is invested now has focused on both the purpose and the profit, and I'm big on that," Kim Raath, president and co-founder of Topl, says.

The team has built six blockchain platforms that operate on the Topl network — two are live now, and four will go live later this year. The platforms are focused on four different areas: agriculture (tracking food products from the farm to the shelves), mining (diamonds, for instance), sustainability and impact (tracking a program to see how it succeeds), and carbon credits and renewables within the energy industry.

Click here to read more about the raise and what it means to Topl's technology.

Apple doubles down on Houston with new production facility, training center Photo courtesy Apple.

Apple doubles down on Houston with new production facility, training center Photo courtesy Apple.