Editor's note: Houston innovators are making waves this month with revolutionary VC funding, big steps towards humanoid robotics, and software that is impacting the agriculture sector. Here are three Houston innovators to know right now.

Zach Ellis, founder and partner of South Loop Ventures

Zach Ellis. Photo via LinkedIn

Zach Ellis Jr., founder and general partner of South Loop Ventures, says the firm wants to address the "billion-dollar blind spot" of inequitable distribution of venture capital to underrepresented founders of color. The Houston-based firm recently closed its debut fund for more than $21 million. Learn more.

Ty Audronis, CEO and founder of Tempest Droneworx

Ty Audronis, CEO and founder of Tempest Droneworx

Ty Audronis, CEO and founder of Tempest DroneworxTy Audronis, center. Photo via LinkedIn.

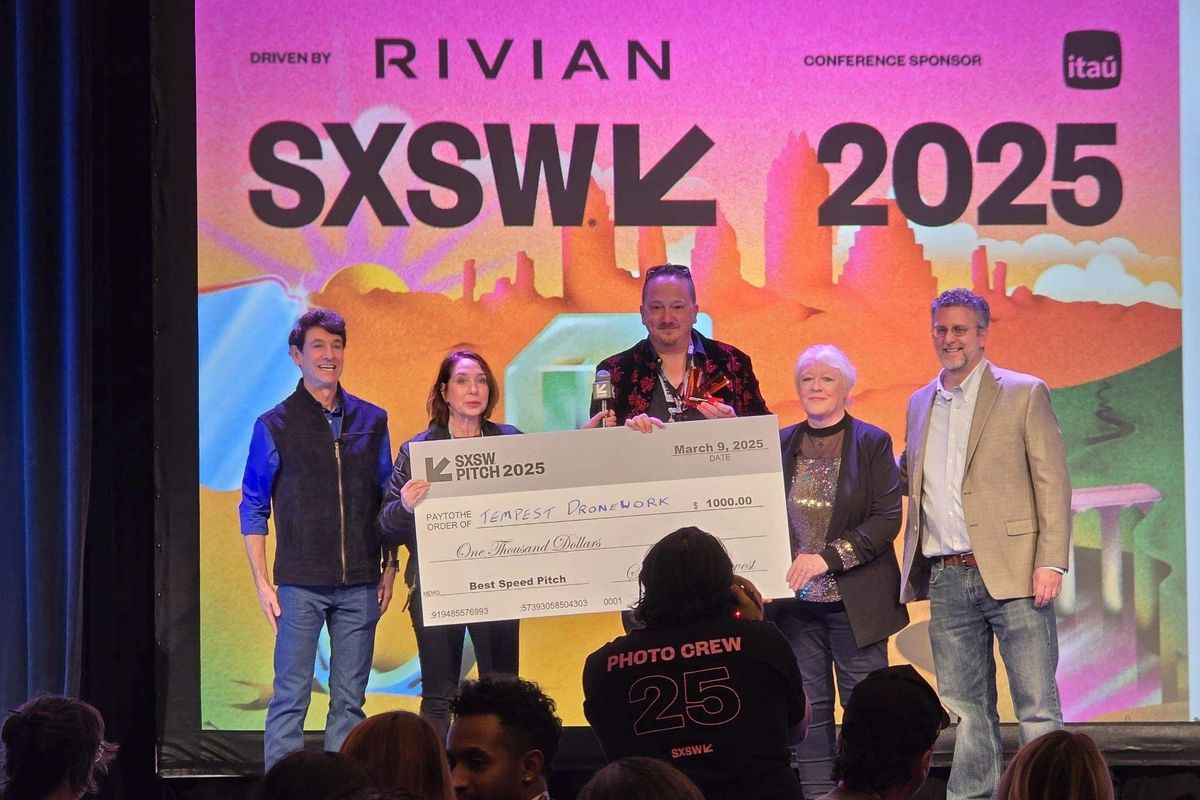

Ty Audronis and his company, Tempest Droneworx, made a splash at SXSW Interactive 2025, winning the Best Speed Pitch award at the annual festival. The company is known for it flagship product, Harbinger, a software solution that agnostically gathers data at virtually any scale and presents that data in easy-to-understand visualizations using a video game engine. Audronis says his company won based on its merits and the impact it’s making and will make on the world, beginning with agriculture. Learn more.

Nicolaus Radford, CEO of Persona AI

Nicolaus Radford, founder and CEO of Nauticus RoboticsNicolaus Radford. Image via LinkedIn

Nicolaus Radford, founder and CEO of Nauticus RoboticsNicolaus Radford. Image via LinkedInHouston-based Persona AI and CEO Nicolaus Radford continue to make steps toward deploying a rugged humanoid robot, and with that comes the expansion of its operations at Houston's Ion. Radford and company will establish a state-of-the-art development center in the prominent corner suite on the first floor of the building, with the expansion slated to begin in June. “We chose the Ion because it’s more than just a building — it’s a thriving innovation ecosystem,” Radford says. Learn more.