Overheard: NASA administrator shares Houston's potential as a commercial space hub

eavesdropping online

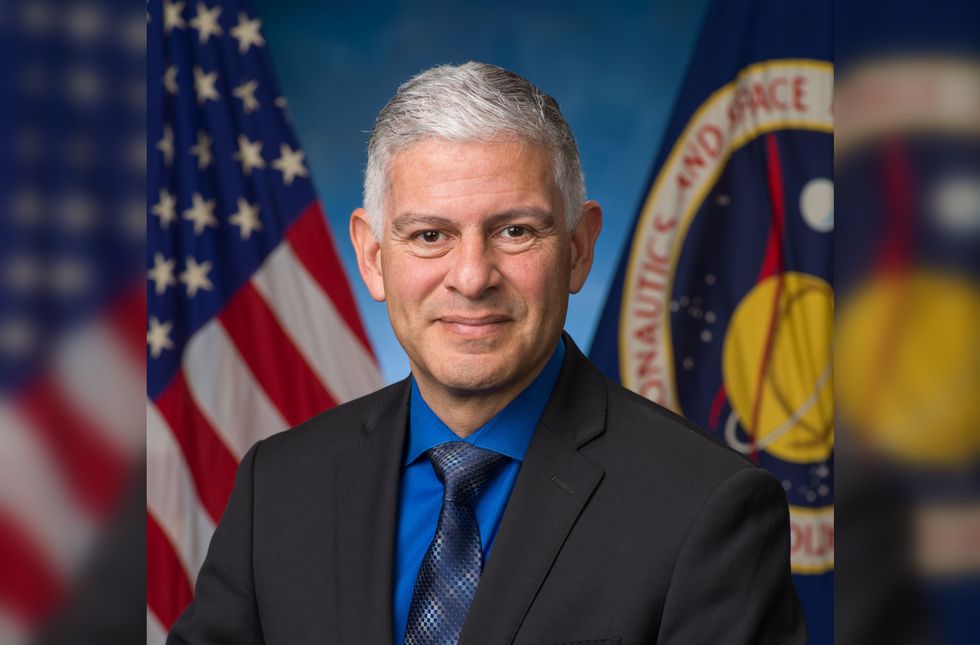

The Greater Houston Partnership hosted its inaugural State of Space event featuring a keynote address by Jim Bridenstine, NASA administrator, that touched on the many ongoing projects at Houston's Johnson Space Center.

The online event, which also featured speeches from GHP President Bob Harvey and JSC Mark Geyer, took place Tuesday, December 15, for GHP members and nonmembers alike.

In his address, Bridenstine discussed the commercialization of space, how politics have affected the agency's history, and the exciting projects underway — including returning man to the moon. Missed the discussion? Here are some significant overheard moments from the virtual event.

"Houston is a city that chooses to take on humankind's boldest challenges head-on, and through that work we have built Houston as a technology-oriented city."

— Bob Harvey, president and CEO of the Greater Houston Partnership. Harvey called out, specifically, the Johnson Space Center and its history as the mecca for human space flight, as well as the emerging Houston Spaceport, which hopes to combine innovation across industries, from space to energy and life sciences.

"In fiscal year '21, NASA will see the first two lunar landings of the agency's Commercial Lunar Payload Services — this is an initiative led in Houston where American companies will serve science and technology payloads to the surface of the moon to prepare for human missions."

— Mark Geyer, director of JSC. Geyer mentions this initiative specifically, as well as 2020's collaboration with SpaceX to have the first American launch since 2011. Geyer also calls out NASA's new Commercial Crew Program. "All of these things position Houston to be a leader and a focal point for this new commercial space ecosystem, which is national and global in nature," Geyer says.

"We are very fortunate to have a center like Johnson in a city like Houston — a city that produces talent, that has an amazing workforce, a dedication to education and to the STEM fields."

— Jim Bridenstine, NASA administrator. Bridenstine, a Rice University alumnus, adds that the JSC currently has more programs and projects under development at any point in history.

"Johnson is focused like a laser on Mission Control. ... The No. 1 project NASA has, which we celebrated last month, is 20 years of humans working and living in space continuously."

— Bridenstine says, noting some of the continued missions like Artemis, which will return humans to the surface of the moon, and Gateway, an outpost orbiting the moon to support continued human space exploration.

"Our goal is to put an American flag on Mars — the moon is the proving ground, and Mars is the destination."

— Bridenstine says regarding NASA's focus on returning to the moon.

"I am judging my time as NASA administrator based on whether or not — when my children are my age — we are still on the moon and on Mars."

— Bridenstine says. He notes that part of moving forward is looking back and learning about programs got canceled and why, and which ones were sustainable and why. In some cases, says Bridenstine, who served in U.S. Congress for five years, it was due to divisive politics.

"The Johnson Space Center is quite well positioned for attracting a lot of commercial industry and international partners."

— Bridenstine says when asked about Houston's potential for attracting space business. He mentions how crucial Houston-based Mission Control is and always has been, as well as the emerging focus on Gateway, which will be open for other countries to be supported by. "I think Houston is in great shape — between Mission Control and the Gateway."