Houston companies have been up to some huge accomplishments, from winning money at Texas A&M University to launching a local software-focused venture capital fund. Here's what big news trended this week in Houston innovation.

Need more than just trending news on Fridays? Subscribe to our daily newsletter that sends fresh stories straight to your inboxes every morning.

These are the Houston companies headed to MassChallenge Texas in Austin

A handful of Houston startups will be bouncing back and forth to Austin for the second annual MassChallenge Texas accelerator. Getty Images

It's the second cohort for Boston-based MassChallenge Texas in Austin, and this year's 74 selected finalists are well represented by Houston. Here are seven of the Houston-related companies that will be trekking back and forth to Austin from June until October.

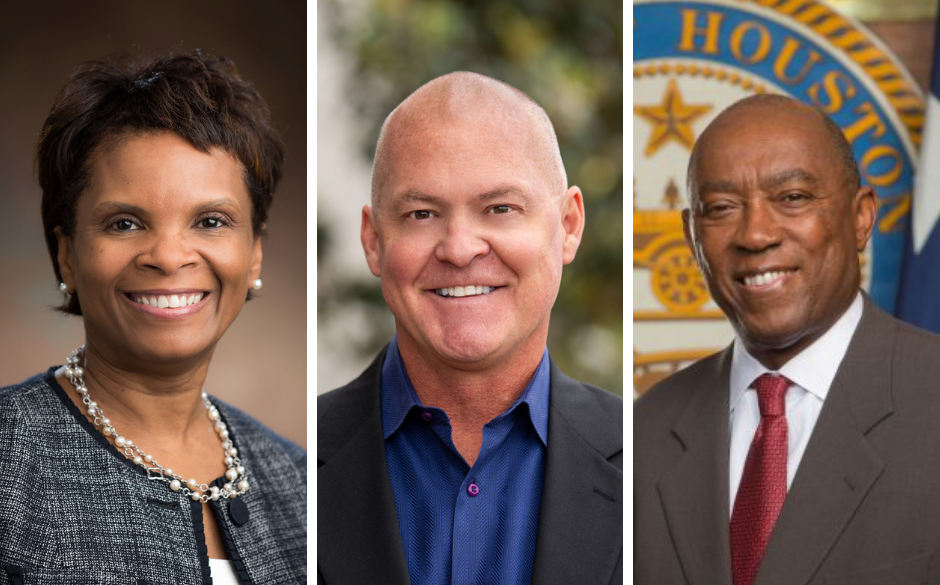

3 Houston innovators to know this week

From health care to politics, here's who you need to know in Houston innovation this week. Courtesy photos

There's no summer slowdown in sight, as Houston's innovation world keeps turning. Texas Children's Hospital is amping up their attention to innovation — and so is the mayor. Meanwhile, a local software company just made a big hire. Read about what innovators you need to keep an eye on.

Houston companies take home big prizes from a Texas A&M startup competition

Spark Biomedical took home first place at the Texas A&M New Ventures Competition. Courtesy of Texas A&M

Earlier this month, 16 startups competed in the 2019 Texas A&M New Ventures Competition for more than $350,000 in cash and in-kind services — the largest pool of prizes in the contest's history.

Houston had a huge presence at TNVC this year. Several Houston startups competed in the technology- and science-focused pitch competition, and the top three prizes were claimed by Houstonians. Of the 13 health and life science companies that were named semifinalists, seven were related to the TMC Innovation Institute. Check out the Houston companies that walked away from the TNVC with cash and/or prizes.the Houston companies that walked away from the TNVC with cash and/or prizes.

This Houston sports tech entrepreneur wants more big wins for Houston

Stephane Smith wants his company, Integrated Bionics, and its sports tech sensor to be a big win for Houston. Courtesy of Integrated Bionics

It took Stephane Smith and his brother, Yves, a few tries to get a revolutionary sports device that the market actually wanted. Now that they have, their Houston-based company, Integrated Bionics, has its Titan Sensor device being used worldwide — from Zimbabwe and Israel to Brazil and Mexico.

The Titan, which launched in 2017, syncs GPS with video and provides athletic metrics at an attainable price. Most of the company's customers are soccer teams primarily in the collegiate space — with some professional and even youth teams. Smith says the company has a firm footing within soccer because that's where this technology really started. Read more about the Titan Sensor and its creator.

Houston startup consulting firm launches $20 million venture capital fund for early stage software companies

The new, Houston-based GSTVC fund will dole out $20 million to scalable SaaS companies. Photo by rawpixel.com from Pexels

A new venture capital fund has launched in Houston to serve seed-stage, software-as-a-service companies. The $20 million fund plans to make its first investment by the end of the third quarter of this year.

The fund is launching under Golden Section Technology, a Houston-based software consulting firm focused on demystifying technology and providing training and counseling for entrepreneurs. Managing director, Dougal Cameron, says he and a small group of investors made investments in some of the companies that GST has worked with over the years. Learn more about this new fund.