Houston startups closed out the last half of 2025 with major funding news.

Here are 14 Houston companies—from groundbreaking energy leaders to growing space startups—that secured funding in the last six months of the year, according to reporting by InnovationMap and our sister site, EnergyCapitalHTX.com.

Did we miss a funding round? Let us know by emailing innoeditor@innovationmap.com.

Fervo Energy

Fervo Energy has closed an oversubscribed Series E. Photo via Fervo Energy

Houston-based geothermal energy company Fervo Energy closed an oversubscribed $462 million series E funding round, led by new investor B Capital, in December.

The company also secured $205.6 million from three sources in June.

“Fervo is setting the pace for the next era of clean, affordable, and reliable power in the U.S.,” Jeff Johnson, general partner at B Capital, said in a news release.

The funding will support the continued buildout of Fervo’s Utah-based Cape Station development, which is slated to start delivering 100 MW of clean power to the grid beginning in 2026. Cape Station is expected to be the world's largest next-generation geothermal development, according to Fervo. The development of several other projects will also be included in the new round of funding. Continue reading.

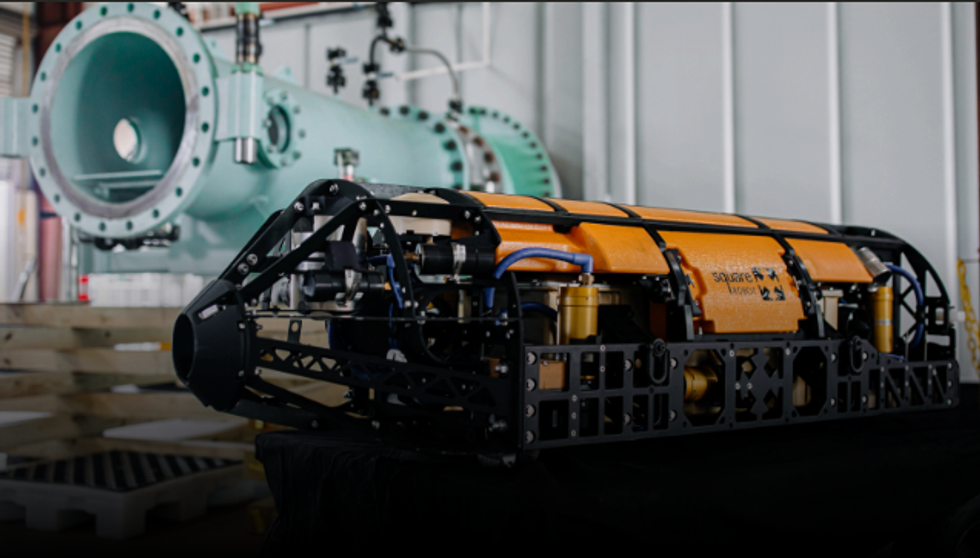

Square Robot

Houston robotics co. unveils new robot that can handle extreme temperatures

Houston robotics co. unveils new robot that can handle extreme temperaturesSquare Robot's technology eliminates the need for humans to enter dangerous and toxic environments. Photo courtesy of Square Robot

Houston- and Boston-based Square Robot Inc. announced a partnership with downstream and midstream energy giant Marathon Petroleum Corp. (NYSE: MPC) last month.

The partnership came with an undisclosed amount of funding from Marathon, which Square Robot says will help "shape the design and development" of its submersible robotics platform and scale its fleet for nationwide tank inspections. Continue reading.

Eclipse Energy

Eclipse Energy and Weatherford International are expected to launch joint projects early this year. Photo courtesy of Eclipse Energy.

Oil and gas giant Weatherford International (NASDAQ: WFRD) made a capital investment for an undisclosed amount in Eclipse Energy in December as part of a collaborative partnership aimed at scaling and commercializing Eclipse's clean fuel technology.

According to a release, joint projects from the two Houston-based companies are expected to launch as soon as this month. The partnership aims to leverage Weatherford's global operations with Eclipse Energy's pioneering subsurface biotechnology that converts end-of-life oil fields into low-cost, sustainable hydrogen sources. Continue reading.

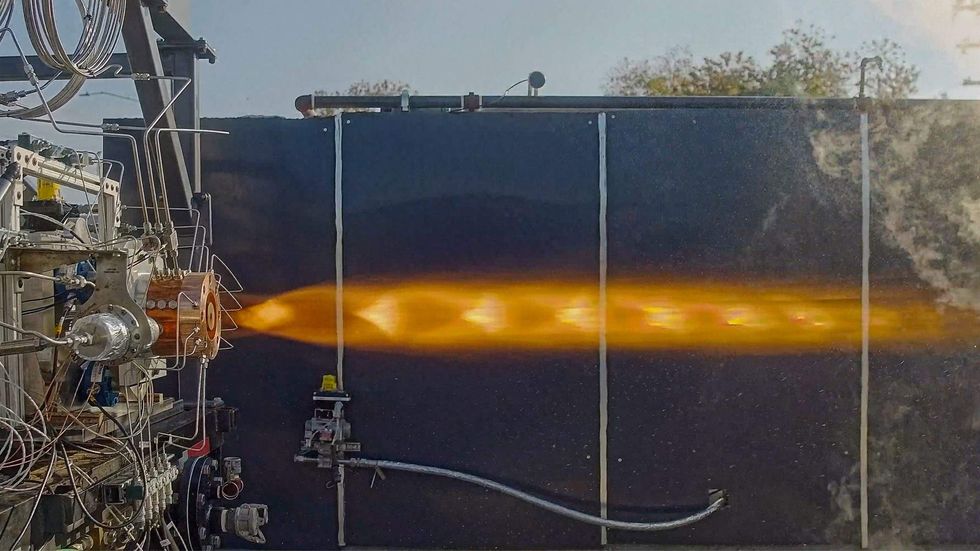

Venus Aerospace

Lockheed Martin Ventures says it's committed to helping Houston-based Venus Aerospace scale its technology. Photo courtesy Venus Aerospace

Venus Aerospace, a Houston-based startup specializing in next-generation rocket engine propulsion, has received funding from Lockheed Martin Ventures, the investment arm of aerospace and defense contractor Lockheed Martin, for an undisclosed amount, the company announced in November. The product lineup at Lockheed Martin includes rockets.

The investment follows Venus’ successful high-thrust test flight of its rotating detonation rocket engine (RDRE) in May. Venus says it’s the only company in the world that makes a flight-proven, high-thrust RDRE with a “clear path to scaled production.”

Venus says the Lockheed Martin Ventures investment reflects the potential of Venus’ dual-use technology for defense and commercial uses. Continue reading.

Koda Health

Tatiana Fofanova and Dr. Desh Mohan, founders of Koda Health, which recently closed a $7 million series A. Photo courtesy Koda Health.

Houston-based digital advance care planning company Koda Health closed an oversubscribed $7 million series A funding round in October.

The round, led by Evidenced, with participation from Mudita Venture Partners, Techstars and Texas Medical Center, will allow the company to scale operations and expand engineering, clinical strategy and customer success, according to a news release.

The company shared that the series A "marks a pivotal moment," as it has secured investments from influential leaders in the healthcare and venture capital space. Continue reading.

Hertha Metals

U.S. Rep. Morgan Luttrell, a Magnolia Republican, and Hertha Metals founder and CEO Laureen Meroueh toured Hertha’s Conroe plant in August. Photo courtesy Hertha Metals/Business Wire.

Conroe-based Hertha Metals, a producer of substantial steel, hauled in more than $17 million in venture capital from Khosla Ventures, Breakthrough Energy Fellows, Pear VC, Clean Energy Ventures and other investors.

The money was put toward the construction and the launch of its 1-metric-ton-per-day pilot plant in Conroe, where its breakthrough in steelmaking has been undergoing tests. The company uses a single-step process that it claims is cheaper, more energy-efficient and equally as scalable as conventional steelmaking methods. The plant is fueled by natural gas or hydrogen.

The company, founded in 2022, plans to break ground early this year on a new plant. The facility will be able to produce more than 9,000 metric tons of steel per year. Continue reading.

Helix Earth Technologies, Resilitix Intelligence and Fluxworks Inc.

Helix Earth's technology is estimated to save up to half of the net energy used in commercial air conditioning, reducing both emissions and costs for operators. Photo via Getty Images

Houston-based Helix Earth Technologies, Resilitix Intelligence and Fluxworks Inc. each secured $1.2 million in federal funding through the Small Business Innovation Research (SBIR) Phase II grant program this fall.

The three grants from the National Scienve foundation officially rolled out in early September 2025 and are expected to run through August 2027, according to the NSF. The SBIR Phase II grants support in-depth research and development of ideas that showed potential for commercialization after receiving Phase I grants from government agencies.

However, congressional authority for the program, often called "America's seed fund," expired on Sept. 30, 2025, and has stalled since the recent government shutdown. Continue reading.

Solidec Inc. (pre-seed)

7 innovative startups that are leading the energy transition in Houston

7 innovative startups that are leading the energy transition in HoustonHouston-based Solidec was founded around innovations developed by Rice University associate professor Haotian Wang (far left). Photo courtesy Greentown Labs.

Solidec, a Houston startup that specializes in manufacturing “clean” chemicals, raised more than $2 million in pre-seed funding in August.

Houston-based New Climate Ventures led the oversubscribed pre-seed round, with participation from Plug and Play Ventures, Ecosphere Ventures, the Collaborative Fund, Safar Partners, Echo River Capital and Semilla Climate Capital, among other investors. Continue reading.

Molecule

Sameer Soleja is the founder and CEO of Molecule, which just closed its series B round. Photo courtesy of Molecule Software.

Houston-based energy trading risk management (ETRM) software company Molecule completed a successful series B round for an undisclosed amount, according to a July 16 release from the company.

The raise was led by Sundance Growth, a California-based software growth equity firm. Sameer Soleja, founder and CEO of Molecule, said in the release that the funding will allow the company to "double down on product innovation, grow our team, and reach even more markets." Continue reading.

Rarefied Studios, Solidec Inc. and Affekta

Houston startups were named among the nearly 300 recipients that received a portion of $44.85 million from NASA to develop space technology this fall. Photo via NASA/Ben Smegelsky

Houston-based Rarefied Studios, Solidec Inc. and Affekta were granted awards from NASA this summer to develop new technologies for the space agency.

The companies are among nearly 300 recipients that received a total agency investment of $44.85 million through the Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) Phase I grant programs, according to NASA.

Each selected company received $150,000 and, based on their progress, will be eligible to submit proposals for up to $850,000 in Phase II funding to develop prototypes. The SBIR program lasts for six months and contracts small businesses. Continue reading.

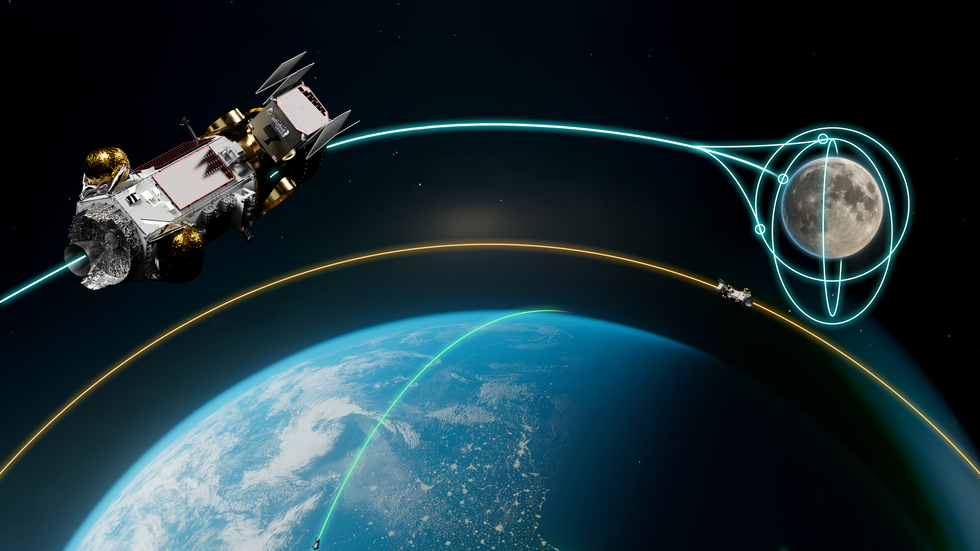

Intuitive Machines

Intuitive Machines expects to begin manufacturing and flight integration on its orbital transfer vehicle as soon as 2026. Photo courtesy Intuitive Machines.

Houston-based Intuitive Machines secured a $9.8 million Phase II government contract for its orbital transfer vehicle in July.

The contract was expected to push the project through its Critical Design Review phase, which is the final engineering milestone before manufacturing can begin, according to a news release from the company. Intuitive Machines reported that it expected to begin manufacturing and flight integration for its orbital transfer vehicle as soon as this year, once the design review is completed.

The non-NASA contract is for an undisclosed government customer, which Intuitive Machines says reinforces its "strategic move to diversify its customer base and deliver orbital capabilities that span commercial, civil, and national security space operations." Continue reading.

Mark Frohlich is the CEO of the Houston- and Seattle-based company. Photo courtesy of Indapta Therapeutics

Mark Frohlich is the CEO of the Houston- and Seattle-based company. Photo courtesy of Indapta Therapeutics