Houston venture group leads Austin-based tech company's $8M series A round

spruced

A Houston-founded startup that designed an app-based service for apartment dwellers has closed an $8 million series A led by Houston-based Mercury Fund.

Spruce, which was founded in Houston in 2016 as Apartment Butler before rebranding and relocating to Austin, announced the close of its latest round this week. The startup partners with multifamily companies to provide concierge-like services, such as cleaning, dog walking, and even COVID-19 sanitation.

"Spruce is changing how people live in their homes," says Ben Johnson, founder and CEO, in a news release. "Today's apartment community is a vibrant micro-economy for services and goods, and Spruce efficiently channels these interactions into a single marketplace. This Series A will expand our offerings to more residents and properties as well as continue our national roll-out."

Mercury Fund also invested in the company's seed round last year, and since that funding, Spruce has expanded out of state and into nine new markets. According to the release, the company, which still has an office in houston, has 40 employees and over 760 properties with 230,000 units on its platform.

"Spruce has perfected their market model and built a best-in-class team. Their resilience and growth during this unprecedented time have impressed us, and we are excited to continue on this journey with them," says Blair Garrou, managing director at Mercury Fund, in the release.

Houston-based Sweat Equity Partners, a new Spruce investor, also contributed to the round. Andrew White, president of the investment group, will also join the board of directors.

"Spruce is building a valuable platform focused on delivering outstanding home services under the unique requirements of the multi-family segment," says White in the release.

Steven Pho, an Austin-based entrepreneur and investor previously with Favor Delivery and RetailMeNot, will also join the board.

"Spruce has an amazing opportunity to quickly and cost effectively reach a mass market through their partnerships with national property managers," Pho says in the release. "This unique channel strategy differentiates Spruce from their competitors and enables them to rapidly achieve scale and density in new markets."

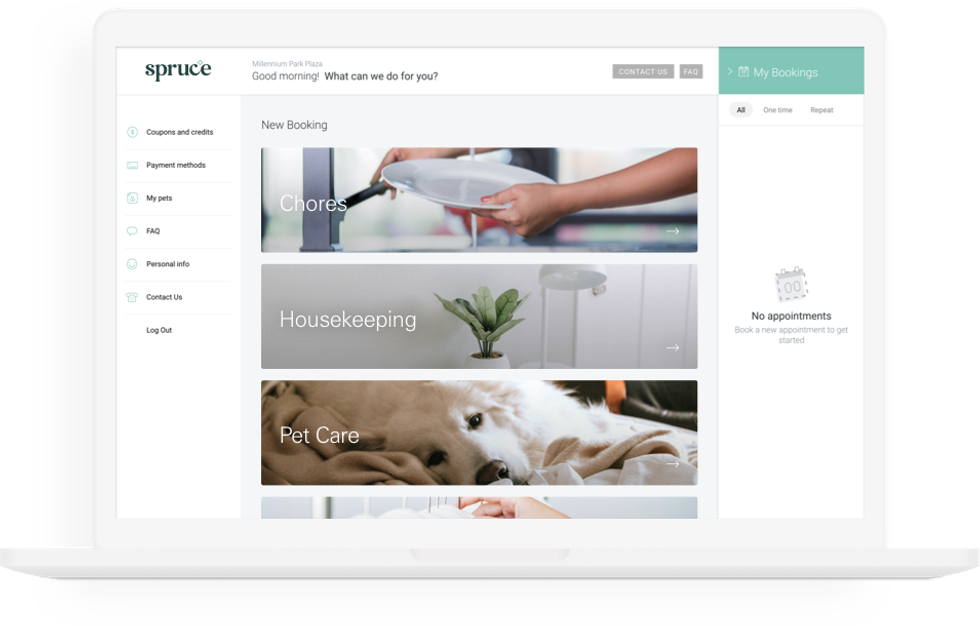

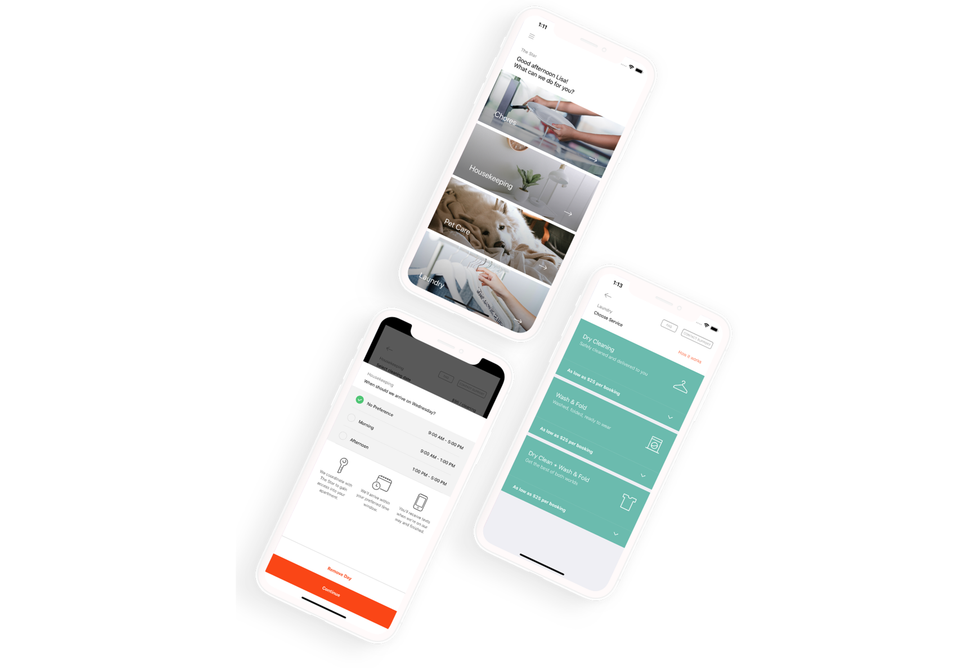

Apartment dwellers that live in a Spruce-partner community can access services through an app or desktop interface.Photo via GetSpruce.com

Apartment dwellers that live in a Spruce-partner community can access services through an app or desktop interface.Photo via GetSpruce.com

Apple doubles down on Houston with new production facility, training centerPhoto courtesy Apple.

Apple doubles down on Houston with new production facility, training centerPhoto courtesy Apple.