What's trending

5 most popular innovation stories in Houston this week

Editor's note: Houston began October with a flurry of innovation news stories, from a new accelerator being launched in town and three innovators to know to events not to miss and a name change for a Houston company. Here are this week's top stories.

3 Houston innovators to know this week

This week's Houston innovators are bringing new exciting things to town. Courtesy photos

New and exciting things are coming to town — from a data-focused conference two two startup development organizations announcing a Houston presence. Here are three Houston innovators making it happen in town. Click here to continue reading.

10+ can't-miss Houston business and innovation events for October

Check out these conferences, pitch competitions, networking, and more. Getty Images

October is another busy one for Houston innovation. Data-focused conferences, a rescheduled grand opening for The Cannon, and so much more. Click here to continue reading.

Exclusive: Houston sports tech company rebrands to attract a wider range of clients

FanReact is now Truss, and the company will be able to reach a greater audience. Photo courtesy of Truss

A Houston company that's specialized in digital sports fan engagement is reinventing itself to grow its client base.

FanReact, which earlier this year spun off its esports business into a new company called Mainline, is now known as Truss. The transition opens doors for the company to reach new clients that aren't in the sports industry — but that maybe want to take a page out of the fan experience's book. Click here to continue reading.

Houston millionaire starts biotech accelerator for companies focusing on regenerative medicine

The new biotech accelerator has already worked with two companies, which have relocated their operations to Houston. Getty Images

A new Houston-based startup accelerator is planning to advance companies focusing on regenerative medicine and stem cell treatment.

Houston Healthspan Innovation Group was created by founder and CEO Ed Bosarge, a local entrepreneur who's made millions of developing health care and finance technology. Click here to continue reading.

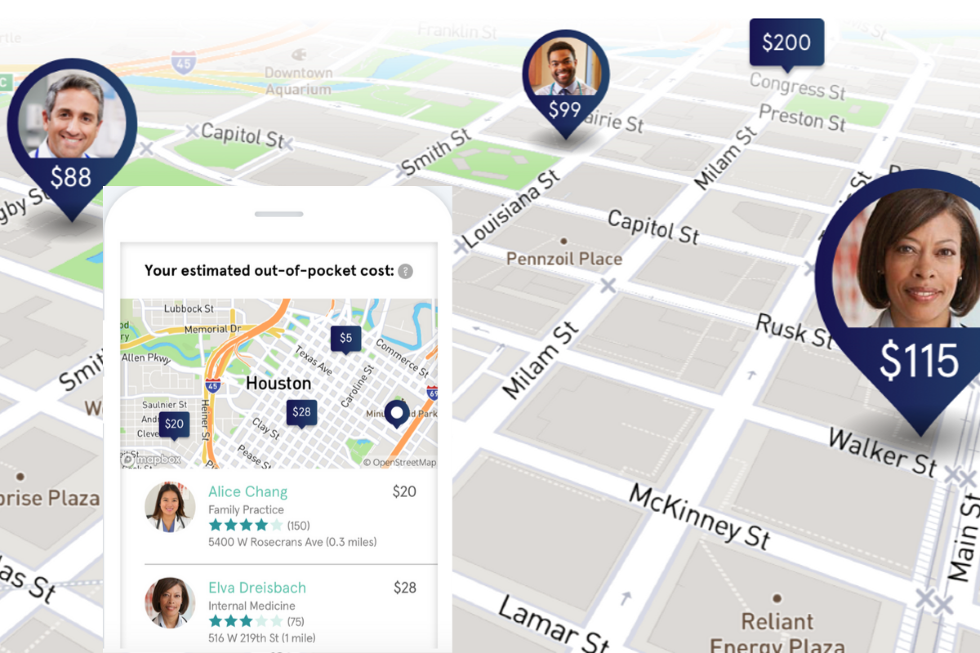

Health insurance tech startup taps Texas for its launch due to its large uninsured population

California-based Sidecar Health has rolled out its health insurance tech services in Texas. Images via sidecarhealth.com

The health insurance situation in Texas is anemic.

Last year, 17.7 percent of Texans lacked health insurance, according to newly released data from the U.S. Census Bureau. That's the highest rate of uninsured residents among all of the states.

The problem is even more acute in the Houston metro area. In 2018, nearly 1 in 5 residents of the region (18.6 percent) had no health insurance, the Census Bureau says. That's the highest rate of uninsured residents among the country's 25 most populous metro areas.

If you do the math, that translates into more than 5 million residents of Texas, including more than 1.3 million in the Houston area, who have no health-insurance safety net. A startup called Sidecar Health is setting out to reduce those numbers. Click here to continue reading.