Editor's note: Welcome to another Monday edition of Innovators to Know. Today I'm introducing you to three Houstonians to read up about — three individuals behind recent innovation and startup news stories in Houston as reported by InnovationMap. Learn more about them and their recent news below by clicking on each article.

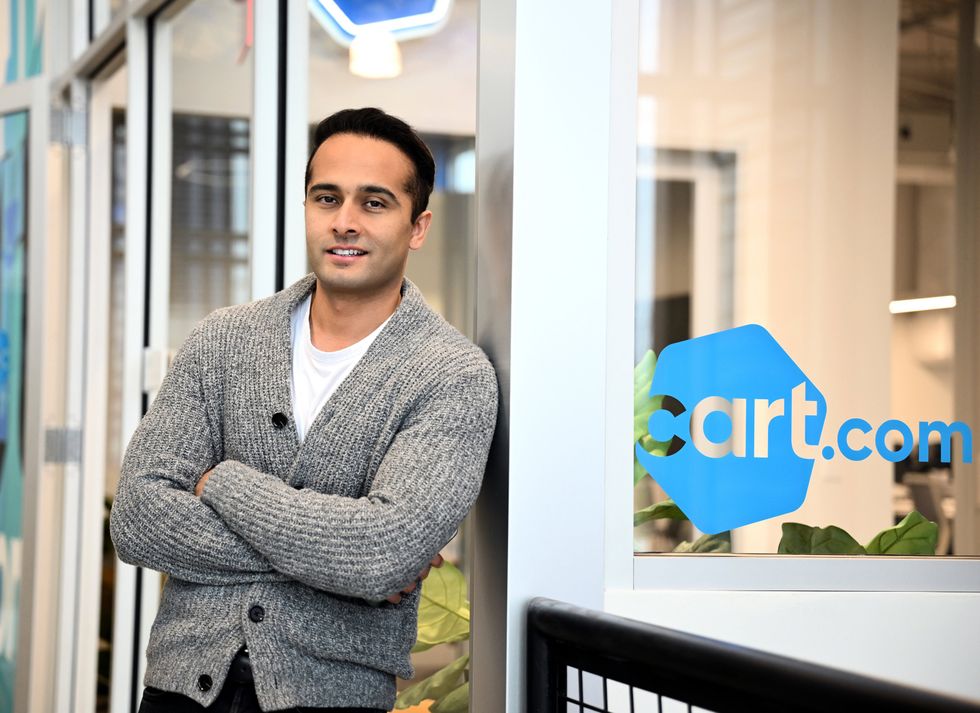

Omair Tariq, co-founder and CEO of Cart.com

Omair Tariq of Cart.com joins the Houston Innovators Podcast to share his confidence in Houston as the right place to scale his unicorn. Photo via Cart.com

Last November, Houston-founded logistics tech company Cart.com announced that it would be returning its headquarters to Houston after spending the last two years growing in Austin. But Co-Founder and CEO Omair Tariq says that while the corporate address may have changed, he actually never left.

"I've been in Houston now forever — and I don't think I'm planning on leaving anytime soon. I love Houston — this city has given me everything I have," Tariq says on the Houston Innovators Podcast. "I even love the traffic and everything people hate about Houston."

Tariq, who was born in Pakistan and grew up in Dubai before relocating as a teen to Houston, shared his entrepreneurial journey on the show, which included starting a jewelry business and being an early employee at Blinds.com before it was acquired in 2014 by Home Depot. Continue reading.

Amanda Marciel, the William Marsh Rice Trustee Chair of chemical and biomolecular engineering at Rice University

In addition to supporting Amanda Marciel's research, the funds will also go toward creating opportunities in soft matter research for undergraduates and underrepresented scientists at Rice University. Photo by Gustavo Raskosky/Rice University

An assistant professor at Rice University has won one of the highly competitive National Science Foundation's CAREER Awards.

The award grants $670,406 over five years to Amanda Marciel, the William Marsh Rice Trustee Chair of chemical and biomolecular engineering, to continue her research in designing branch elastomers that return to their original shape after being stretched, according to a statement from Rice. The research has applications in stretchable electronics and biomimetic tissues.

“My goal is to create a new paradigm for designing elastomers,” Marciel said in a statement. “The research has four aims: to determine the role of comb polymer topology in forming elastomers, understanding the effects of that topology on elastomer mechanics, characterizing its effects on elastomer structure and increasing the intellectual diversity in soft matter research.” Continue reading.

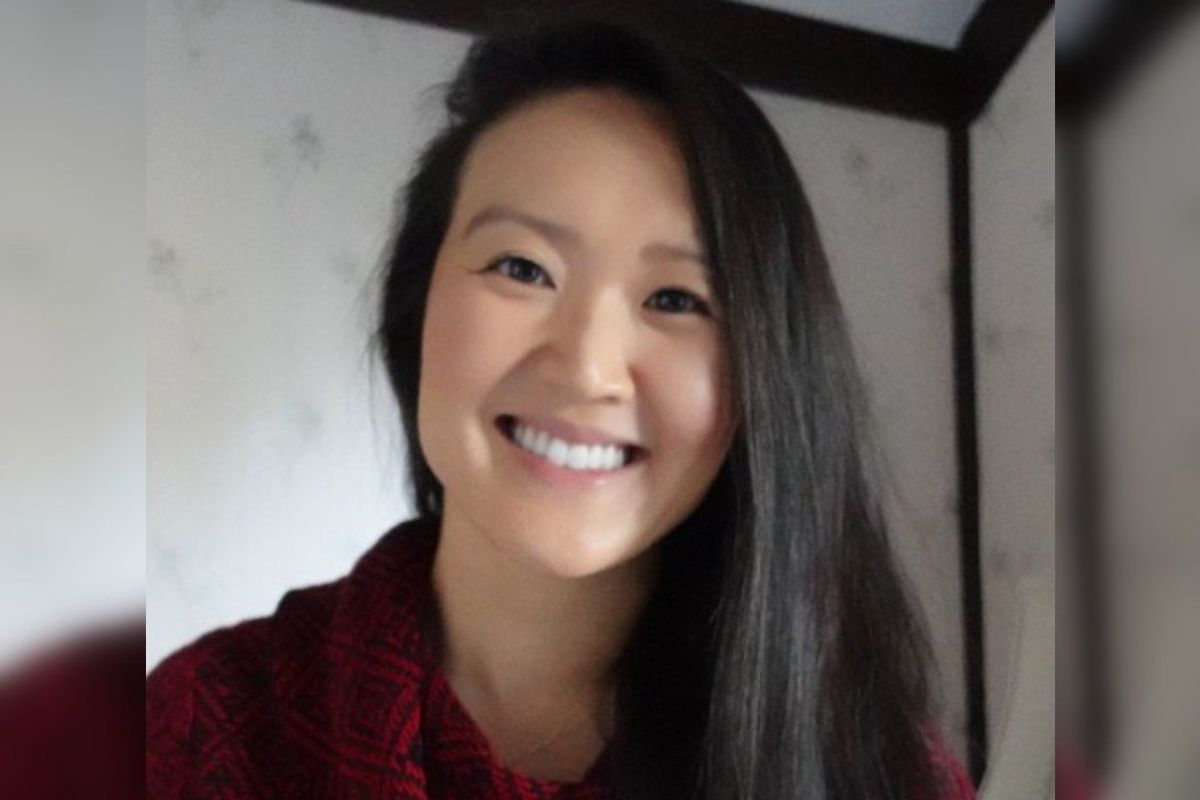

Youngro Lee, founder of Brassica

Youngro Lee is celebrating the acquisition of his company, Brassica. Photo courtesy

A Houston fintech innovator is celebrating his latest startup's exit.

Brassica Technologies Inc., a fintech infrastructure company that's provides a platform for alternative assets, has been acquired by BitGo, a Palo Alto, California-based tech company with digital asset services. The terms of the deal were not disclosed.

"Joining forces with BitGo is a significant step towards Brassica's ultimate vision of building the financial infrastructure of the future," Youngro Lee, founder and CEO of Brassica, says in a news release. "Our strength lies in our 'one stop shop' approach of providing API-enabled infrastructure for the alternative assets industry. Continue reading.