Editor's note: Every week, I introduce you to a handful of Houston innovators to know recently making headlines with news of innovative technology, investment activity, and more. This week's batch includes three health tech innovators celebrating milestones for each of their companies.

Matthew Kuhn, co-founder and CEO of Taurus Vascular

Taurus Vascular is one step closer to stopping abdominal aortic aneurysms for good. Photo courtesy of TNVC

A Houston biotech company has won the Texas A&M New Ventures Competition (TNVC). Taurus Vascular took home $30,000 for its first-place victory.

Taurus Vascular is working on a new solution to stopping abdominal aortic aneurysms (AAA) before they rupture and become potentially fatal. The company arose out of the TMC Innovation Biodesign Program. Fellows Matthew Kuhn and Melanie Lowther had a year to bring a company to fruition. The highly qualified team can boast of Kuhn’s more than 40 patents and Lowther’s former role as director of entrepreneurship and innovation at Texas Children’s Hospital.

The competition’s intense process included presenting to commercialization experts across several rounds. In fact, vetting takes four months and includes coaching to help competitors thrive in their pitches. Read more.

Tim Boire, CEO and co-founder of VenoStent

VenoStent has raised additional funding. Image courtesy of VenoStent

A clinical-stage Houston health tech company with a novel therapeutic device has raised venture capital funding and secured a grant from the National Institutes of Health.

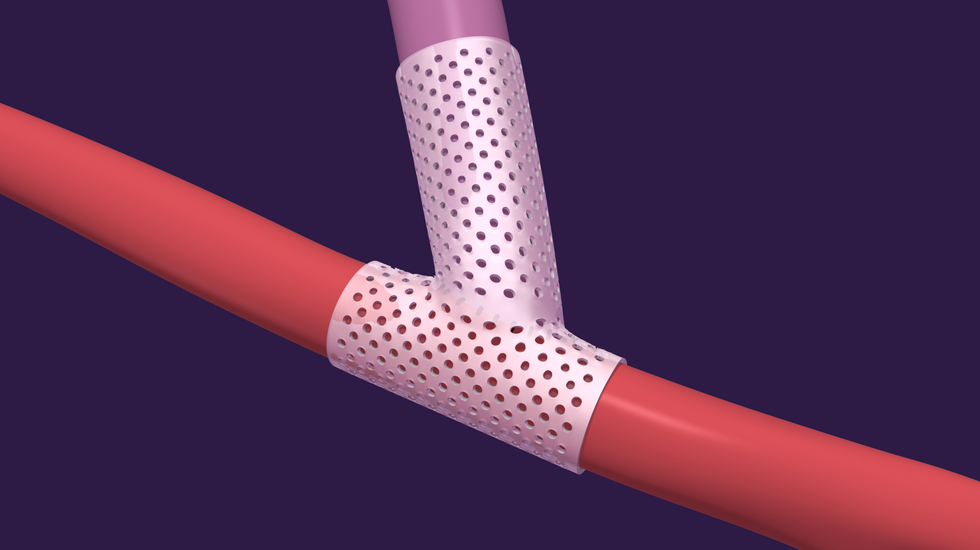

VenoStent Inc., which is currently in clinical trials with its bioabsorbable perivascular wrap, announced the closing of a $20 million series A round co-led by Good Growth Capital and IAG Capital Partners. The two Charleston, South Carolina-based firms also led VenoStent's 2023 series A round that closed last year at $16 million.

Additionally, the company secured a $3.6 million Small Business Innovation Research (SBIR) Phase II Grant from NIH, which will help fund its multi-center, 200-patient, randomized controlled trial in the United States.

Tim Boire, VenoStent CEO and co-founder, describes 2024 so far as "a momentous year" so far for his company. Read more.

Howard Berman, CEO and co-founder of Coya Therapeutics

Coya Therapeutics announced an expanded research collaboration with the Houston Methodist Research Institute, as well as funding from the Johnson Center. Photo via LinkedIn

A clinical-stage Houston biotech company has expanded its collaboration with Houston Methodist Research Institute, or HMRI.

Coya Therapeutics is already sufficiently established to be publicly traded since late 2022, but there’s always room to grow. With the help of a new sponsored research agreement, Coya will work on multiple initiatives. Coya is led by co-founder and CEO Howard Berman, who was inspired by his father’s dementia diagnosis.

"I was interested in what I could do for my dad," Berman said on the Houston Innovators Podcast, explaining that he met with renowned Houston Methodist researcher and neurologist, Dr. Stanley Appel, who showed him that he was not only working on treatments that could help Berman’s now-deceased father, but that he’d been able to stop the progression of ALS. Read more.

VenoStent's novel therapeutic medical device is a bioabsorbable wrap. Image courtesy of VenoStent

VenoStent's novel therapeutic medical device is a bioabsorbable wrap. Image courtesy of VenoStent Tim Boire is the CEO of VenoStent. Photo via LinkedIn

Tim Boire is the CEO of VenoStent. Photo via LinkedIn

Apple doubles down on Houston with new production facility, training centerPhoto courtesy Apple.

Apple doubles down on Houston with new production facility, training centerPhoto courtesy Apple.