Houston health tech startup secures $16M series A, prepares for first U.S. clinical trials

money moves

Fueled by fresh funding in the bank, a medical device startup has announced upcoming trials.

VenoStent, Inc., a company developing an innovative tool to improve outcomes for hemodialysis patients, has closed $16 million in a series A round of financing. Two Charleston, South Carolina-based firms — Good Growth Capital and IAG Capital Partners — led the round.

The company also announced it received Investigational Device Exemption from the FDA for its United States clinical trial, SAVE-FistulaS.

“Our mission at VenoStent is to improve the quality and length of life of dialysis patients. On the heels of our very promising results in several preclinical studies and a 20-patient feasibility study that led to our Breakthrough Designation last year, this recent IDE approval is perhaps our biggest milestone to date," Tim Boire, CEO of VenoStent, says in a news release. "We now enter an exciting new epoch in our company’s development that we believe will ultimately result in FDA Approval and vastly improve the quality and length of life for patients."

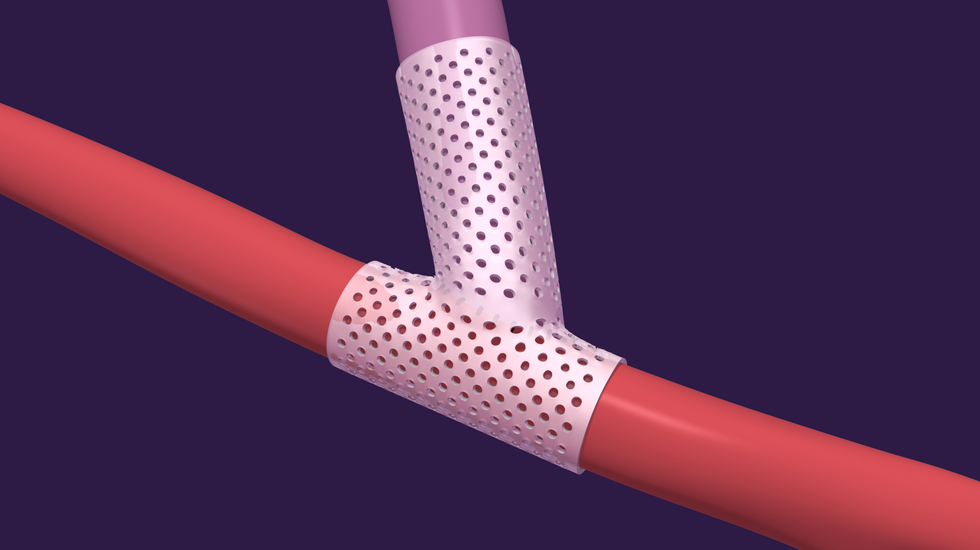

VenoStent's series A will fund the trial, expand manufacturing capabilities, and more. The company is targeting the more than 800,000 people in the U.S. with end-stage renal disease. Currently, more than half of the surgeries performed to initiate hemodialysis fail within a year. VenoStent's novel therapeutic medical device is a bioabsorbable wrap that reduces vein collapse by providing mechanical support and promoting outward vein growth.

“This trial is designed to provide the highest level of clinical evidence. We’re excited to be in this position to treat the first patients in the United States with this technology, and demonstrate the safety and efficacy of our device,” continues Boire in the release.

Per the release, the company is aiming for FDA Approval and be the first-to-market device to improve hemodialysis access surgery.

“We’re extremely pleased to be partnering with VenoStent on this critical mission. This company and technology are poised for commercial success to address a critical, unmet need,” says Bob Crutchfield, operating partner at Good Growth Capital, in the release.

The TMC Venture Fund also contributed to the series A investment round, along with SNR, Baylor Angel Network / Affinity Fund, Creative Ventures, Cowtown Angels, Alumni Ventures, and other notable angel investors. Past investors in VenoStent include KidneyX, National Science Foundation, National Institute of Health, Y Combinator, Health Wildcatters, and the Texas Halo Fund.

“VenoStent’s data and traction to date is impressive and gives us a lot of confidence in their continued success. We look forward to helping them get this Breakthrough product to market and help patients that are in dire need of this innovative technology,” says Joel Whitley, partner at IAG Capital Partners, in the release.

Splay can be used as a portable screen, or the projector can be removed to be used on its own. Photo via Splay

Splay can be used as a portable screen, or the projector can be removed to be used on its own. Photo via Splay

Apple doubles down on Houston with new production facility, training center Photo courtesy Apple.

Apple doubles down on Houston with new production facility, training center Photo courtesy Apple.