Houston startups are keeping pace when it comes to venture capital raised this year. In this roundup of funding closed in the second quarter, Houston businesses across sectors and industries close significant rounds from seed to series B.

Eight startups raised over $140 million last quarter, according to InnovationMap reporting, which is right on par with Q1's numbers. In chronological order, here's what companies snagged fresh funding recently.

![]()

Houston-based Venus Aerospace has raised $20 million — and is one step closer to providing one-hour global travel. Photo courtesy of Venus Aerospace

A year after raising $3 million in seed funding, a Space City startup has closed its high-flying series A round to the tune of $20 million.

Venus Aerospace, which is working on a zero-carbon emission spaceplane that will enable one-hour global travel, closed its series A funding round led by Wyoming-based Prime Movers Lab. The firm has a few dozen breakthrough scientific companies in its portfolio, including another Houston-based, space-focused startup, Axiom Space. The round also saw participation from previous investors: Draper Associates, Boost, Saturn 5, Seraph Group, Cantos, The Helm & Tamarack Global.

Venus Aerospace was founded by Sarah "Sassie" and Andrew Duggleby, who serve as the company's CEO and CTO, respectively, in 2020 in California. The Texas A&M University alumni later moved the business into its current facilities in the Houston Spaceport. Click here to continue reading.

![]()

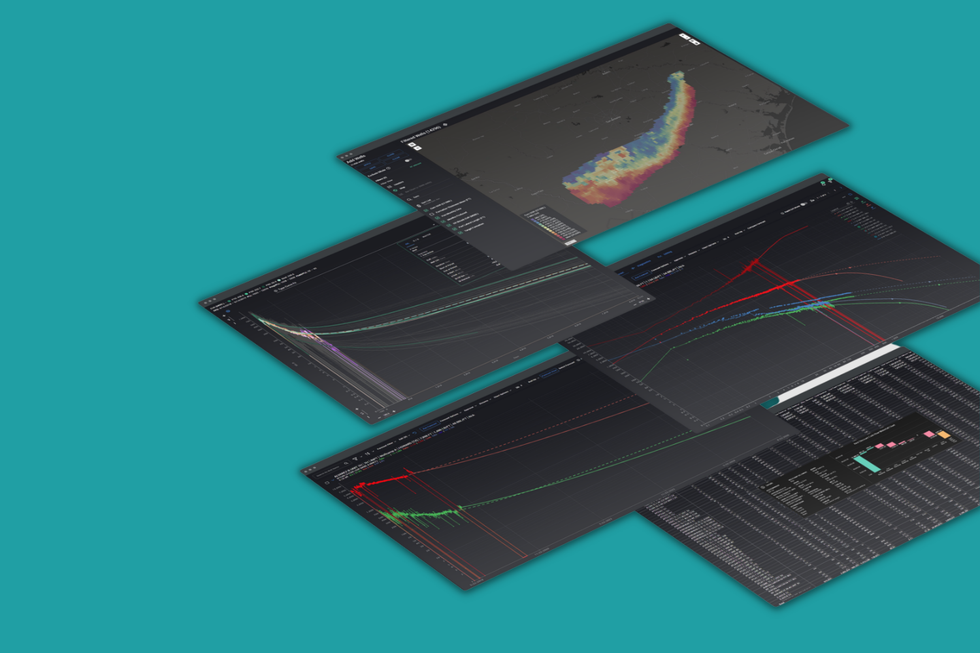

The series B capital will allow the company to enhance its core product, while also adding on other workflows that focus on emissions and renewable energy. Image via combocurve.com

Houston-based ComboCurve announced today that it has raised $50 million through a series B funding round led by Dragoneer Investment Group and Bessemer Venture Partners.

Founded in 2017, the company is a cloud-based energy analytics and operating platform that uses sophisticated software to forecast and report on a company's energy assets, including renewables.

The series B capital will allow the company to enhance its core product, while also adding on other workflows that focus on emissions and renewable energy. Click here to continue reading.

![]()

This innovative medical device company has closed $6 million for further product development and clinical trials. Image via Getty Images

A Houston-based medical device company born out of the Texas Medical Center has closed its series A round of funding.

Ictero Medical's oversubscribed $6 million round was led by MedTex Ventures, S3 Ventures, and an undisclosed strategic investor, according to a news release. The company's novel cryoablation system was designed to treat high-risk gallstone disease patients and provide a less invasive and lower risk alternative to gallbladder removal surgery — something over 1 million Americans undergo annually.

“Our technology provides an immediate solution for critically ill patients who currently have no good treatment options, and also has the potential to benefit healthier patients who want to avoid surgery,” says Ictero Co-Founder and CEO Matthew Nojoomi in the release. Click here to continue reading.

Houston-based Upgrade has raised additional seed funding. Photo via LinkedIn

Houston-based Upgrade has raised additional seed funding. Photo via LinkedInHouston-based Upgrade Boutique — which uses technology to connect women with high-quality wigs and hair extensions — extended its seed round by $1 million, Fast Company reported. The round's initial seed leaders included Houston-based venture capital firms Artemis Fund and Mercury Fund, as well as Logitech president and CEO Bracken P. Darrell and ANIM.

“This [investment] will enable us to scale even faster and continue to invest in tools and resources that will improve the consumer experience, and help stylists operate more efficiently,” Winters tells Fast Company. “Based on feedback from the stylists on our platform, we see this as a natural development in the company’s evolution.” Click here to continue reading.

![]()

Growing Houston-based WizeHire tripled its headcount last year and plans to grow even more as it scales up. Photo courtesy of WizeHire

A Houston software company has closed its latest funding round to the tune of $30 million.

WizeHire, a tech-enabled hiring solution for small businesses, announced the closing of its series B round, bringing its total funding to $37.5 million and its valuation to $250 million, according to the news release. The round was led by Tiger Global with participation from prior Houston-based investors Amplo and Mercury.

The pandemic has greatly impacted businesses ability to hire new employees. Founded in 2014, WizeHire launched a free version of its optimized hiring solution at the height of COVID-19. The company also helped small businesses find and apply for refundable tax credits and Payment Protection Program loans to keep their doors open.

“The pandemic was an incredibly tough time for Main Street, and we were right there with them," says Sid Upadhyay, CEO of WizeHire, in the release. "We’re constantly amazed by the depth of our clients’ trust in us and in response, have stepped up to serve them as a trusted advisor in their business growth. We plan to build a marketplace for small businesses to have access to the resources they need to succeed.” Click here to continue reading.

![]()

This Houston company has rolled out its expansion plans following a $20 million series A. Photo via ridekolors.com

A Houston-based company that's using tech and data to provide its intercity bus network has announced $26 million in funding.

Kolors has announced the close of its $20 million series A financing round led by UP.Partners with participation from Maniv Mobility, Toyota Ventures, K5 Global, Mazapil — plus contribution from existing investors Tuesday Capital, Garret Camp's Expa, Chris Sacca's Lowercase, Moving Capital, MGV, Brainstorm Ventures, Bling Capital and Amplifica. The round, which brings the company's total investment raised to $26 million, will allow Kolors to grow in Mexico, expand into new Latin American markets, and enable cross-border US travel.

The company has created a "smart-bus-platform," which is defined as being a combination of airline and ridesharing style technology. The service includes attendants superpowered by technology, according to a news release.

"Kolors is redefining the experience of intercity travel. We are thrilled to see Kolors advancing in Mexico and bringing its phenomenal service to other parts of Latin America in the coming months this year," says Ally Warson, partner of UP.Partners. "Kolors is thinking about the next phase for intercity bus travel and intends to design an ecosystem that prioritizes the passenger while providing more profitable and climate-friendly outcomes for bus operators." Click here to continue reading.

![]()

This tech company wants to replace passwords for good. Photo courtesy of Allthenticate

A California-founded company that recently put down roots in Houston has announced the closing of its seed round of funding.

Allthenticate, a tech startup that enables unified authentication, announced over $3 million raised in its seed funding round led by Austin-based Silverton Partners with participation from California-based Amplify and Denver-based Ping Identity. The total raised in the round is $3,133,337, which, as the press release explains, translates to “elite” in hacker speak.

Allthenticate’s technology and services allow users to utilize smartphone devices to unlock and log in to everything — from doors to computers and servers. The company's mission is to provide safe, easy-to-use security infrastructure for everyday use and to target small- to medium-sized businesses to deploy the technology across their workforces. Click here to continue reading.

![]()

Houston-based Liongard has fresh funding to work with. Photo via Getty Images

A Houston software company has announced its latest funding.

Liongard, an IT software provider, has raised an additional $10 million led by Updata Partners with contribution from TDF Ventures — both existing investors in the company. The funding, according to a news release, will go toward providing the best customer service for Liongard's growing customer base.

The technology is providing managed service providers, or MSPs, improved visibility across the IT stack and an optimized user experience.

“Since working with our first MSP partners, we’ve seen time and again the power of visibility into IT data, reducing the time they spend researching customer issues and allowing them to respond faster than their peers,” says Joe Alapat, CEO and co-founder of Liongard, in the release. “This investment enables us to continue to achieve our vision of delivering visibility into each element of the IT stack.” Click here to continue reading.

Houston-based Upgrade has raised additional seed funding. Photo via LinkedIn

Houston-based Upgrade has raised additional seed funding. Photo via LinkedIn