These 11 Houston startups closed funding rounds so far this year

following the money

Venture capital investment is moving and grooving in Houston this year so far, which really is a continuation of the leap in VC investment from 2021.

According to a recent report from Houston Exponential, Houston’s average early-stage deal size of $18 million represents a 68 percent growth rate since 2019. Compared with the national growth rate of 23 percent, “this demonstrates the broader expansion and maturities within the Houston ecosystem,” the analysis says.

Last year, local startups collected $2.02 billion in VC funding, according to PitchBook data. That’s up 175 percent from the $734.2 million raised in 2020.

“That VC-backed companies were able to generate such enormous value in 2021 during a time characterized by great uncertainty and extraordinary circumstances highlights the continued importance of VC-backed companies to the resilience of Houston’s economy,” says Serafina Lalany, executive director of Houston Exponential.

In continuance with last year, 2022 has started with a flurry of VC activity. In case you missed some of these first quarter deals, InnovationMap has rounded up all its coverage of funding rounds closed between January and March based on previous reporting. Scroll through to see which Houston startups are catching the eyes — and cashing the checks — of investors.

P97 Networks has raised $40M of venture debt financing

P97 Networks, a Houston-based mobile payments company, has fresh funds to scale its operations. Photo via Getty Images

A Houston company that has created a mobile commerce platform for the convenience retail, fuels marketing, and automotive industries has fresh funding to support its growth.

P97 Networks has raised $40 million of venture debt financing from an affiliate of Peak Rock Capital, a leading middle-market private investment firm, according to a news release from the company.

“We will use this new capital to fund P97’s high growth initiatives, which include accelerating user adoption across our Consumer Engagement platform, Energy Transition programs for our clients, and our Mobility Services platform,” said Donald Frieden, president and CEO of P97, in the release. Click here to continue reading.

Zeta Energy close $23M series A

Houston-based Zeta Energy has raised fresh funding to grow its Houston operations and further commercialize the company's innovative batteries for electric vehicles and energy storage. Photo via Getty Images

Houston-based Zeta Energy announced this month that it has closed a $23 million series A round led by New York VC firm Moore Strategic Ventures.

The funding will be used to expand Zeta's lab facility in the Houston area and further commercialize the company's innovative batteries for electric vehicles and energy storage.

"We are delighted to have Moore Strategic Ventures join Zeta Energy. Moore's focus on transportation, advanced materials, energy, and clean tech aligns perfectly with Zeta's strategic objectives," Charles Maslin, founder and CEO of Zeta Energy, said in a statement. "We are so excited to work together to help the world transition to clean energy and build a more sustainable future." Click here to continue reading.

DECISIO raises $18.5M, appoints new leadership

DECISIO has fresh funding and a new board member. Photo via decisiohealth.com

A Houston-based digital health startup has officially closed its latest funding round and has a new member to its leadership to support the company's next phase.

DECISIO has appointed Major General Elder Granger to the company's board of directors. Dr. Granger is currently president and CEO of The 5Ps LLC, a healthcare, education, and leadership consulting organization.

"Dr. Granger joining our board provides enormous value and validation for our company moving forward," says Dr. John Holcomb, co-CEO and co-founder of DECISIO, says in a news release. "His expertise and leadership in the healthcare industry is a welcome addition to our esteemed group of Board of Directors." Click here to continue reading.

Vivante Health raises $16M series A round

Vivante Health closed a fresh round of funding. Photo via Getty Images

A Houston-based digital health startup that's targeting solutions for digestive diseases has closed its latest round of funding.

Vivante Health closed a $16 million series A funding round led by Chicago-based 7wireVentures with contribution from new investors, including Human Capital, Intermountain Ventures, SemperVirens, Elements Health Ventures, and Leaps by Bayer. Additionally, the round saw participation from returning investors FCA Venture Partners, NFP Ventures, Lifeforce Capital, and Big Pi Ventures.

The fresh funding will support commercial scaling and growth of the company, which is based in Houston's JLABS @ TMC space.

"The Series A financing round represents another pivotal milestone in our mission to improve our member's digestive health and provide outcomes at scale for our enterprise partners," says Bill Snyder, Vivante Health CEO, in a news release. "We are thrilled to partner with premier investors in this latest round of funding that will enable us to continue our rapid growth trajectory and further establish ourselves as the leader in digestive health." Click here to continue reading.

SiteAware closes $15M in funding round

Houston-based SiteAware has raised $15 million in its latest round of funding. Photo courtesy of SiteAware

A Houston startup that provides artificial intelligence-enabled verification software to the construction industry has closed its series B round.

SiteAware raised $15 million in the round, which was led by Singapore-based Vertex Ventures Israel. Existing investors Robert Bosch Venture Capital GmbH, Axon Ventures, Oryzn Capital, The Flying Object, and lool Ventures also contributed to the round.

The company's digital construction verification, or DCV, platform uses AI and digital twin technology to provide real-time verification of construction fieldwork. According to a press release from SiteAware, the construction industry represents a $1.3 trillion market share of the United States economy. Click here to continue reading.

Codenotary raises $12.5M series B

Codenotary's software enables tools for notarization and verification of the software development life cycle. Photo via Getty Images

Houston-based Codenotary, whose technology helps secure software supply chains, has raised $12.5 million in a series B round. Investors in the round include Swiss venture capital firm Bluwat and French venture capital firm Elaia.

The $12.5 million round follows a series A round that was announced in 2020, with total funding now at $18 million.

Codenotary, formerly known as vChain, says the fresh round of money will be used to accelerate product development, and expand marketing and sales worldwide. Today, the startup has 100-plus customers, including some of the world’s largest banks. Click here to continue reading.

Rugged Robotics raises $9.4M series A

The tech solution provides construction customers with an automated layout-as-a-service tool. Image via rugged-robotics.com

A Houston robotics startup working in the commercial construction field has closed its latest round of funding.

Rugged Robotics Inc. announced last week that it's raised $9.4 million in its series A round led by BOLD Capital Partners and Brick & Mortar Ventures. Riot Ventures, Morpheus, and Embark — all investors in the company's 2019 seed round — also contributed, as did Consigli Construction Company and Suffolk Technologies. To date, Rugged Robotics has raised $12 million.

“We are thrilled to be part of the Rugged team,” says Maxx Bricklin, partner at BOLD Capital, in a news release. “We looked at a number of companies in the space and became convinced that the Rugged team, technology and partner ecosystem would allow Rugged to dominate and capitalize on this significant and disruptive market opportunity.” Click here to continue reading.

Koda Health raises $3.5 million in seed funding to expand nationally

Tatiana Fofanova, co-founder and CEO of Koda, closed recent funding for the digital health startup. Image via LinkedIn

Houston-based Koda Health announced this month that it raised $3.5 million in its latest seed round.

The round was led by Austin-based Ecliptic Capital, which focuses on emergent and early-stage investments. Sigmas Capital, Headwater Ventures, CRCM, and a number of angel investors also participated in the round.

The funding will be used to help the digital advanced care planning company double the size of its team in the next six months.

"Koda Health helps vulnerable people navigate and communicate difficult decisions about their health care journey. So, when hiring, we look for empathetic people who are phenomenal communicators," Tatiana Fofanova, Koda co-founder and CEO, says in a statement. Click here to continue reading.

INOVUES raises $2.75M to make buildings more energy efficient

Window-retrofitting climatetech company has raised its first round of funding. Photo via inovues.com

A Houston startup that retrofits windows with smart glass innovations to reduce energy use has raised its first round of funding.

INOVUES closed its seed round at $2.75 million last month. The oversubscribed round was led by Dallas-based Paulos Holdings with participation from new and existing investors, including Houston-based VC Fuel, Saint-Gobain NOVA, Fund4SE, Momentum Glass, Lateral Capital, E8 Angels, and the Central Texas Angel Network.

"Our mission is to help cities achieve their energy efficiency and emissions-reduction targets by increasing the rate of window upgrades in existing buildings," says INOVUES founder and CEO, Anas Al Kassas, in a news release. "To achieve that, we have developed a low-carbon, high-ROI retrofit solution that makes upgrading building windows a financially attractive energy conservation measure instead of a massive capital upgrade associated with business disruptions and prohibitive payback periods." Click here to continue reading.

Roboze closed a multimillion-dollar round of funding

Roboze has closed its latest round of funding. Photo courtesy of Roboze

Roboze — an Italian high-performance 3D printing company with its U.S. headquarters in Houston — closed a multimillion-dollar round of funding this month with investments from an international group of leaders from diverse backgrounds.

Investors include Nova Capital, Lagfin, Andrea Guerra, Luigi De Vecchi, Roberto Ferraresi, Luca Giacometti, Denis Faccioli and others, according to a statement.

“We are honored to have a group of investors of this caliber, who strongly believe in the vision of Roboze and in the change of production paradigm that our technology is enabling by replacing metals and producing parts without wasting raw materials," Alessio Lorusso, founder and CEO of Roboze, said in a statement. Click here to continue reading.

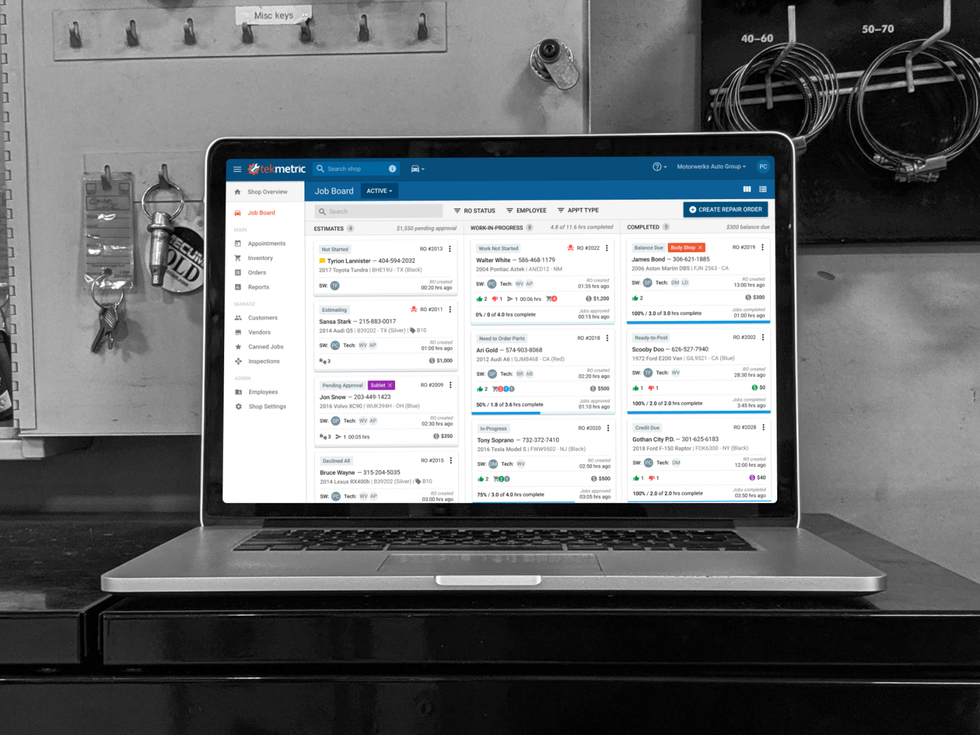

Tekmetric closes recent fundraising round

A Houston software company has raised an undisclosed amount of funding. Photo via tekmetric.com

A Houston software company has raised an undisclosed amount of funding. Photo via tekmetric.comTekmetric, a cloud-based shop management system for automotive repair shops, announced the close of its growth investment from California-based Susquehanna Growth Equity. The details of the round were not disclosed, but, according to a news release, the fresh funds will go toward growing Tekmetric's engineering and technical teams and expansion across the United States.

Launched three years ago by Prasanth Chilukuri and Sunil Patel, co-founders and co-CEOs, Tekmetric's SaaS solution provides shop owners with digital inspections, integrated payments, and more of their business needs. Click here to continue reading.