Overheard: Experts share advice on investing in health tech amid the pandemic

Eavesdropping online

The coronavirus pandemic has upset countless industries, but if you zoom in on health tech you'll find a mix of opportunities and challenges for both health tech startups and investors.

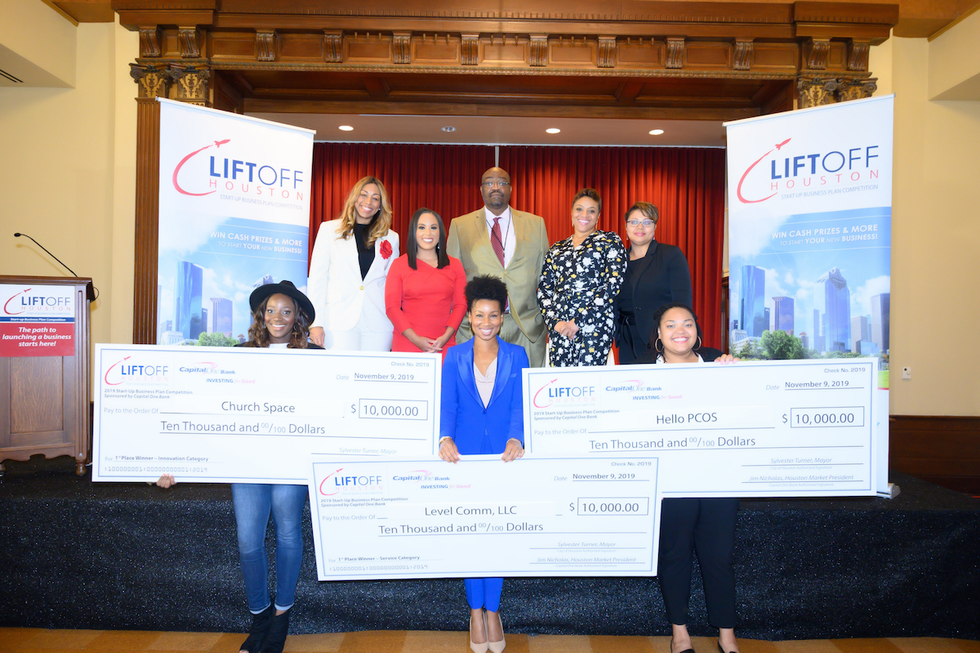

On a virtual panel hosted by TMC Innovation and Ignite Healthcare Network, four female investors or founders discussed the health tech startup landscape. From advice for getting the attention of investors amid COVID-19 to inequities in health care and innovation, here's what the panel covered.

“I never thought I’d make an investment without meeting the founder face-to-face and visiting their site. The way I got comfortable with it was the opportunity was referred to me — it was a warm lead.”

— Karen Kerr, lead partner at Portfolia Rising America Fund. Kerr says those warm leads are more important now than ever, as is sharing a network.

“The first thing you need to do is understand our fund — or whatever fund you’re trying to go after — and pitch in a way that’s personal. You have to stand out from the beginning.”

— Kyra Doolan, managing director of Texas Halo Fund, says on reaching out to investors. She adds that she looks for a strong team, an innovative solution, a market need, and the terms of the deal. Meanwhile, red flags include if a startup says it has no competition, has unreasonable projections, is led by entrepreneurs who think they know everything, has an unwillingness to be upfront about COVID challenges, and doesn't have enough money in the bank.

“It’s important for companies to be upfront about the problems they’re facing — we all know these problems exist. Addressing that head-on with investors is a good way to go because having trust in a company you’re investing in is important.”

— Doolan continues on the importance of transparency between startup and investor.

“I’m looking for great entrepreneurs that are high integrity people. I’m looking to see that they really understand the industries they are in.”

— Kerr says on what she looks for in a founder. She adds that she tries to understand how they think and the advantages and disadvantages of their leadership are.

“You have to have the art of persuasion. You have this dream and vision — and there may not be anything there yet — but you need to be able to take people on this journey with you.”

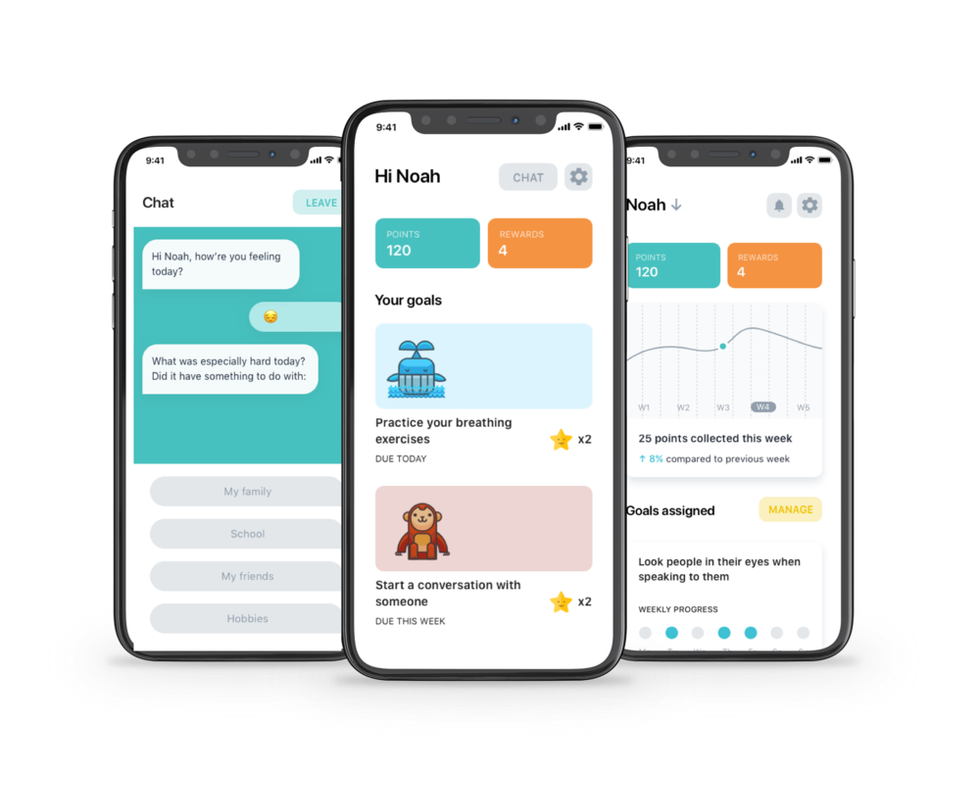

— Damayanti Dipayana, CEO and co-founder of Manatee, a member of TMCx's 2020 cohort. She adds, representing the entrepreneur side of the table, that you really have to know yourself and your shortcomings.

“Any investor will look at it like if you can’t get the right people around and sell it to them, how are you going to uproot an industry.”

— Dipayana expands on the importance of growing your team and being persuasive.

“I think the pandemic has certainly shone a bright light on the inequities that exists, so solutions to these challenges are interesting things to think through.”

— Kerr says adding that the first investment from the Rising America Fund was into a fintech startup that serves underbanked communities.

“We’re seeing lower valuations maybe than we would have before this because the effects of this are going to go on for a long time, I would guess. Even when COVID starts to come down, the economic downturn is still going to exist.”

— Doolan says on where investment is at amid the pandemic.

“Ultimately if you want to have real bargaining power over your valuation, find other people who are interested.”

— Dipayana adds to the conversation about valuations. "If only one person interested, they are going to drive the valuation."

“Picking the right partners is such an important decision — don’t take that lightly just because they have money.”

—Chantell Preston, lead partner at Portfolio, co-founder and CEO of Facilities Management Group, and moderator of the event.

Manatee

Manatee Houston medical organizations pivot to telemedicine and remote care amid COVID-19 crisis

Houston medical organizations pivot to telemedicine and remote care amid COVID-19 crisis