Rice Alliance and the Ion leader Brad Burke to retire this summer

lasting legacy

Brad Burke—a Rice University associate vice president who leads the Ion District’s Rice Alliance for Technology and Entrepreneurship and is a prominent figure in Houston’s startup community—is retiring this summer after a 25-year career at the university.

Burke will remain at the Rice Alliance as an adviser until his retirement on June 30.

“Brad’s impact on Rice extends far beyond any single program or initiative. He grew the Rice Alliance from a promising campus initiative into one of the most respected university-based entrepreneurship platforms,” Rice President Reginald DesRoches said in a news release.

During Burke’s tenure, the Rice Business School went from unranked in entrepreneurship to The Princeton Review’s No. 1 graduate entrepreneurship program for the past seven years and a top 20 entrepreneurship program in U.S. News & World Report’s rankings for the past 14 years.

“Brad didn’t just build programs — he built an ecosystem, a culture, and a reputation for Rice that now resonates around the world,” said Peter Rodriguez, dean of the business school. “Through his vision and steady leadership, Rice became a place where founders are taken seriously, ideas are rigorously supported, and entrepreneurship is embedded in the fabric of the university.”

One of Burke’s notable achievements at Rice is the creation of the Rice Business Plan Competition. During his tenure, the competition has grown from nine student teams competing for $10,000 into the world’s largest intercollegiate competition for student-led startups. Today, the annual competition welcomes 42 student-led startups that vie for more than $1 million in prizes.

Away from Rice, Burke has played a key role in cultivating entrepreneurship in the energy sector: He helped establish the Energy Tech Venture Forum along with Houston Energy and Climate Startup Week.

Furthermore, Burke co-founded the Texas University Network for Innovation and Entrepreneurship in 2008 to bolster the entrepreneurship programs at every university in Texas. In 2016, the Rice Alliance assumed leadership of the Global Consortium of Entrepreneurship Centers.

In 2023, Burke received the Trailblazer Award at the 2023 Houston Innovation Awards and was recognized by the Deshpande Foundation for his contributions to innovation and entrepreneurship in higher education.

“Working with an amazing team to build the entrepreneurial ecosystem at Rice, in Houston, and beyond has been the privilege of my career,” Burke said in the release. “It has been extremely gratifying to hear entrepreneurs say our efforts changed their lives, while bringing new innovations to market. The organization is well-positioned to help drive exponential growth across startups, investors, and the entrepreneurial ecosystem.”

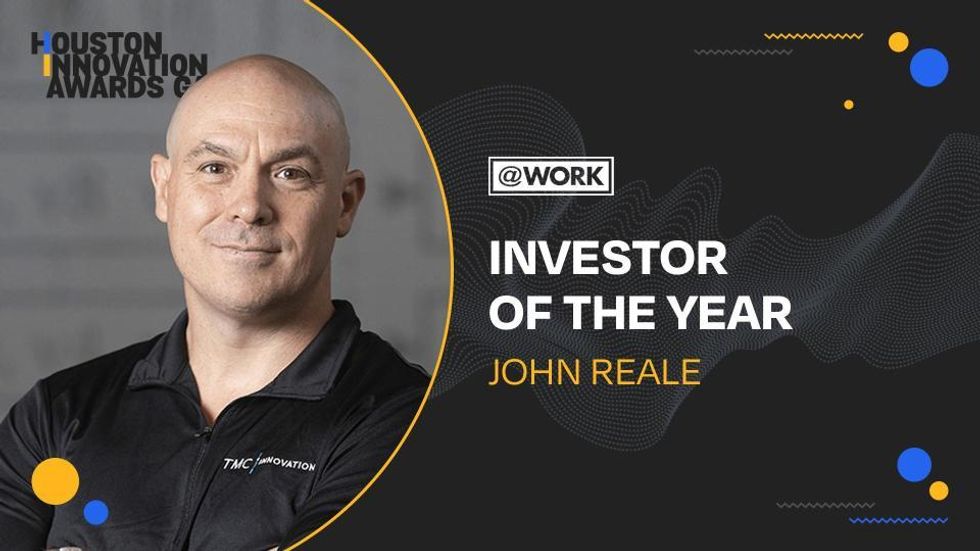

Starting April 15, John “JR” Reale Jr. will serve as interim associate vice president at Rice and executive director of the Rice Alliance. He is managing director of the alliance. Reale is co-founder of the Station Houston startup hub and a startup investor. He was also recently named director for startups and investor engagement at the Ion.

“The Rice Alliance has always been about helping founders gain advantages to realize their visions,” Reale said. “Under Brad’s leadership, the Rice Alliance has become a globally recognized platform that is grounded in trust and drives transformational founder outcomes. My commitment is to honor what Brad has built and led while continuing to serve our team and community, deepen relationships and deliver impact.”

Burke joined the Houston Innovators Podcast back in 2022. Listen to the full interview here.