Big deals: These were the top 5 investment rounds raised by Houston startups in 2022

year in review

Editor's note: As 2022 comes to a close, InnovationMap is looking back at the year's top stories in Houston innovation. When it came to the money raised in Houston, these five startups raised the most, according to reporting done by InnovationMap.

Houston unicorn chemicals company raises $200M series D

Solugen closed its series D funding round at $200 million. Photo via Getty Images

Houston-based Solugen has announced its latest round of investment to the tune of $200 million. The company, which reached unicorn status after its $357 million series C round last year, uses its patented Bioforge processes to produce "green" chemicals from bio-based feedstocks.

"Solugen is reimagining the chemistry of everyday life with enzymes found in nature. We make chemicals better, faster, cheaper, and without fossil fuels from right here in Houston, Texas. Whether you care about the climate, local competitiveness, or just plain old profits, we have good news: it's working," the company states in its news release. Read more.

Houston microgrid tech company announces $150 investment

Houston-based VoltaGrid provides small-scale, self-contained microgrids that can operate independently of major power grids or in tandem with other microgrids. Photo via voltagrid.com

VoltaGrid, a Bellaire-based startup that specializes in distributed power generation via microgrids, has hauled in $150 million in equity funding.

Founded in 2020, VoltaGrid provides small-scale, self-contained microgrids that can operate independently of major power grids or in tandem with other microgrids. VoltaGrid’s product consists of natural gas engines, portable energy storage, natural gas processing and grid power connectivity. Read more.

Houston company raises $138M for next-generation geothermal energy

The future of geothermal energy is here — and just got a big payday. Photo via Getty Images

Houston-based startup Fervo Energy has picked up $138 million in funding to propel its creation and operation of carbon-free power plants fueled by geothermal energy.

Fervos says the series C round will help it complete power plants in Nevada and Utah and evaluate new projects in California, Idaho, Oregon, Colorado, and New Mexico, as well as in other countries.

California-based investment firm DCVC led the round, with participation from six new investors. Read more.

Houston company closes $76M series C round to fuel its mission of reducing carbon emissions

Syzygy Plasmonics has raised a series C round of funding. Photo courtesy of Syzygy

A Houston-based company that is electrifying chemical manufacturing has closed its largest round of funding to date.

Syzygy Plasmonics closed a $76 million series C financing round led by New York-based Carbon Direct Capital. The round included participation from Aramco Ventures, Chevron Technology Ventures, LOTTE CHEMICAL, and Toyota Ventures. The company's existing investors joining the round included EVOK Innovations, The Engine, Equinor Ventures, Goose Capital, Horizons Ventures, Pan American Energy, and Sumitomo Corporation of Americas. According to a news release, Carbon Direct Capital will join Syzygy's board and serve as the series C director. Read more.

Fast-growing energy fintech startup raises $50M series B

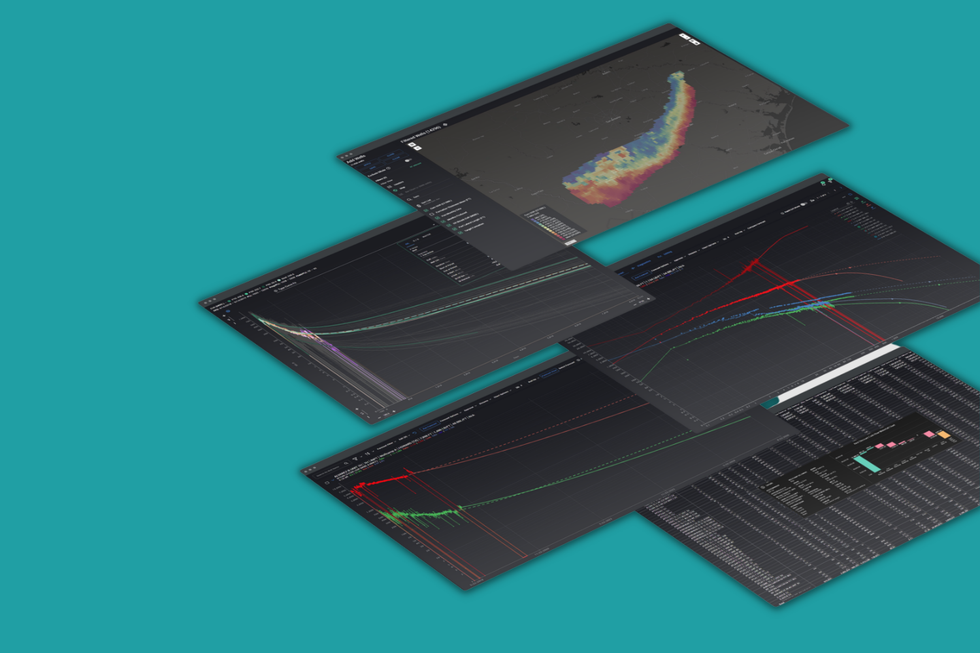

The series B capital will allow the company to enhance its core product, while also adding on other workflows that focus on emissions and renewable energy. Image via combocurve.com

Houston-based ComboCurve announced today that it has raised $50 million through a series B funding round led by Dragoneer Investment Group and Bessemer Venture Partners.

Founded in 2017, the company is a cloud-based energy analytics and operating platform that uses sophisticated software to forecast and report on a company's energy assets, including renewables.

The series B capital will allow the company to enhance its core product, while also adding on other workflows that focus on emissions and renewable energy. Read more.