Houston health tech company raises $7.85M series A led by local VC

green for growth

A Houston-based health tech company has scored fresh funds from a Houston venture group to fuel its growth and to expand nationally.

KARE Technologies, a digital labor marketplace for health care workers, raised a $7.85 million series A investment round led by Houston-based Golden Section Ventures.

"The KARE team are well known in senior care and the caring industry at large," says Dougal Cameron, general partner at GSV, in a news release. "They are experts in their field and know this problem well. Their care for the industry and knowledge in the space clearly shows in the company's rapid adoption. They are providing a needed solution to an extremely important industry for our society."

The digital platform offers senior facilities and qualified caregivers a platform to post and accept work for hire. The company's founder Charles Turner had the idea for the technology after seeing hospitals struggle to get care workers during the 2017 hurricanes. Again, with the rise of COVID-19, that need for health care staff became even more apparent.

"The biggest issue we're facing — and this is even a non-COVID world — is staffing," Turner previously told InnovationMap. According to the release, 82 percent of caring communities that face chronic staffing challenges.

The growing company will use the funds to support its growth and national expansion.

"It feels good when you build something that the marketplace loves and helps alleviate a major crisis that so many of our operator customers are dealing with," says Turner, who serves as KARE's CEO, in the release. "We are eternally grateful that GSV has understood our vision from our very first day and has been such a committed partner to help fuel our growth."

Golden Section Ventures supports early-stage software startups with B2B applications. The VC fund recently launched its venture studio concept.

"We partner with founders who have built creative solutions that solve real customer pain points. Charles Turner, Bridget Kaselak and their team are great examples of this," says Adam Day, general partner at GSV, says in the release. "They lived the customer problem then pioneered a set of solutions that help their clients address the chronic and widespread issue of labor shortages in the caring industry."

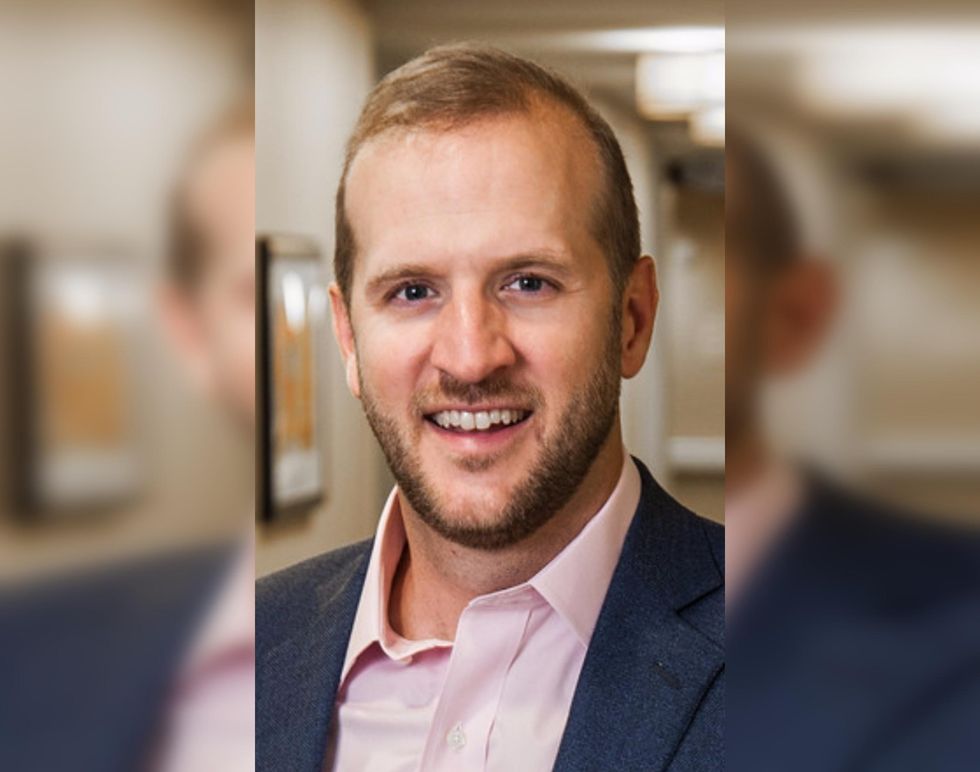

Charles Turner founded Kare Technologies on the heels of a crisis — and the pandemic has accelerated the company's growth. Photo courtesy of Kare

Charles Turner founded Kare Technologies on the heels of a crisis — and the pandemic has accelerated the company's growth. Photo courtesy of Kare