Houston PE firm scores $725M to launch new business unit to invest in decarbonization

seeing green

Houston-based Ara Partners, a private equity firm that focuses on industrial decarbonization investments, is receiving up to $725 million from a Tennessee-based family office to launch an energy decarbonization unit.

HF Capital, the Knoxville, Tennessee-based investment arm of the Haslam family, made the multimillion-dollar commitment to set up Ara Energy Decarbonization. The new business will work toward reducing carbon emissions at ethanol plants, natural gas power plants, and other traditional energy assets.

The Haslam family founded Pilot Co., North America’s largest transportation fuel business and chain of travel centers. Shameek Konar, former CEO of Pilot, has been tapped to lead Ara Energy Decarbonization.

“It is an uncomfortable truth that highly pollutive energy sources are going to play an essential role in delivering an energy transition over the next several decades,” Charles Cherington, co-founder and managing partner of Ara, says in a news release. “We can ignore these staggering carbon emissions, or we can apply our proven methods and financing expertise to decarbonize the conventional energy value chain.”

The energy sector accounts for more than 75 percent of global greenhouse gas emissions.

“The world’s energy demands are increasing and complex, and renewable power needs time and support for it to fulfill rising global energy demand. Ara’s … skillset, portfolio network, and decarbonization management knowledge [are] perfectly positioned to attack the carbon-intensive energy sector,” Konar says.

Ara Partners closed its third private equity fund in December 2023 with over $2.8 billion in new commitments. As of June 30, 2024, Ara Partners had about $6.3 billion of assets under management.

------

This article originally ran on EnergyCapital.

- Houston innovator shares investment opportunities outside traditional VC model ›

- VC investor: Houston's energy tech ecosystem grows as Bay Area activity seemingly slows ›

- The Ion announces new tenants that have recently moved in, expanded within the hub ›

- Houston clean energy company secures $53M series C investment ›

- PE firm acquires Houston renewables fuels infrastructure company ›

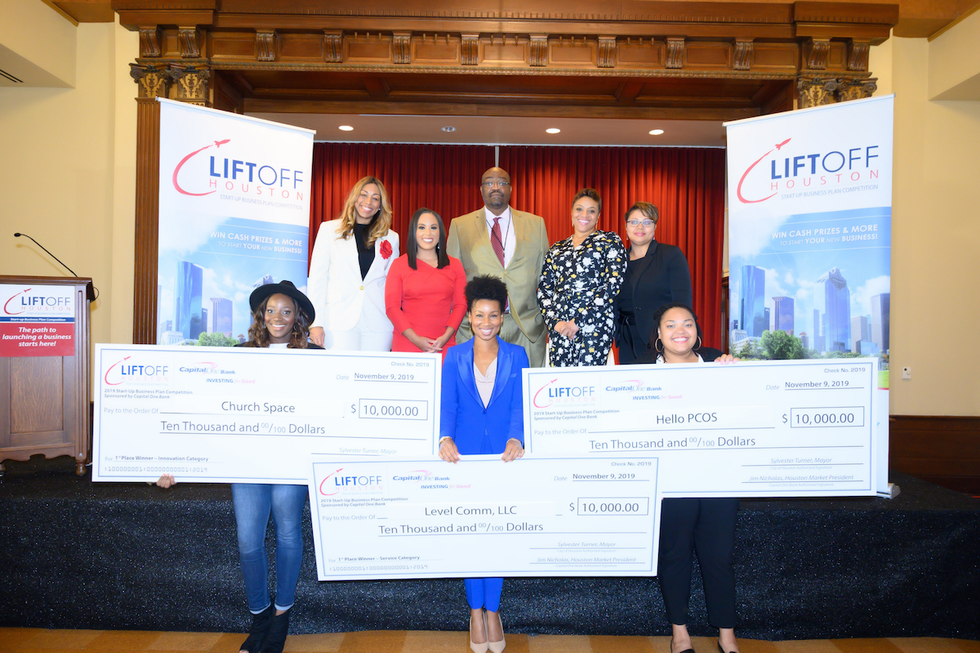

Houston business competition opens applications

Houston business competition opens applications