eye on the ion

Photos: Here's a sneak peek at The Ion Houston's construction progress

Planning to open in the coming months, The Ion Houston has made great progress on its construction. Scroll down to view the slideshow. Photo by Natalie Harms

The Ion Houston is expected to open its doors this year, and the building's exterior is close to completion. Now, the construction team is focusing on interiors and then tenant build outs.

The 270,000-square-foot coworking and innovation hub owned and managed by Rice Management Co. is slated to be a convening building for startups, corporations, academic partners, investors, and more. The building is organized as follows:

- The underground Lower Level will act as academic flex space with a few classrooms and open-concept desks for The Ion's accelerators, including: The Ion Smart and Resilient Cities Accelerator, DivInc, the Rice Alliance's Clean Energy Accelerator, and the Aerospace Innovation Hub and Accelerator. There will also be an event space and The Ion's own programming.

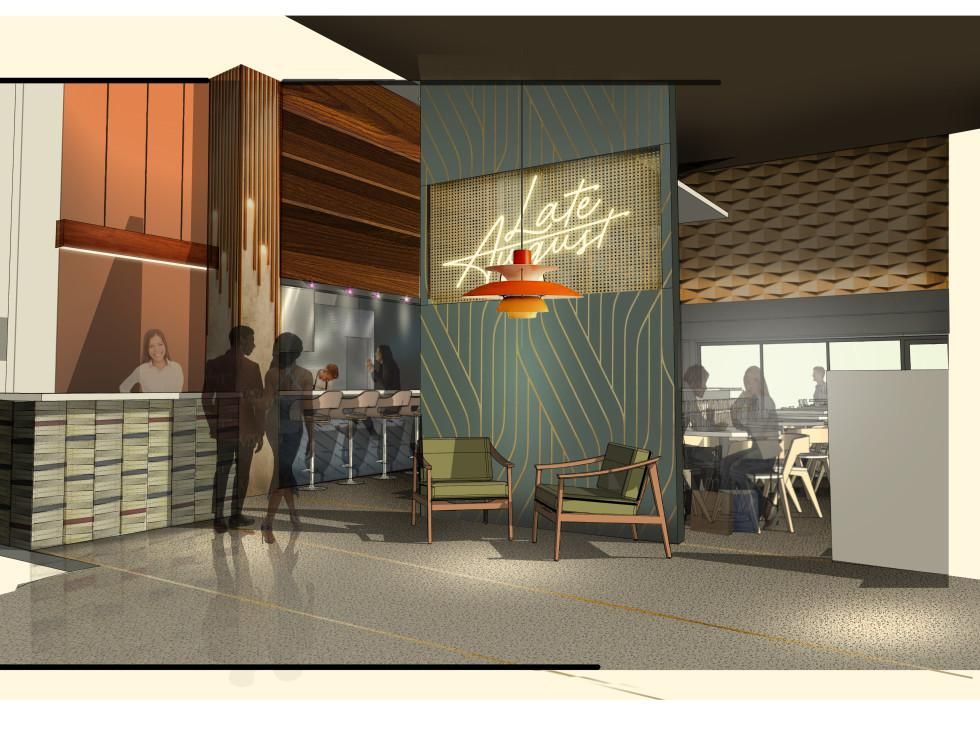

- On the first, street-level floor, The Ion's restaurant tenants will reside with access from both the greenspace as well as into the building. The Ion's first three restaurant tenants include: Late August, Common Bond, and STUFF'd Wings.

- Additionally, the first floor will be home to a venture studio and the prototyping lab. There is additional space available for other tenants.

- On the second floor, there will be 58,000 square feet of coworking space managed by Common Desk. Note: For floors 2 and up of the Ion, tenants will have access cards that allow them entrance. The first and lower floors will not require access cards.

- The third floor of the building will house eight to 10 tenants each with 5,000 to 10,000 square feet of space. Chevron was announced as the first tenant and will reside on this floor.

- On the fourth and fifth floors, The Ion will house one to two larger tenants on each level. These levels of the building were added on to the existing structure. The fourth floor features two balconies that tenants will have access to. Microsoft is signed on to have its space on half of the fifth floor.

The Ion is still planning on an open date in late spring or summer. For leasing information, click here. Scroll through the slideshow of construction images and renderings to see the progress of the building.

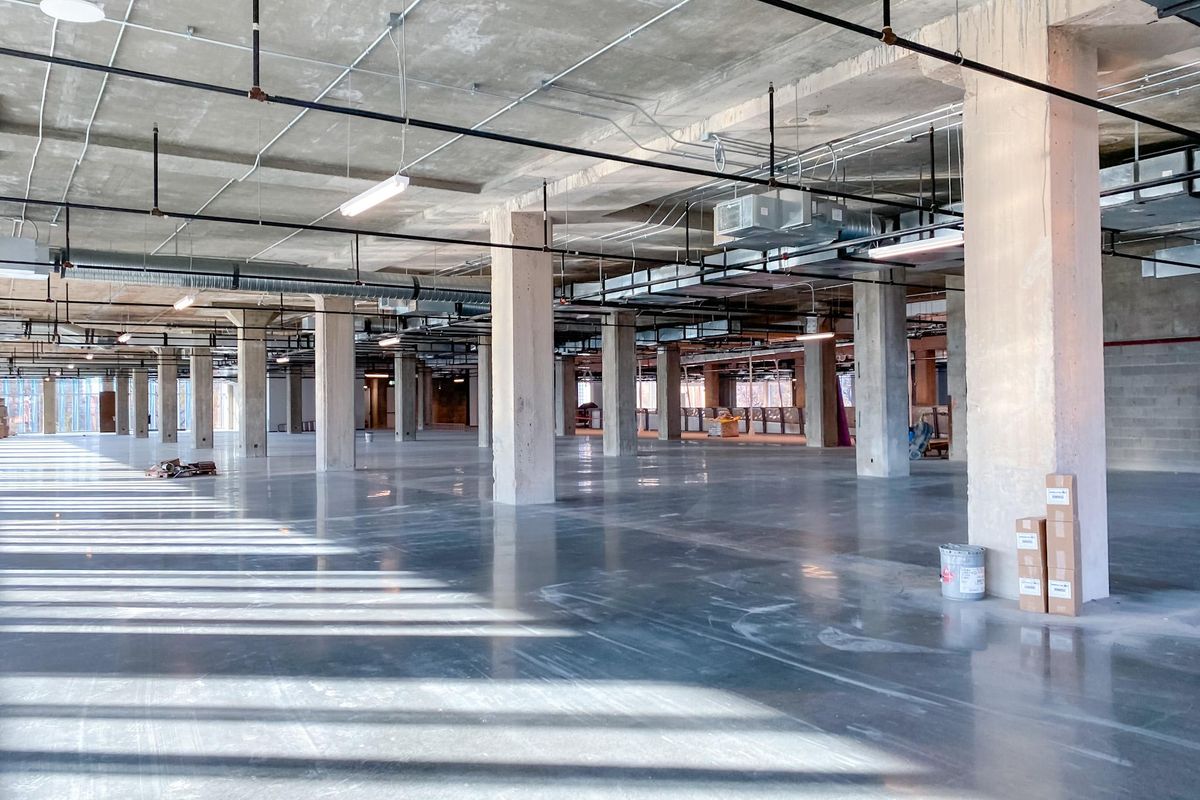

Another look at the third floor

Photo by Natalie Harms

Chevron was announced as the first tenant and will reside on this floor