10 Houston startups start 2023 with fresh venture capital funding

money moves

Houston startups saw a busy last quarter when it came to funding in 2022. From seed to series C, 10 Houston startups wrapped up the year with investment round closings.

In case you missed some of these headlines, InnovationMap has rounded up these 10 deals based on previous reporting. Scroll through to see which Houston startups are catching the eyes — and cashing the checks — of investors.

Houston-based virtual reality startup raises $3.2M in first outside capital round

VR training startup, HTX Labs, has raised funding from an outside investor for the first time. Courtesy of HTX Labs

HTX Labs, a Houston-based company that designs extended reality training for military and business purposes, announced last week that it has raised its first outside capital.

The company has received a $3.2 million investment from Cypress Growth Capital. Founded in 2017, HTX Labs — developer of the EMPACT Immersive Learning Platform — has been granted funding from the Department of Defense as well as grown its client base of commercial Enterprises. The platform uses virtual and extended reality that "enables organizations to rapidly create, deploy, measure, and sustain cost-effective, secure, and centralized immersive training programs, all within engaging, fully interactive virtual environments," per a news release.

“We have been looking to secure outside capital to accelerate the growth of our EMPACT platform and customer base but we hadn’t found the right partner who provided an investment vehicle that matched our needs,“ says HTX Labs CEO Scott Schneider in the release. “We found everything we were looking for in Cypress Growth Capital. They have a non-dilutive funding model that aligns with our capital expectations and have the level of experience that really makes this smart money." Read more.

Houston-based travel tech startup raises nearly $1M to continue expansion

A Houston company has raised additional funding as it grows its encrypted lodging booking platform. Photo via Gustavo Fring/Pexels

A travel booking technology company that's looking to alleviate some of the stresses of finding and making hotel reservations has raised additional seed funding.

Houston-based Pinktada has raised additional funding to the tune of $975,000. Ireland-based Selenean Capital contributed to the seed funding round, joining the company's previous investor True Global Ventures 4 Plus, which has invested $2 million to date. According to Crunchbase data, the latest investment brings the company's total to $3.9 million.

“Selenean Capital’s approach to partnership is identifying real world future needs and then working relentlessly to achieve those goals," says Davin Browne, Selenean’s CEO, in a news release. "Pinktada encapsulates this perfectly with a transformational approach to the hotel booking model built around a brilliant team. We look forward to the partnership and journey with them." Read more.

Houston microgrid tech company announces $150 investment

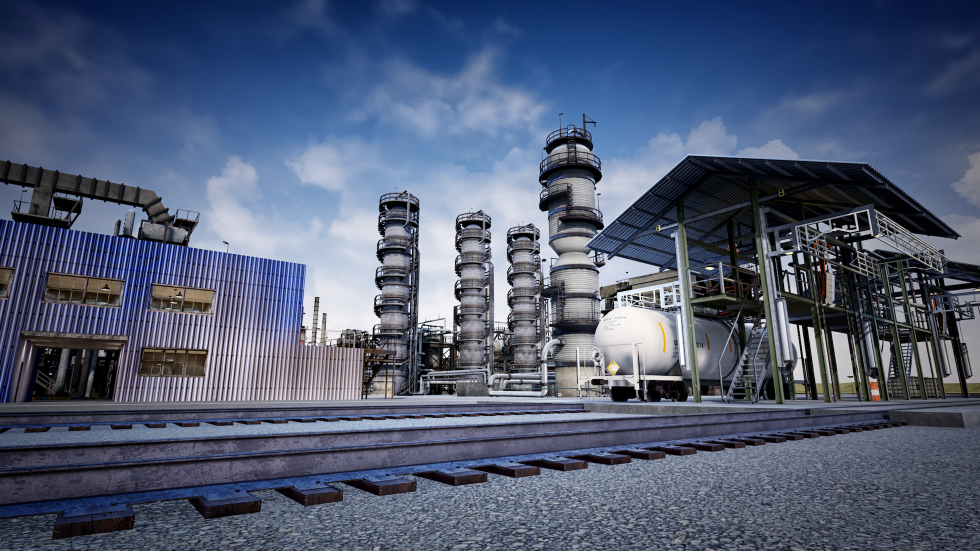

Houston-based VoltaGrid provides small-scale, self-contained microgrids that can operate independently of major power grids or in tandem with other microgrids. Photo via voltagrid.com

VoltaGrid, a Bellaire-based startup that specializes in distributed power generation via microgrids, has hauled in $150 million in equity funding.

Founded in 2020, VoltaGrid provides small-scale, self-contained microgrids that can operate independently of major power grids or in tandem with other microgrids. VoltaGrid’s product consists of natural gas engines, portable energy storage, natural gas processing and grid power connectivity.

Investors in the $150 million round include the Canada Pension Plan Investment Board (CPP Investments), Longbow Capital, Walter Ventures, and Pilot Company (operator of more than 800 retail and fueling locations in the U.S. and Canada). The $150 million round comes less than a year after VoltaGrid announced a $100 million round featuring the same investors. Read more.

Houston SaaS company raises $15M series B, announces latest release

Houston-based GoCo.io has raised fresh funding and launched the latest version of its platform. Courtesy of GoCo

A Houston startup that is optimizing human resource operations for small businesses has raised fresh funding from an Austin-based venture capital investor.

GoCo.io raised $15 million in September in a funding round led by ATX Venture Partners. Founded in 2015, the company has raised $27.5 million to date, including its $7 million series A in 2019.

The fresh funding will be used to continue expanding on the company's software services operations and upgrades to its product, which is is modernizing HR, benefits, and payroll.

“We believe that GoCo is the company best positioned to provide HR departments at SMBs with the most flexible employee management software,” says Chris Shonk, general partner at ATX Venture Partners, in a news release. “In a crowded marketplace, GoCo clearly rises to the top with its ease-of-use, flexibility and unparalleled customization. Read more.

Houston tech startup raises $3.5M following industry expansion

Rivalry Tech's co-founders — Marshall Law and Aaron Knape — share news of the company's latest round of investment. Photo courtesy of Rivalry Tech

A Houston-based company that optimizes mobile ordering for large venues has closed its latest round of funding.

Rivalry Tech, originally founded as sEATz and tackling mobile ordering in sports venues, has raised $3.5 million following expanding with a new product, myEATz, that targets the health care, leisure, and business industries. The round was led by Houston-based Sightcast, with participation from Houston-based Softeq Venture Studio, Rice University’s Valhalla Investment Group, and more.

“Sightcast Capital Partners looks to invest in strong, founder-led companies that bring a forward-thinking solution to everyday problems," says Neal Simpson, managing partner of Sightcast Capital Partners, in a news release. "In Rivalry Tech, we saw a team that recognized an opportunity to streamline the way in which food and beverage transactions occur in the healthcare, leisure, sports, and entertainment markets. Their two-sided approach of using technology as a tool to increase vendor profitability and also positively influence consumer experience is what immediately attracted us to this opportunity." Read more.

Houston unicorn chemicals company raises $200M series D

Solugen closed its series D funding round at $200 million. Photo via Getty Images

Solugen closed its series D funding round at $200 million. Photo via Getty ImagesHouston-based Solugen has announced its latest round of investment to the tune of $200 million. The company, which reached unicorn status after its $357 million series C round last year, uses its patented Bioforge processes to produce "green" chemicals from bio-based feedstocks.

"Solugen is reimagining the chemistry of everyday life with enzymes found in nature. We make chemicals better, faster, cheaper, and without fossil fuels from right here in Houston, Texas. Whether you care about the climate, local competitiveness, or just plain old profits, we have good news: it's working," the company states in its news release. Read more.

Houston company closes $76M series C round to fuel its mission of reducing carbon emissions

Syzygy Plasmonics has raised a series C round of funding. Photo courtesy of Syzygy

A Houston-based company that is electrifying chemical manufacturing has closed its largest round of funding to date.

Syzygy Plasmonics closed a $76 million series C financing round led by New York-based Carbon Direct Capital. The round included participation from Aramco Ventures, Chevron Technology Ventures, LOTTE CHEMICAL, and Toyota Ventures. The company's existing investors joining the round included EVOK Innovations, The Engine, Equinor Ventures, Goose Capital, Horizons Ventures, Pan American Energy, and Sumitomo Corporation of Americas. According to a news release, Carbon Direct Capital will join Syzygy's board and serve as the series C director.

"We were very attracted to the multiple use cases for the Syzygy reactor and the lifetime-value of each Syzygy customer," says Jonathan Goldberg, Carbon Direct Capital's CEO, in the release. "Emissions from hydrogen production total more than 900 million metric tons of carbon dioxide per year. Syzygy's photocatalysis technology is a key solution to decarbonize hydrogen production as well as other critical industries." Read more.

Houston SaaS startup raises $6M seed

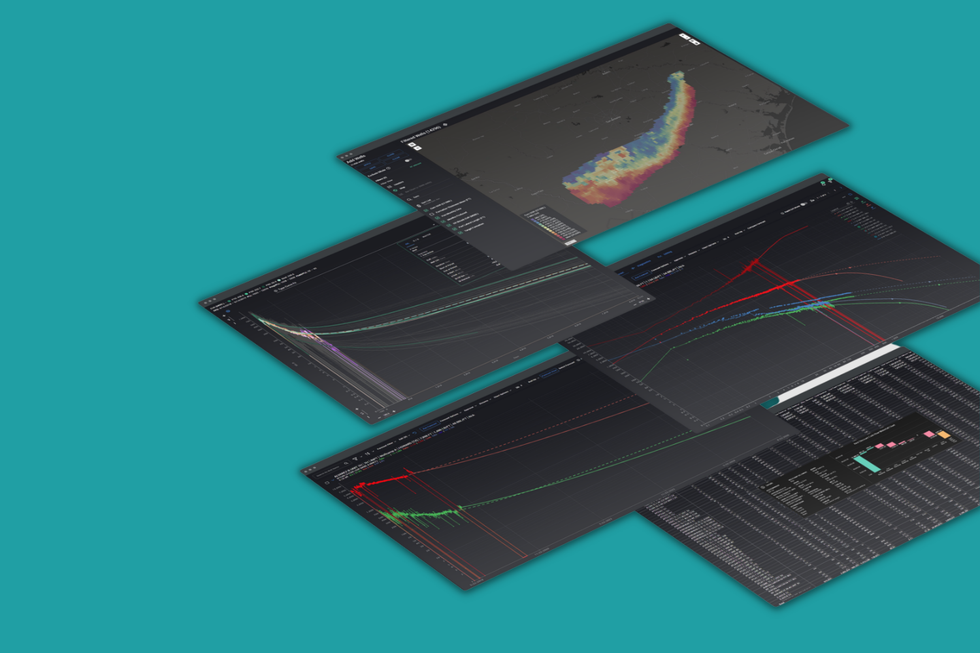

Houston-based SynMax has closed its first round of funding. Photo via Getty Images

A Houston-based satellite data analytics company is celebrating an oversubscribed round of recent funding.

SynMax announced this week that it closed its seed round at $6 million with an oversubscription of $2 million. The startup is providing geospatial intelligence software as a service to customers within the energy and maritime industries. The technology combines earth observation imagery and key data sources for predictive analytics and artificial intelligence.

The company reports that all of the investment came from SynMax customers. The round was led by Houston-based Skylar Capital, an investment management firm focused on the natural gas market. Read more.

Houston health tech startup secures $27M in financing

A Houston startup that created a remote monitoring and care platform has raised millions in financing. Image via michealthcare.com

A virtual health care and analytics provider startup has closed its latest round of funding for a total of $27 million in financing.

Medical Informatics Corp. closed a $17 million series B co-led by Maryland-based Catalio Capital Management and California-based Intel Capital. The financing also includes an additional $10 million in debt led by Catalio through Catalio’s structured equity strategy, according to a news release.

“We are excited to have had this round co-led by Catalio and Intel Capital," says Emma Fauss, CEO and co-founder of MIC, in the release. "Catalio brings significant financial and technical resources, while Intel Capital possesses strong operational and industry experience, and we look forward to continuing to leverage both firms’ expertise as we continue to scale.” Read more.

Houston sportstech platform raises $1.3M seed round

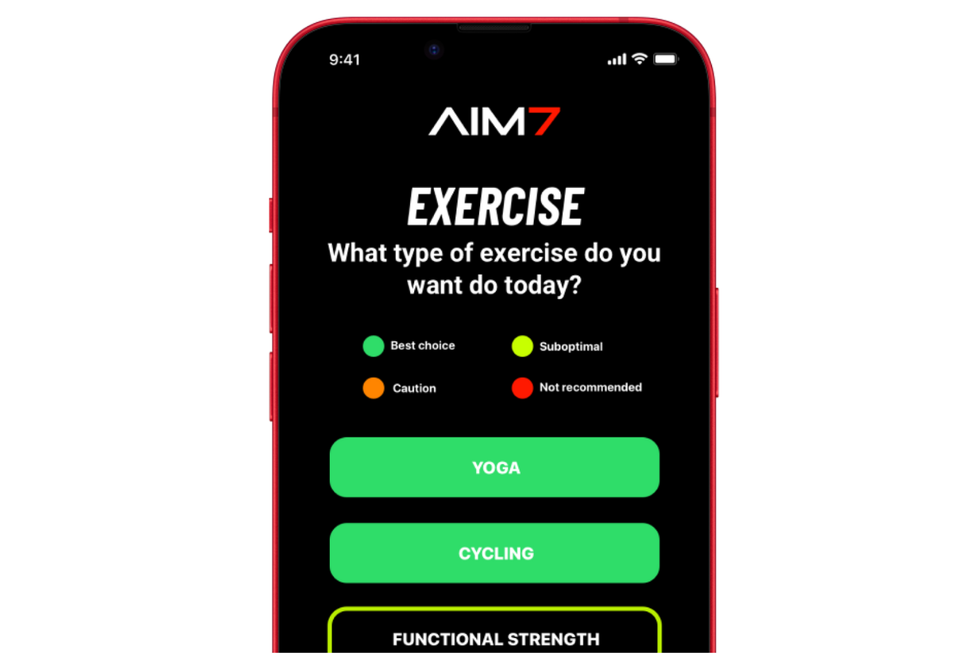

This Houston startup has fresh funding to build out its data intelligence platform. Photo via aim7.com

How many times have you forced yourself to do an arduous workout when you just weren’t feeling it? Despite what some trainers will tell you, you probably didn’t feel any better after. Sports scientist Dr. Erik Korem could have told you that, but more importantly, so could his creation, AIM7.

Marketed as “the fastest, easiest way to change your habits and improve your health,” Korem just raised a $1.3 million seed round that will bring his ambitious app to consumers in its beta form early next month.

The data intelligence platform would know that on a day that you’re stressed, that Peloton tabata ride might not be in your best interest. How? “The data from your Apple Watch or your Fitbit is just data. ‘I walked 7000 steps or I slept 8 hours,’” explains Korem. “We are the recommendation engine that makes this usable for you.” Read more.