9 innovation & networking events for Houstonians to attend at SXSW 2025

A Houstonian's Guide to SXSW

South by Southwest, Austin's signature hybrid music, film and interactive festival, returns to the Texas capital this month, running March 7 through 15.

In the business and innovation sector, the festival fuses together SXSW Edu for educators at the beginning of the week and SXSW Interactive, which is one of the largest gatherings in the world of innovators, technologists, artists, startups, investors and policy-makers. SXSW is a powerful international magnet for creators and the people who serve them.

I started coming to Austin for SXSW in 1999, a few years after the Interactive portion (nicknamed "Spring Break for Nerds") launched and when the entire conference of 6,000 attendees fit into the Austin Convention Center. Back then, you could rub shoulders with famous bloggers who challenged established tech journalists in the hallways, multimedia artists handing out bootleg CD-ROMS, and hard-core geeks setting web standards and laws related to technology that we enjoy today.

SXSW, like Austin itself, has grown up quite a bit in the last two decades and has fended off the common Austin refrain of "It was better X years ago," as everything has become more commercial, less "authentic" and more expensive. SXSW officially sells tickets or badges for $2295.00 at the Platinum level (with cheaper options as well) providing access to stand in lines with hundreds of your friends for the most popular keynotes and panels.

One critical tradition of SXSW and part of the relentless motivation to "Keep Austin Weird" is the dozens of unofficial side events that pop up during the event all across the city. These unofficial events and activations typically provide networking opportunities fueled by the draw of internet-famous speakers, free food, and free alcohol. As SXSW has grown exponentially, it still seems to retain its charm and quirkiness as not quite a music festival, like Bonnaroo or Lollapalooza, nor a film festival like Sundance or Tribeca, and certainly not a traditional tech conference like CES. I like to think of it as a Carnival with many things to do and see but without a specific agenda or outcome. Since COVID and the financial market retraction, these parties and happy hours have become a lot more restrained, but they still exist if you know where to look.

This article is designed to guide you through the highlights, both official and unofficial, of SXSW with a focus on professional business development with a strong bent toward networking with tech startups. Here's what not to miss.

Friday, March 7

Equitech Texas Welcome Breakfast

9–11 a.m.

Inn Cahoots, 1221 E 6th St.

A breakfast gathering of people involved with Impact Investing and Equity Tech, led by Laurie Felker Jones

Startup Superconnector featuring Practice Pitch

11 a.m.–4 p.m.

Funded House, 315 Lavaca St.

This is a "Pop Up Pitch" event designed to help startups with their investor pitches by putting them in the same room with investors and professional service providers.

Startup Crawl at SXSW 2025

5 p.m. for Backstage VIP

6–9 p.m.

Capital Factory, 701 Brazos St., Suite 1600

Startup Crawl is arguably the most important unofficial event during SXSW where hundreds of startups showcase their offerings in a huge trade show, party format.

Saturday, March 8

The Red ThreadX

607 W. Third Street, 29th Floor

Curated content, strategic connections and actionable insights for military and defense-oriented businesses

SXSW 2025: Dolphin Tank

8–10:30 a.m.

FQ Lounge: Waller Creek Boathouse, 74 Trinity St.

In partnership with Amazon and The Female Quotient, this event is dedicated to championing women entrepreneurs.

Sunday, March 9

2025 TXST SXSW Lab: The Bobcat Den

1:30–8:00 p.m.

The Bobcat Den @ SXSW, Q-Branch 200 E. Sixth St., Suite 310

PROMO CODE: MICHAELBESTVIP

The TXST SXSW Lab: The Bobcat Den is a dynamic, all-day event that showcases Texas State University’s cutting-edge research, industry collaborations, and student innovation.

Monday, March 10

Founded in Texas - For Women Founders

9 a.m.–12:30 p.m.

Brown Advisory, 200 W. Sixth St., Suite 1700

Project W, The Artemis Fund, HearstLab and Brown Advisory have joined forces to bring you Founded in Texas, an investor feedback session designed to support Texas-based women who are founders of B2B and B2B2C technology companies.

Inaugural Texas House

11:00 a.m. on Monday, March 10, until 11:59 p.m. on Tuesday March 11

315 Lavaca St.

More than ever, Texans are leading at the frontiers of technology, entrepreneurship, and culture. See the full agenda

Tuesday, March 11

Super Connectors Meet Up

4–5 p.m.

Hilton Austin Downtown, 500 E. Fourth St., Room 412

*Badge-only event

"Superconnectors," tor those who seem hyper-connected to large networks of people, are naturally drawn to SXSW. They thrive in a creative and innovative environment, affording them countless opportunities to meet interesting people. Meet some here.

---

This information and more can be found at Marc Nathan's VIP Insider’s Guide to SXSW.

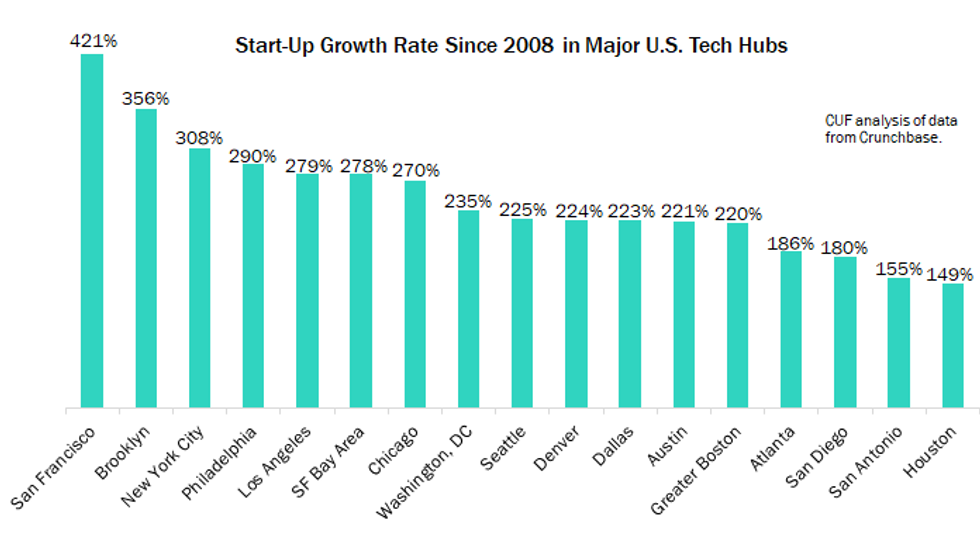

Chart via the

Chart via the