Houston's spike in VC deals, accelerator acquired, new coworking, and more innovation news

Short stories

Houston has seen some big headlines this month when it comes to innovation news — and you could have missed something.

From a report on venture capital funding last year and new coworking coming to town to a Houston investor selling her accelerator company, here's the latest batch of short stories in Houston innovation.

Houston sees spike in venture capital deals in 2019

Houston saw more venture capital funding in 2019 compared to 2018. Chart via crunchbase.com

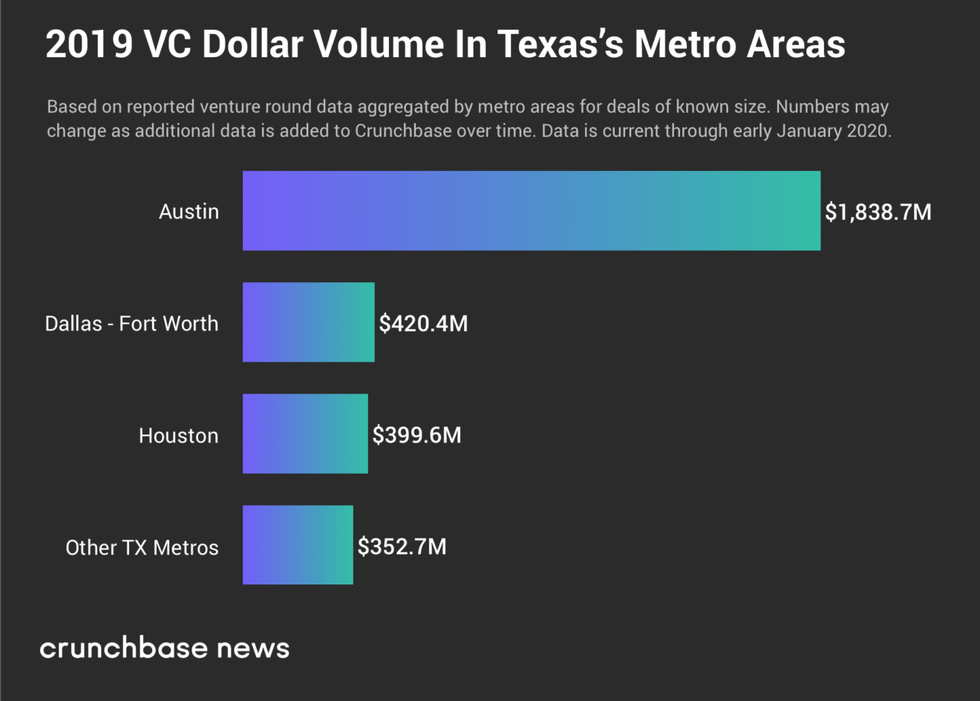

Overall, 2019 was a good one for Texas venture capital deals. Austin had a record turnout of money invested in startups. Austin companies raised over $1.8 billion, which put the state capitol in the top 10 cities based on money raised, according to a report by Crunchbase.

And this Texas VC roundup on Crunchbase focused a lot of the Austin funding and didn't harp too much on the other Texas cities. But Houston's numbers are also record breaking. The Bayou City raised nearly $400 million last year — with the bulk of that being recorded in Q2 of 2019.

Houston's recorded $399.6 million in VC deals surpasses 2018's recorded funding by almost $20 million, but if you look at PitchBook and the National Venture Capital Association's data, the amount is higher. According to Pitchbook, the total funding raised in 2019 in Houston deals surprasses $600 million across 98 deals.

Houston investor-founded accelerator acquired

Houston investor Diana Murakhovskaya has sold her New York-based accelerator program. Photo courtesy of The Artemis Fund

New York-based Monarq Incubator, a venture capital-focused accelerator program for women, has been acquired by Female Founders Alliance. Monarq was co-founded by Diana Murakhovskaya, one of the three co-founders of Houston-based, female-focused The Artemis Fund.

Since its founding in 2017, Monarq accelerated 32 companies that have then gone on to raise more than $10 million in venture capital. The combined company, according to a news release, now represents the largest network of women and non-binary venture-scalable founders.

"FFA and Monarq share more than just a mission – we share founder DNA," says Leslie Feinzaig, CEO of Female Founders Alliance, in the release. "Our two communities and accelerator programs were built by women founders, for women founders. We are uniquely able to build programming that accelerates the success of women in our space, and now along with founder cred, we have scale and a national footprint. I am so excited for what we can achieve in this next stage of FFA."

The acquisition means a heightened focus on The Artemis Fund for Murakhovskaya.

"Now that I am full time focused on raising and investing with Artemis, it's great to know that our community and founders will have a home and provide us with a great source of deal flow," she says in an email to InnovationMap.

A new coworking company to enter Houston with Galleria-area office

New Galleria-area coworking is coming later this year. Photo via serendipitylabs.com

Serendipity Labs Coworking, which has over 100 coworking spaces across the United States and United Kingdom, announced its plans to enter six new markets this year. Houston is among the new locations for the coworking company.

Expected top open in the fall, the Houston coworking space will be a 28,331-square-foot space on the 20th floor of the Marathon Oil Tower at 5555 San Felipe St. in the Galleria area. According to the release, Cameron Coworking, a division of Cameron Management, will be the development partner for the Houston market.

"By partnering with asset owners of office, retail and residential buildings and then managing the Labs, we bring our operational expertise and marketing power, and we assure the upscale service standards of one of the top national flexible workplace networks will be met at every location," says John Arenas, chairman and CEO of Serendipity Labs, in a news release.

MassChallenge Texas opens applications for second cohort

Applications are open for MassChallenge Texas' second Houston cohort. Courtesy of MassChallenge

At an event on January 29 in both Houston and Austin, MassChallenge Texas opened applications for its 2020 cohorts

The 4-month accelerator program is set to begin in June and online applications close March 9. Prizes include six months of free office space and up to $250,000 in equity free investment. Click here for more information.

Houston entrepreneur named to 2020 class of Presidential Leadership Scholars

Houston startup founder, Reda Hicks, has been named a Presidential Leadership Scholar. Photo via presidentialleadershipscholars.org

For this sixth year, the Presidential Leadership Scholars announced its class of veterans, educators, physicians, public servants, and corporate professionals to participate in the program. Reda Hicks, founder of GotSpot was named as one of the 60 scholars. The program began this week in Washington D.C..

"I cannot wait to work with, and learn from, these exceptional leaders," Hicks shares on LinkedIn. "And through the program, I will be working on RescueSpot, a community resiliency application of GotSpot Inc."

Another Houstonian was selected too — Ganesh Betanabhatla, who is the managing partner and chief investment officer at Ramas Capital Management.

Ion Smart Cities Accelerator opens applications for second cohort

Aatonomy, a member of the first cohort, walked away with a cash prize at Demo Day. F. Carter Smith/Station Houston

The second cohort for the Ion Smart Cities Accelerator Program has opened applications online. The first cohort, focused on resilience and mobility, is currently in pilot mode. Cohort II will be focused on water purification/quality, air quality, and clean technology.

The applications will close on Monday, February 17, and startups that are selected will be notified the week of March 2.

The program, which was announced in June, is backed by Microsoft and Intel and named its first cohort last fall. The demo day for the first cohort took place last month. The accelerator has its own space and prototyping lab in downtown Houston, which opened in September.

Apple doubles down on Houston with new production facility, training centerPhoto courtesy Apple.

Apple doubles down on Houston with new production facility, training centerPhoto courtesy Apple.