Here's what Houston startups have raised in funding so far this year

money tracker

While Houston startups saw a busy first quarter of 2023 — including IPOs in the space and biotech arenas — funding activity fell somewhat flat.

According to InnovationMap reporting, five startups have raised funding this year so far — which is less than half of the number of deals at the same time last year. Last year in the first quarter, 11 startups announced funding deals to the tune of $140 million. This year, startups raised around $106 million across five deals.

Tech-enabled manufacturing startup based in Houston secures $42M in growth financing

MacroFab has secured fresh investment to the tune of $42 million. Photo via macrofab.com

A Houston company has nearly doubled its total raised with its latest funding round.

MacroFab, a Houston-based electronics manufacturing platform, has announced $42 million in new growth capital led by Foundry and joined by BMW i Ventures, as well as existing investors Edison Partners and ATX Venture Partners. The platform was first launched by Misha Govshteyn and Chris Church in 2015.

“Given MacroFab’s compelling solutions to electronics manufacturing challenges and Foundry’s successful history with parallel companies, our investment is a perfect fit," Foundry Partner Seth Levine says in a news release. "This is a unique opportunity to be part of next generation cloud manufacturing and we’re excited to be joining forces with Misha and his team." Read the full story.

Houston e-commerce company raises another $40M round to support growth

P97 Networks has again raised $40 million to support its growth. Photo via Getty Images

For the second time in just over a year, a Houston business that provides mobile commerce and digital marketing to the mobility and fuel industries has raised $40 million.

P97 Networks, which has developed a cloud-based mobile commerce platform that helps brands securely do business with customers, announced that it has closed its series C round at $40 million. The equity financing round was led by Portage and included participation from existing investors. The fresh funding will go to support growth strategy.

"In this highly connected world, retail brands are looking for new ways to increase consumer engagement — the power of network effects in the digital world will be a key contributor to revenue growth and margins," says Donald Frieden, CEO of P97 Networks, in a news release. "With consumers of all ages further adopting mobile payment solutions, we are proud to have built the leading connected commerce and digital marketing platform for the convenience retail, energy marketing, and transportation industry." Read the full story.

Houston med device startup raises $18M, prepares to hire

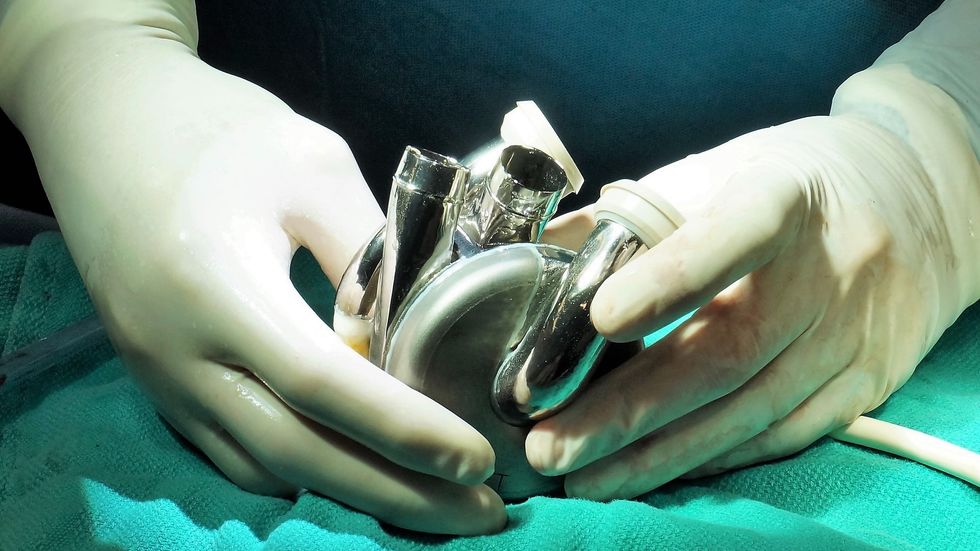

BiVACOR has received fresh funding from its investors to further develop its artificial heart. Photo courtesy of BiVACOR

A Houston medical device company that is developing an artificial heart announced it has received investment funding to the tune of $18 million.

BiVACOR's investment round was led by Boston-based Cormorant Asset Management and Australia's OneVentures's Healthcare Fund III. According to the company, the funding will be deployed to continue research and development, hiring executives, and support the path to first in human trials.

“We are extremely grateful for the ongoing support from our core investors," says Thomas Vassiliades, who was named CEO of BiVACOR last year, in a news release. "This additional commitment further validates our technology and the need for improved options to treat end-stage biventricular heart failure." Read the full article.

Houston health tech company closes $3M series A

Prana Thoracic, an innovative startup in the lung cancer diagnostics space, has raised its series A round of investment. Photo via LinkedIn

It's been just under six months since the launch of Prana Thoracic, a Houston health tech startup tackling lung cancer diagnostics, and the company has already secured its next round of investment funding.

Prana Thoracic, a medical device company developing a tool for early interception of lung cancer, announced last week that it closed a $3 million series A financing round led by Florida-based New World Angels with participation from Johnson & Johnson Innovation – JJDC, Inc., Texas Medical Center Venture Fund, and the University City Science Center’s Phase 1 Ventures.

In August, the company received a $3 million award from the Cancer Prevention & Research Institute of Texas. All of Prana Thoracic's funding is being used to develop the unique diagnostic product and the company's path to first-in-human clinical studies.

“Our technology provides a definitive answer to patients with lung nodules and allows physicians to intervene earlier in the lung cancer patient’s journey,” says Joanna Nathan, CEO, and co-founder of Prana, in a news release. “Our team is grateful to have the support of our investors and excited to leverage this financing to accelerate our technology to the bedside.” Read the full story.

Houston climate tech startup closes $3M seed led by Shell

DexMat, a Houston-based materials science startup with tech originating at Rice University, has raised $3 million. Image via Getty Images

A material science startup with technology originating at Rice University has announced it has closed its seed round of funding.

DexMat raised $3 million in funding in a round led by Shell Ventures with participation from Overture Ventures, Climate Avengers and several individuals. The company transforms hydrocarbons, renewable fuels, and captured carbon into its flagship product Galvorn.

“DexMat presents an opportunity to capture methane, an abundant and inexpensive resource, and use it to replace materials such as steel, aluminum, and copper with a more sustainable option. We are excited to be part of DexMat’s journey going forward and to realize their ambitions,” says Aimee LaFleur, investment principal at Shell, in a news release.Read the full story.