With a busy September just days away, the Houston innovation world has seen an uptick in news. Just in case you missed some, here are some short stories from Houston startups — funding, product launches, clinical trials, oh my.

TMC invests in Luma Health's recent $16 million round

Luma Health, a San Francisco-based startup and TMCx08 cohort member, has closed a $16 million Series B round. The Texas Medical Center contributed to the round, along with U.S. Venture Partners and Cisco. PeakSpan Capital lead the series.

The company has a text-first communication platform to ease and automate the provider-patient conversations. The money, per VentureBeat, will go toward scaling up business.

"As we've spent more time with patients, doctors, and healthcare teams across the country, we've seen the disconnect between patients and clinics — patients really struggle to connect with their clinic, and clinics struggle to simply get a hold of their patients," the companies founders write on their website. "The one consistent theme we've heard after now deploying Luma Health at over 300 clinics is: how can we make it easier for our patients to get started on their care journey and connect with us as they map their personal path to healing?"

ExxonMobil scales its arrangement with Houston drone company

![Dyan Gibbons]()

Dyan Gibbons is the CEO of Trumbull Unmanned. Courtesy of Alice

Houston-based Trumbull Unmanned has provided its drone technology to ExxonMobil since 2014. Now, the major energy company is scaling up its involvement with the local company.

Trumbull was recently awarded a five-year Unmanned Aircraft Systems Agreement and now will expand drone data collection and inspections as part of a new contract.

"Trumbull is grateful to serve amazing clients. After conducting data collection and inspections for ExxonMobil in over 25 locations, we are excited to scale operations starting in the Americas," says Trumbull CEO Dyan Gibbens in a release. "We look forward to helping ExxonMobil integrate amazing safety, efficiency, and data-driven technology into their operations."

Houston-founded startup relocates to Austin

![]()

Ben Johnson's business idea turned into a growing company making the lives of apartment dwellers easier. Courtesy of Apartment Butler

A company founded in Houston has moved its headquarters to Austin, according to reports. Spruce — formerly known as Apartment Butler — provides luxury services (like dry cleaning, cleaning, and pet services) to apartment complexes.

Founder Ben Johnson told InnovationMap last December that, even though he's raised two rounds of funding from Houston — a $2 million Seed and a $3 million Series A — it was tough to convince venture capital firms from Houston. Houston-based Mercury Fund and Austin-based Capital Factory contributed to both the company's rounds. Princeton, New Jersey-based Fitz Gate Ventures led the Series A round, and the Houston Angel Network contributed too.

"Every single VC I pitched to wanted to require us to move to Austin as a condition to our funding," Johnson tells InnovationMap in a previous article. "I wanted to grow this business in Houston. I thought I was going to have to move to Austin because there wasn't a VC for us here."

Spruce already has a presence in Austin. The company has its services in 35 Austin-area apartment complexes, per the Austin Business Journal, as well as having Austin-based employees. Earlier this year, Spruce expanded its services to Denver, representing the first out-of-state business for the company.

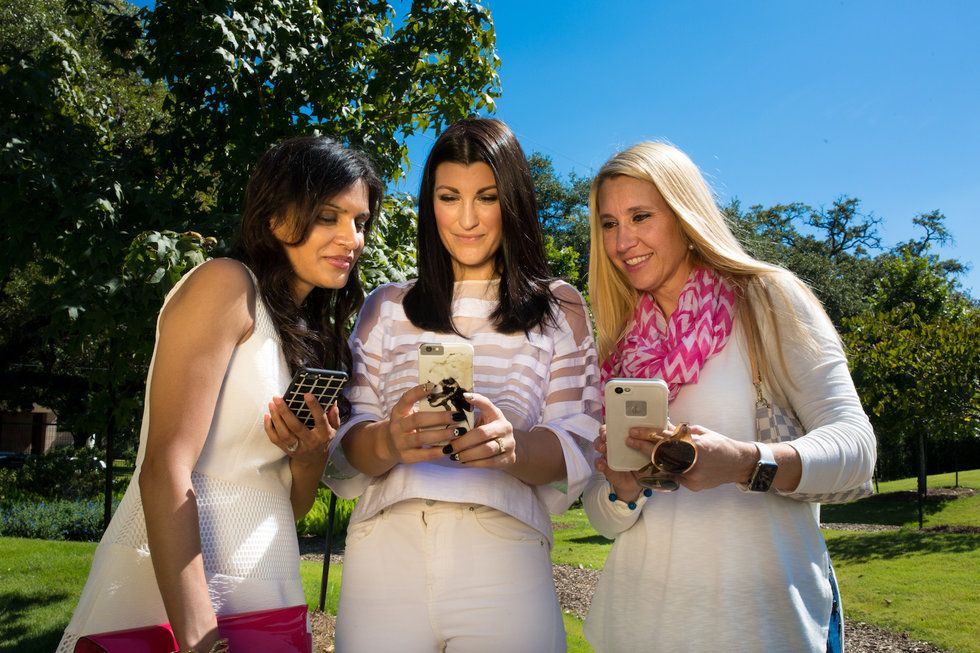

Houston anti-fungal fabric fashion line launches

Accel Lifestyle is a anti-stink, ethically sourced athletic line. Courtesy of Accel

Houston entrepreneur, Megan Eddings, was disappointed with the athleticwear industry. She couldn't find a company that prioritized ethical and sustainable designs that were made with a fabric that wouldn't hold on to that strong, unpleasant sweat smell. So, a chemist by trade, she made her own.

Now, after months and months of work, Eddings has launched her company and the fitness line, Accel Lifestyle. The products are made in the United States in ethical conditions and shipped in 100 percent biodegradable packaging without any plastics involved. The custom-designed fabric — called the Prema™ fabric, which is now patent pending in 120 countries — doesn't hold onto the stink from working out, meaning consumers will be less inclined to throw them away, preventing unnecessary textile waste.

"I founded Accel Lifestyle because, even though there are so many fitness apparel companies today, none of them hit all the boxes on my checklist. I wanted to support a fashionable fitness apparel company that has an ethical supply chain (no sweatshops), and a fabric that doesn't smell. What did I find? Absolutely nothing. And, I wanted to change that," says Eddings in a release. "With my science background and experience working in science labs at University of Virginia and Brown University, it took 2.5 years to create the fabric from scratch, using the most luxurious threads available and a trade secret protected science."

Houston medical device startup releases positive clinical trial results

Photo via nanospectra.com

A Houston medical device company using nanomedicine has released early results in its clinical trials treating prostrate cancer. Nanospectra Biosciences Inc.'s AuroLase technology uses laser-excited gold-silica nanoparticles with various medical imaging tools to focally remove low to intermediate grade tumors within the prostate, according to its study outcomes published in Proceedings of the National Academy of Sciences.

"As the first ultra-focal therapy for prostate cancer, AuroLase has the potential to maximize treatment efficacy while minimizing side effects associated with surgery, radiation, and traditional focal therapies," says David Jorden, CEO of Nanospectra, in a news release. "We are encouraged by the clinical success of our feasibility study to date and look forward to the initiation, potentially next month, of the pivotal study with an expected cumulative treatment population of 100 subjects."

One of the company's co-founders, Naomi J. Halas, is a professor of biophysics at Rice University.

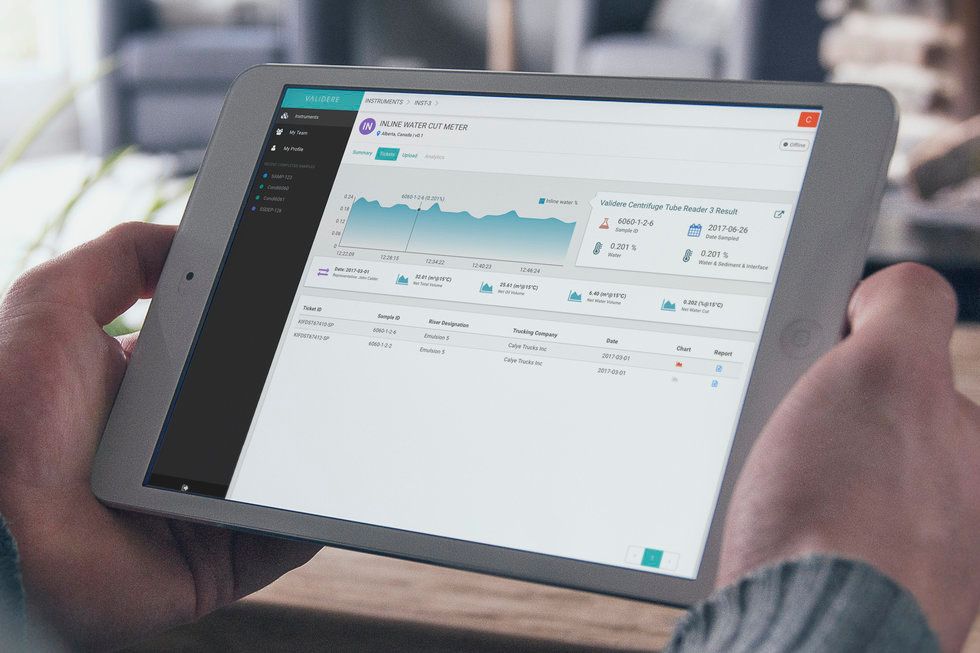

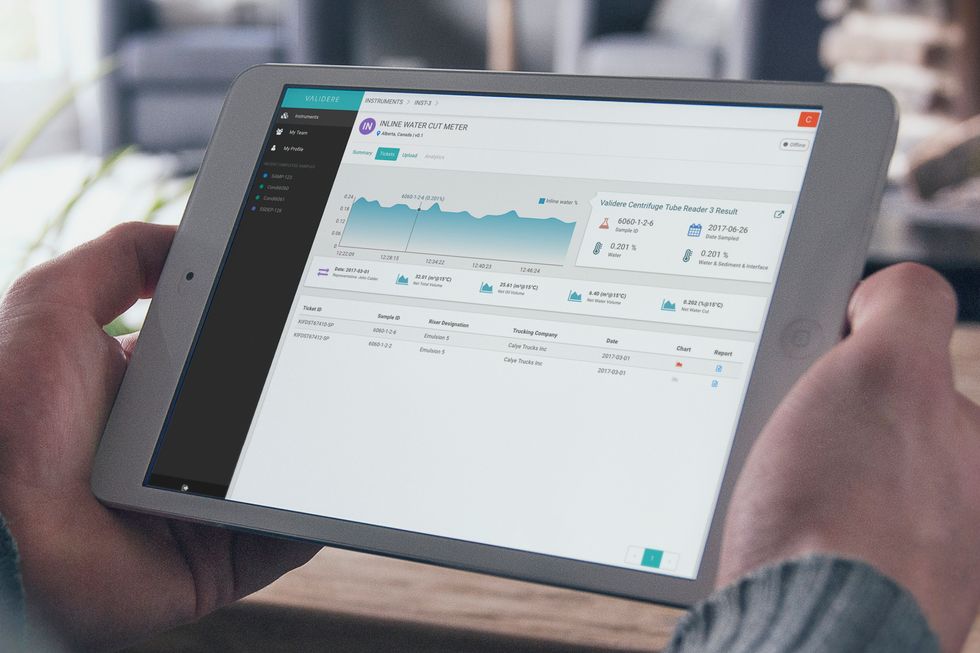

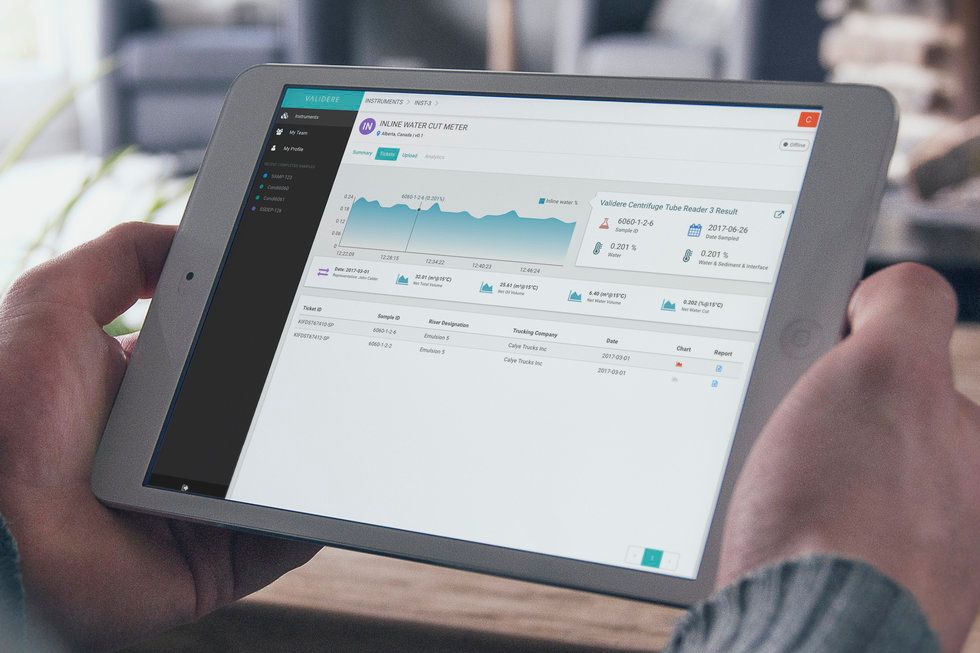

Canadian oil and gas company with a growing presence in Houston named finalist in World Oil awards

![]() Validere, a Canada-based energy logistics company, is expanding in Houston. Courtesy of Validere

Validere, a Canada-based energy logistics company, is expanding in Houston. Courtesy of ValidereWhile Houston can't completely claim Canadian oil and gas data company Validere, the company, which has a growing presence in the Bayou City, has been named a finalist in a prestigious awards program.

Validere is a finalist in the World Oil Awards' best data management and application solution award. The company is up against technology from the likes of Schlumberger, Halliburton, Siemens, NOV, Baker Hughes, and more,

The company has created a software that allows for real-time data and both artificial and human intelligence insights to improve its clients' quality, trading, and logistics. The company's technology enhances the ability of oil and gas traders to make informed decisions, which currently are made based off unreliable product quality data. Annually, $2 trillion of product moves around the oil and gas industry, and Validere uses the Internet of Things to improve the current standard of decision making.

Of course, the energy capital of the world has been a major city for growth — something co-founder Nouman Ahmad tells InnovationMap in a previous interview.

"As we think about the long-term future of the business, Houston is one of the most important markets for us going forward," Ahmad says.

Validere, a Canada-based energy logistics company, is expanding in Houston. Courtesy of Validere

Validere, a Canada-based energy logistics company, is expanding in Houston. Courtesy of Validere

Apple doubles down on Houston with new production facility, training center Photo courtesy Apple.

Apple doubles down on Houston with new production facility, training center Photo courtesy Apple.