A Houston startup looking to digitize the human resources industry just completed a reassuring round of funding. GoCo closed its Series A funding round led by ATX Seed Ventures alongside UpCurve, Inc. at $7 million.

GoCo, which was founded by CEO Nir Leibovich, Chief Technology Officer Jason Wang, and Chief Product Officer Michael Gugel, is out to bring the much-maligned HR tasks into the digital world. The funding round brings GoCo's total funding to $12.5 million. Leibovich said the new capital will be allocated to hiring across all departments, further platform development to extend the breadth of offerings and to broadly expand the company's customer base.

"Today, we have 6,200 customers across the U.S. and around the world," Leibovich tells InnovationMap. "And we have 25 employees. We're looking to double and triple — if not quadruple — that across 2019."

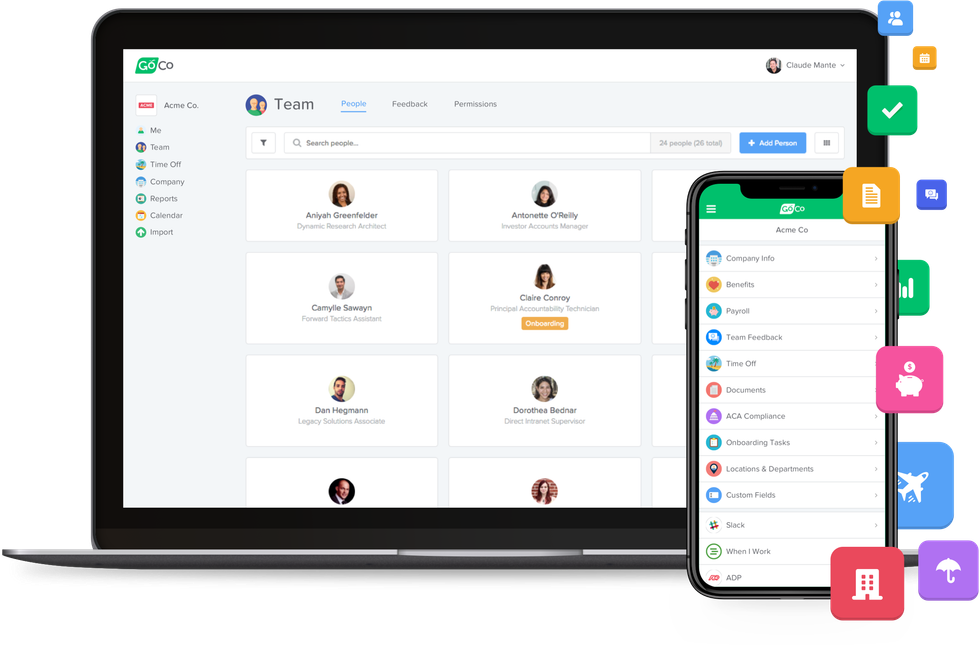

The company has a solid partnership network with employee benefit insurance agencies like OneDigital and PayneWest, and general agencies like Word & Brown, to offer GoCo's technology as an enhancement to their existing insurance benefits services clients. GoCo also auto-syncs with leading payroll providers ADP, PayChex, Paylocity, Intuit Quickbooks and more, thus uniquely enabling businesses to maintain their benefits broker and payroll provider by integrating with GoCo's platform.

"This Series A and the potential addition of UpCurve's distribution channel to reach hundreds-of-thousands of new customers continues our mission to free SMBs and HR professionals from outdated and tedious administrative burdens. When these professionals look at current HR and benefits solutions on the market and think 'there must be a better way,' we are the better way," says Leibovich. "We want to be synonymous with modern and streamlined HR."

GoCo is backed by additional investments from Salesforce Ventures, Corp Strategics, GIS Strategic Ventures, the venture arm of Guardian Life Insurance, and Digital Insurance, the largest employee benefits-only company in the US. ATX Seed Ventures is investing for the second time.

"We are doubling down on our investment in GoCo, as it is positioned to become the platform of choice for HR professionals to break out of the chains of outdated and complex HR duties, and empowers them to spend more time on their employees and higher value tasks," says Chris Shonk, managing partner at ATX Seed Ventures, in a release. "GoCo is simply the best platform solution to do all this, and their increasing customer base supports it."

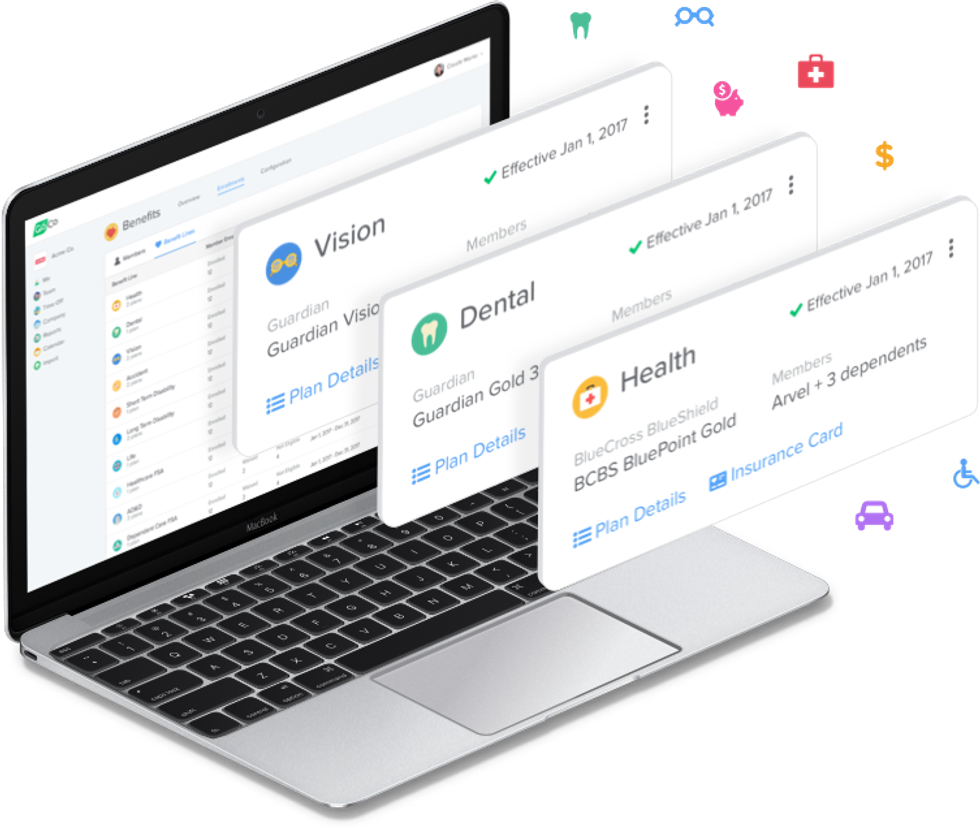

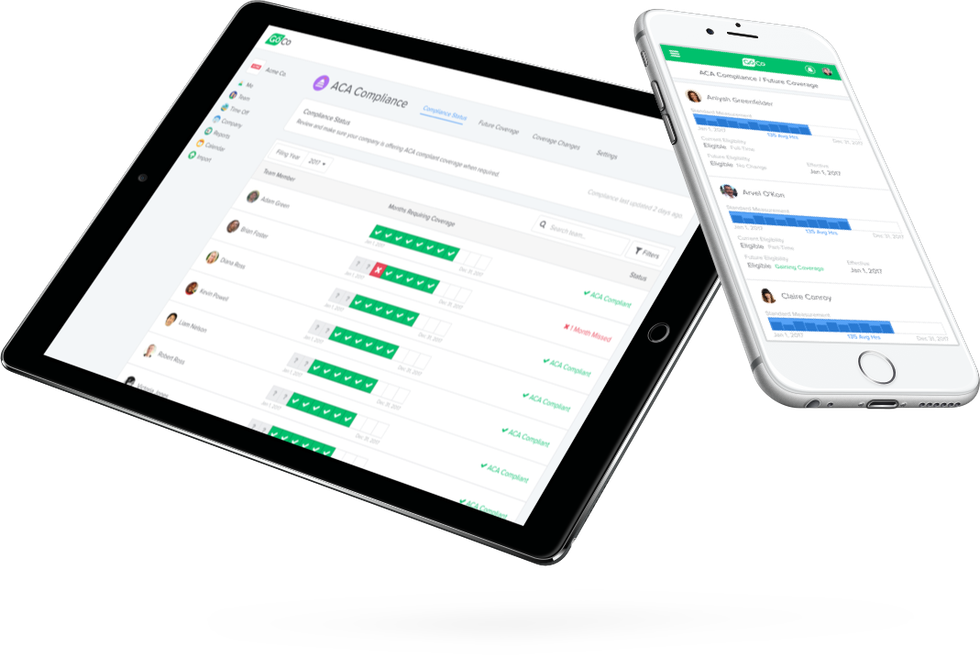

Founded in 2015, GoCo is the fusion of modern, paperless HR functions like employee onboarding, secure cloud-storage document management, eSignature workflows, time-off tracking and HR data reporting. As well, it is paired with simplified benefits enrollment and management, payroll sync and HR compliance enablement. The web and mobile based app empower employers to give employees 24/7 access to the full spectrum of a company's HR and benefits offerings.

GoCo creates platforms to onboard employees, conduct training and myriad HR tasks which, said Leibovich, free up HR personnel to handle the business of actually working with employees to grow their potential and assist companies with their missions.

"Typically, HR has lagged behind when it comes to embracing technology," says Leibovich. "Sales, marketing, development, these are places where it's become the norm to seek out tech solutions to problems. With human resources, many firms are still using that paperwork model, and often, a new hire's first day on the job – and therefore their first impression of a company — is filling out forms."

Leibovich had founded two companies before, one based in analytics that they sold to Zinga, the other a biotech firm. It was the biotech venture that brought the Austin-based trio to Houston. Looking around the landscape, Leibovich said he and his partners liked the fact that Houston was a city on the move, with a highly skilled workforce and companies keen on finding tech solutions to their challenges. The city's "if you can dream it, you can do it here" vibe kept the group here as they launched GoCo. Leibovich said he thinks that, in terms of its startup ventures, Houston is where Austin was 10 years ago. And he believes that continued successes in the tech and startup culture will breed more success in the Bayou City.

"This is an ecosystem that is coming together to attract even more talent for ventures like this," he said. "Funding is going to ramp up, and we see Houston as a place where we — and other companies — can create something really special. This is a great place to do business."

All-in-one platform

GoCo is the fusion of modern, paperless HR functions like employee onboarding, secure cloud-storage document management, eSignature workflows, time-off tracking and HR data reporting.