Editor's note: Judging is now underway for the 2025 Houston Innovation Awards, and before we reveal this year's finalists, it's time to meet the decision makers.

Our 2025 judging panel comprises past award winners who represent a variety of industries and areas of expertise. They are joined by InnovationMap's editorial leaders, past and present. All are deeply engaged in the Houston innovation ecosystem.

Our judging panel will review all nominee applications submitted across 10 prestigious categories. They will determine the 2025 finalists in all categories, and they will select the winners in all but one category — our people's choice award, Startup of the Year.

Learn more about our esteemed judges below, and stay tuned for the 2025 Houston Innovation Awards finalists announcement, coming in early October!

Winners will be announced live at our awards ceremony on November 13 at Greentown Labs.

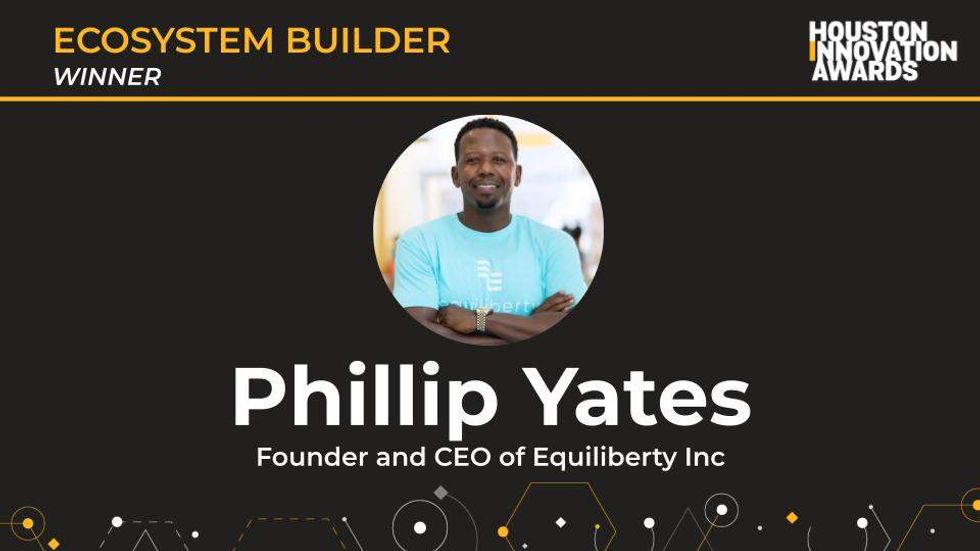

Phillip Yates, 2024 Ecosystem Builder of the Year

Phillip Yates. Photo courtesy of Equiliberty

Attorney-turned-entrepreneur Phillip Yates is the founder and CEO of Equiliberty Inc., a Houston-based fintech platform that connects users with resources to build wealth. Deeply involved in the Houston innovation sector, he helped establish a pre-venture business incubator at the Houston Area Urban League Entrepreneurship Center in 2011. He has served as general counsel for the Business Angel Minority Association and Direct Digital Holdings Inc., and currently serves as chairman of Impact Hub Houston.

"My favorite part of Houston's innovative ecosystem is the growing network of resources for founders," he said. "Given our racial, ethnic, and culturally diverse population, we have a wider range of experiences and perspectives — and ideas that lead to better problem solving, creative solutions, and understanding of the needs our community."

Mitra Miller, 2024 Mentor of the Year

Mitra Miller. Photo via LinkedIn

Mitra Miller is vice president of Houston Angel Network, a nonprofit organization dedicated to developing the innovation ecosystem by supporting founders and startups with financial resources and mentorship. She is also founder and chair of Eagle Investors, a nonprofit that teaches students about the investment and innovation community, and she serves as an active mentor for numerous Houston organizations.

"Houston has the most friendly, open, collaborative, and inclusive innovation environment anywhere," Miller said. "When I ask individuals and organizations to partner on events and initiatives, they readily agree and give freely of their time and resources. There is a generosity of spirit that is very special to Houston."

Juliana Garaizar, 2024 Investor of the Year

Juliana Garaizar. Photo courtesy of Juliana Garaizar

Juliana Garaizar is founding partner of Houston energy and carbontech ecosystem builder Energy Tech Nexus. "A hands-on investor," Garaizar invests in Houston and beyond with groups such as Portfolia, Houston Angel Network, Business Angel Minority Association, and more.

"Houston has the talent, the corporations, and the great intersection of industries where innovations happen: energy, medical, and space," she said. "Houston knows how to do hard things. We are doers, and we know how to build on our key strengths and are resilient when things don't go according to plan."

Anwar Sadek, Corrolytics, 2024 Minority-founded Business of the Year and Startup of the Year

Anwar Sadek. Courtesy photo

Anwar Sadek is CEO and co-founder of Corrolytics, a technology startup that aims to solve microbiologically influenced corrosion problems for industrial assets. In 2023, Sadek made the bold decision to relocate his startup, which was founded in Ohio, to Houston. It was the winner of two Houston Innovation Awards last year.

"Houston is the energy capital of the world. For the technology we are developing, it is the most strategic move for us to be in this ecosystem and in this city," Sadek said.

Remington Tonar, Cart.com, 2024 Scaleup of the Year

Remington Tonar. Courtesy photo

Remington Tonar is co-founder of Cart.com, a unified commerce and logistics solutions provider for B2C and B2B companies. Founded in Houston in 2020 by CEO/co-founder Omair Tariq and Tonar, Cart.com relocated to Austin in 2021, before returning to its roots and reestablishing its Houston headquarters in late 2023. The fast-growing e-commerce platform was then named Scaleup of the Year in the 2024 Houston Innovation Awards.

"When we think about Houston, we think about access to at-scale infrastructure, amenities, and workforce and talent pools," Tonar said, in regards to the relocation.

Laura Furr Mericas, Interim Editor, InnovationMap

Laura Furr Mericas is interim editor for InnovatonMap.com and EnergyCapitalHTX.com. She is a longtime contributor to both sites and has reported on Houston's innovation ecosystem for InnovationMap since 2020. Previously, she served as web editor and data reporter for Houston Business Journal.

Natalie Harms, Inaugural Editor, InnovationMap

Natalie Harms is the inaugural editor of InnovationMap.com, spearheading its launch in 2018 and shepherding its growth through 2024, as well as overseeing sister site, EnergyCapitalHTX.com. Prior to InnovationMap, Harms was associate editor for Houston Business Journal. She now covers the hotel and tourism industry as a reporter for Hotel News Now.

- 2024 Houston Innovation Awards winners named at annual event ›

- Nominate top innovators for the 2025 Houston Innovation Awards by Aug. 31 ›

- 2025 Houston Innovation Awards finalists: Energy Transition - InnovationMap ›

- 2025 Houston Innovation Awards finalists: Scaleup of the Year - InnovationMap ›

- Buy tickets to the Houston Innovation Awards on Nov. 13 2025 - InnovationMap ›

- 2025 Houston Innovation Awards finalists: Health Tech Business - InnovationMap ›

- 2025 Houston Innovation Awards finalists for Mentor of Year - InnovationMap ›

- 2025 Houston Innovation Awards winners revealed - InnovationMap ›