Editor's note: This week's top trending stories are those of entrepreneurship — a cryotherapy chain and a fitness-focused app, both born here with big growth plans — and opportunities — a biotech company expanding overseas and networking events to attend. Here's what InnovationMap readers were reading this week.

Houston-based cryotherapy chain grows its national presence

Houston-based iCRYO has a few Texas franchise locations expected to open in 2019,and more coming nationwide. Courtesy of iCRYO.

A Houston entrepreneur has taken his cryotherapy and wellness brand and franchised it from its origin in League City to upstate New York. But, that's only the beginning. The brand, iCRYO, currently has four locations in the Houston area and one in New York, and has four more coming to the Dallas-Fort Worth area, Austin, and another upstate New York location. But that's only the start, says co-founder and COO, Kyle Jones. To read the full story, click here.

Houston biotech company plans expansion into Saudi Arabian market

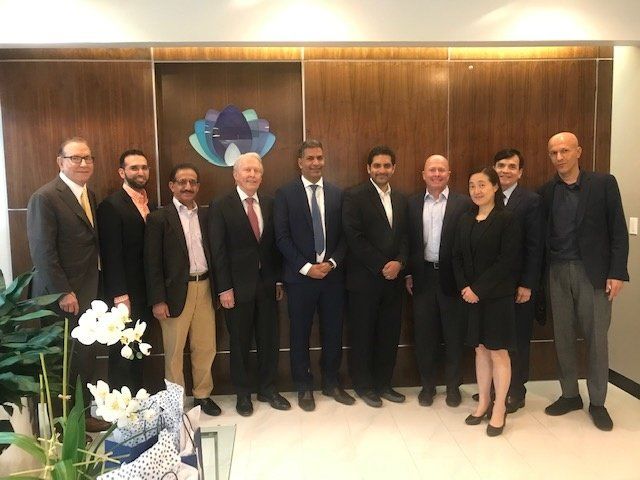

Saudi Arabian representatives met at Houston-based Celltex Therapeutics Corp.'s office earlier this month to finalize a memorandum of understanding. Courtesy of Celltex

A Houston company that uses stem cell technology to treat patients suffering from degenerative diseases is taking its patented technology to another continent. Celltex Therapeutics Corp. has entered a memorandum of understanding with Saudi Arabia's Research Products Development Company. As a part of the partnership solidified by the MOU, Celltex will open an office in Riyadh, Saudi Arabia, later this year. The new office will aid the commercialization of Celltex's technology and expand the company's presence to Saudi Arabia. To read the full story, click here.

Houston entrepreneurs aim to connect fitness fiends around the city through a mobile app and curated events

Through the Houston-based Muvve app, fitness fans can meet each other on the app or at curated events around town. Courtesy of Muvve

When Avi Ravishankar decided to train for a marathon in high school, he wanted to find a training buddy. He got lucky, and one found him: his classmate, Julian Se, took on the task. Usually, finding fitness friends and training buddies isn't that easy — especially in a huge, spread out city of Houston. Ravishankar and Se turned their friendship into a business partnership to solve this problem. Houston-based Muvve is a mobile app that's mission is to connect fellow fitness enthusiasts across the city. The two came up with the idea as a way to merge their passions. To read the full story, click here.

10 can't-miss Houston business and innovation events for March

From startup competitions to thought-provoking panels, here's where you need to be in March. Getty Images

Rodeo has kicked off and spring break is around the corner, which can only mean one thing: March in Houston. The month is chock full of business, entrepreneurial, and innovation-focused events, but we've plucked out 10 to highlight this month. To read the full story, click here.

4 health-focused Houston innovators to know this week

From cryotherapy and NASA-inspired fitness to startup funding and biotech, this week's innovators to know are raising the bar on health tech and innovation. Courtesy photos

This week's innovators to know are focused on health and wellness, from a Houston-based cryotherapy franchise to the person behind funding medical device and digital health startups. We couldn't narrow these folks down to the usual three, so here are the four Houston innovators to know as we start the last week in February. To read the full story, click here.