Houston named top city for female entrepreneurs, 2 local startups collaborate, and more innovation news

Short stories

Houston's innovation ecosystem has been booming with news, and it's likely some might have fallen through the cracks.

For this roundup of short stories within Houston innovation, Houston is recognized for its female-friendly business community, Texas ranks as top for gig economy, the latest Chevron investment is in nuclear energy, and more.

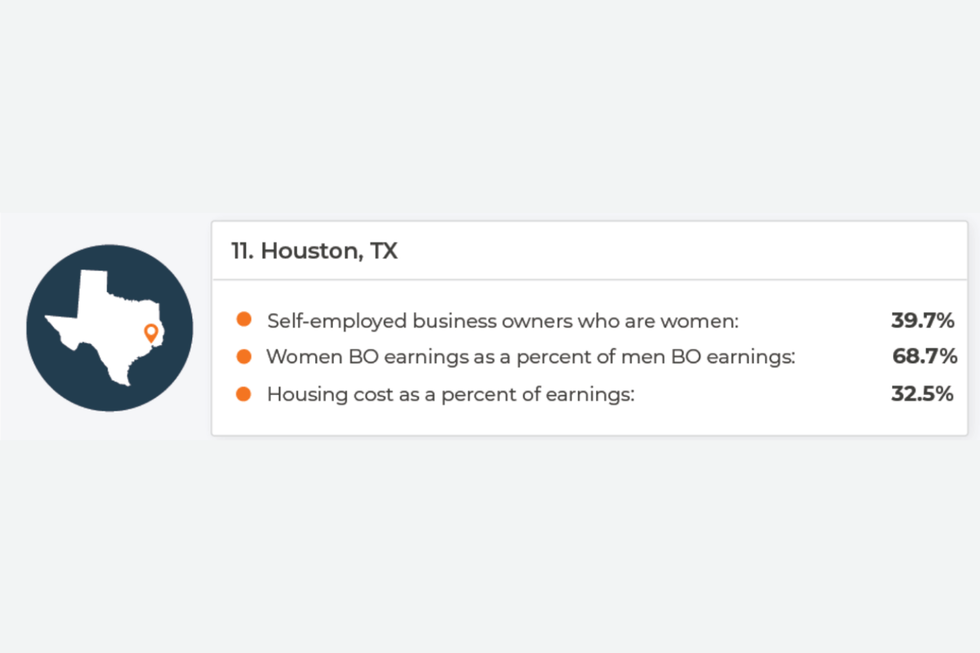

Houston named among top cities for female entrepreneurs

Houston ranked No. 11 on a new study on top cities for female business owners. Via fundera.com

According to a new study from Fundera, Houston ranks among the top 15 cities for female entrepreneurs in the United States. The Bayou City came in at No. 11 based on data pulled from The American Community Survey from the U.S. Census Bureau as well as the Tax Foundation. Metrics included:

- Percent of self-employed business owners who are women — 18 percent of total score.

- Percent of women employed in their own business — 18 percent of total score.

- Earnings gap between male and female business owners — 18 percent of total score.

- Housing cost as a percent of earnings for female entrepreneurs — 18 percent of total score.

- Percent of residents with bachelor's degree, denoting high-skilled workforce — 9 percent of total score.

- Job growth — 9 percent of total score.

- Tax rates — 9 percent of total score.

"One of the most diverse cities in the country, Houston is also good to its women entrepreneur population," the study reads. "Its biggest strength here, however, may be in its job growth numbers, which were likely impacted by 2020's coronavirus pandemic. It remains to be seen whether the city's strong economic numbers will continue in the years to come."

Lubbock, the only other Texas city to crack the top 15, came in at No. 13.

Galen Data and Zibrio team up with new partnership

A Houston company's balance tracking technology is tapping into another Houston company's cloud technology. Photo courtesy of Zibrio

Houston-based tech companies, Galen Data and Zibrio, have announced a new medical device partnership. Zibrio's SmartScale, which can measure and track physical balance to identify an person's chance of falling, will be able to leverage the Galen CloudTM in order to securely connect data from the device with a patient's physician to support remote patient care.

"Our partnership with Zibrio is a case study in helping an early stage medical device company focus on what they do best," says Galen Data CEO Chris DuPont in a news release. "Galen Data provided outside expertise that has saved Zibrio the needless cost and burden of designing a cloud solution from scratch."

According to the release, the CDC reports that 28 percent of individuals over 65 fall each year, and falls are the leading cause of accidental death in those over 65. Amid the pandemic, the Australian PT Association found an increase in fall right of up to 30 percent.

"With COVID-19 impacting activities of older adults, it was even more critical to find a cost-effective solution to better track, manage, and analyze balance data from our SmartScale," says Zibrio founder and CEO, Katharine Forth, in the release.

IGNITE Madness startup applications close Sept. 4

Ignite Healthcare Network, a health tech startup group that promotes and advances female entrepreneurs, is closing startup applications for its October 22 and 29 event, Ignite Madness. The competition mimics a March Madness-style bracket and will be judged by 10 judges.

The brackets include:

- Mental /Behavioral Health

- Telemedicine/Remote Patient Monitoring

- Medical Devices

- Patient Engagement

- Employee Wellness

- Population Health/Analytics

- Femtech/Women's Health

- WILDCARD: Other Disruptive Solutions

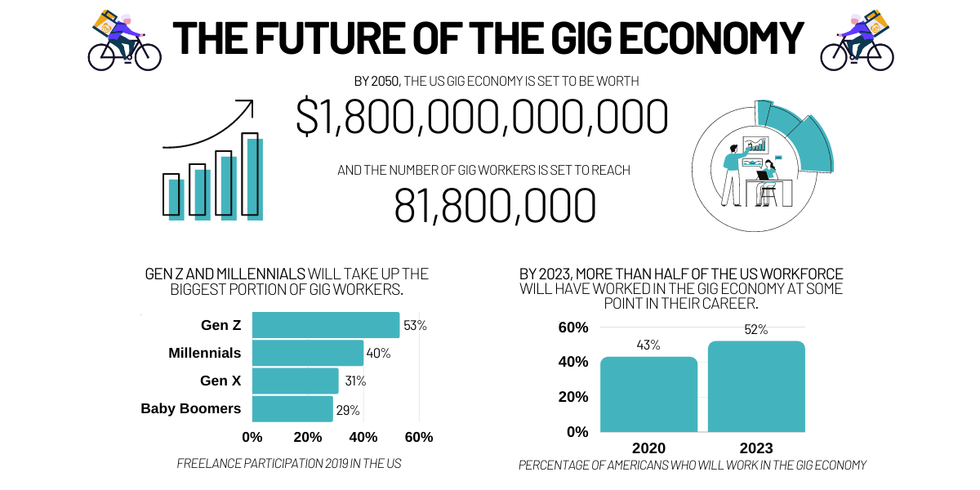

Texas named the 6th best state for freelance and gig workers

Gig workers are welcome in Texas. Screenshot via directlyapply.com

A job discovery platform, DirectlyApply, has identified the best gig economies to work in and Texas ranked as No. 6. The study looked at nine cost and job opportunity factors, which included the cost of living, the number of restaurants and attractions, the number of advertised gig roles, etc.

Texas has a reported 4,859 gig jobs and 16 gig companies operating locally, and the state sports an average gas price of $0.63 a liter and $1,422 a month to rent an apartment. New York, Florida, California, Ohio, and Illinois ranked ahead of Texas, respectively. The full study is available online.

Adapt2 Solutions recognized with award

Jason Kram is the executive vice president of Adapt2 Solutions. Photo courtesy of Adapt2 Solutions

Houston AI software company, Adapt2 Solutions, has been selected as the winner of the "Best AI Solution for Big Data" award in the 2020 AI Breakthrough Awards program conducted by AI Breakthrough. The awards recognize artificial intelligence and machine learning innovation. This year, the contest saw more than 2,750 nominations from over 15 different countries throughout the world, according to a news release.

"Energy enterprises are dealing with an increasingly complex and ever-changing landscape, including increased renewables, volatile markets, and increased pace of technology innovation for each of the commodity market," says James Johnson, managing director of AI Breakthrough, in the release.

"Adapt2 Solutions is in a unique position to support energy companies with powerful artificial intelligence technology to help their operations to automate, optimize and maintain a competitive advantage. We want to recognize this achievement by awarding them with 'Best AI Solution for Big Data' and we extend a hearty congratulations to the entire Adapt2 team on their well-deserved industry recognition."

The win comes at a strategic time for the company. Adapt2's predictive analytics models forecast unexpected fluctuations in power capacity. Amid the pandemic, this technology enables energy companies to map out demand at a time when they're balancing strained revenue and squeezed spending is paramount, Executive Vice President Jason Kram previously told InnovationMap.

"In times of disruption, big data can inform decision-making for energy companies to optimize energy-market operations with timely and reliable data," Kram says.

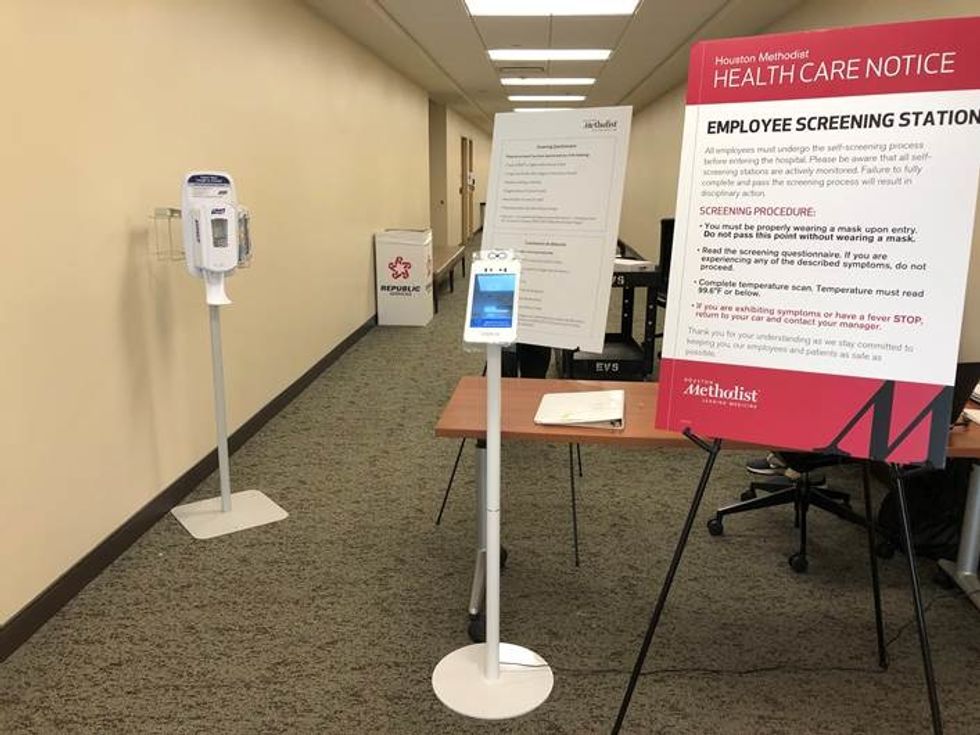

Houston Methodist introduces contactless temperature screening

Houston Methodist has set up over a hundred contactless temp checks across its facilities. Photo courtesy of Houston Methodist

Houston Methodist has incorporated new technology from care.ai, an AI-powered temperature monitoring platform, to conduct contactless temperature checks for visitors across 100 locations throughout eight hospitals and 36 physician clinics.

Upon entrance to designated areas, visitors stand in front of a tablet that scans an individual's temperature through the use of thermal technology aimed at the forehead. The technology aims to speed up screening measures and free up staff from the checkpoints. Should a visitor have an elevated skin temperature out of normal range, Methodist staff is contacted.

Chevron invests in nuclear fusion startup

The latest investment from CTV is in nuclear energy. Photo via chevron.com/technology/technology-ventures

Chevron's investment arm, Chevron Technology Ventures, recently announced an investment in Seattle-based Zap Energy Inc., which is working on a modular nuclear reactor. CTV sees nuclear energy as a promising avenue for innovation "across the globe access to affordable, reliable, and ever-cleaner energy," according to a news release.

"We see fusion technology as a promising low-carbon future energy source," says Barbara Burger, president of CTV, in a release. "Our Future Energy Fund investment in Zap Energy adds to Chevron's portfolio of companies we believe are likely to have a role in the energy transition."

This Series A investment is the 10th for Chevron's Future Energy Fund, which focuses on investments in companies that enable macro decarbonization, the mobility-energy nexus, and energy decentralization.

"Our Future Energy Fund investments provide us with strategic insight into power generation markets and potentially disruptive impacts of innovative approaches, like fusion, geothermal, wind, and solar, on the conventional power value chain," says Burger.