Houston firm scores 2 grants to support testing treatment for addiction, neurodegenerative diseases

money moves

A Houston organization devoted to developing early-stage therapeutic and medical device technologies announced fresh funding for one of its startups.

Fannin Partners' Goldenrod Therapeutics, received a $320,000 Phase I SBIR grant from the National Institute on Drug Abuse (NIDA) for studies regarding both addiction medicine and neurodegenerative diseases with a single lead candidate, called 11h.

The grant will fund studies in rodent models of methamphetamine addiction and the efficacy of 11h for the tiny patients. This is the next step in charting the established promise of 11h in substance use disorders using animal models. Existing therapies for opioid and alcohol addiction have high relapse rates, and there are currently no FDA-approved medications for Stimulant Use Disorders (StUDs).

Previous preclinical studies demonstrated that 11h was effective in the fight against cocaine addiction. The goal is to note similar results in methamphetamine addiction.

At the same time, Fannin was also granted a $250,000 Early Hypothesis Development Award from the Department of Defense (DoD) to study 11h in neurodegenerative diseases. Specifically, the funds will be used to work on rodent models of multiple sclerosis (MS).

Fannin’s goal is to develop an oral medication that slows or reverses the progression of MS, while also improving the patient’s quality of life by relieving symptoms. Many MS medications come with the threat of liver injury and increased risk of infection, so sidestepping those is also a hope for 11h.

In fact, 11h was developed to minimize the toxicities associated with existing PDE4 inhibitors. Early evidence shows that the drug is not only effective, but also safe and easily tolerable.

“NIDA’s continued support of our SUD program highlights the potential of 11h to significantly improve the standard of care for patients suffering from these conditions, some of which lack any approved pharmaceutical options," says Dr. Atul Varadhachary, managing partner at Fannin, in a news release. “The additional DoD funding will allow us to explore 11h’s impact on neurodegenerative disease, as well. We are grateful for the support from both organizations as we advance 11h towards clinical development.”

Previous steps in 11h’s development were funded by a $350,000 Phase I SBIR grant from NIDA. 11h is part of NIDA’s Addiction Treatment Discovery Program. Next year, Fannin will likely scale up Good Manufacturing Practices (GMP) production and complete toxicology studies. This will lead to clinical trials for 11h for cocaine use disorder and other StUDs. But don’t expect Fannin to be quiet for long. Its next big discovery is always on the horizon.

- Top innovation leaders talk Houston's strengths, weaknesses ›

- Early-stage cancer-fighting startup raises pre-seed, launches under Houston life science leader ›

- Houston biotech commercialization company tapped for prestigious federal program ›

- Exclusive: 2 Houston health care institutions team up to develop cancer-fighting treatments ›

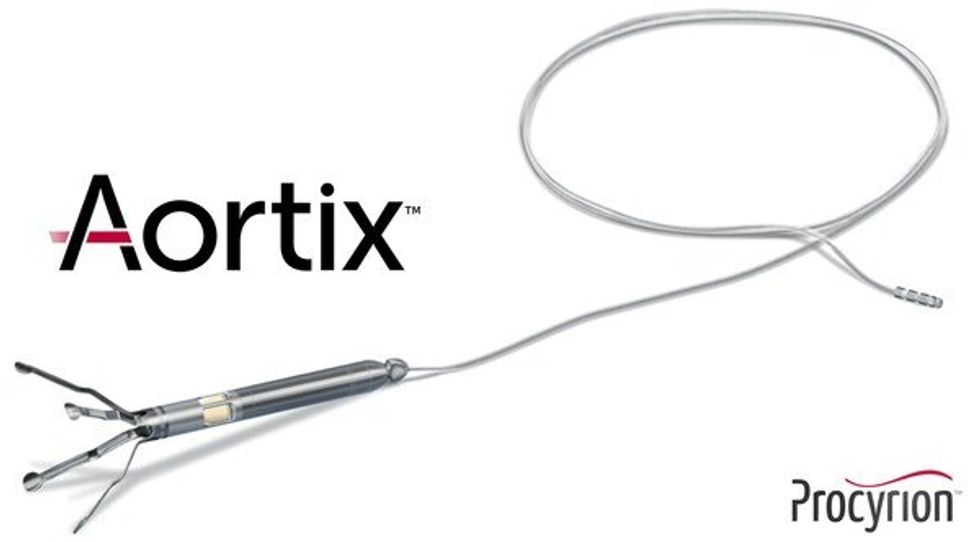

Aortix is a pump designed to be placed in the descending thoracic aorta of heart failure patients. Photo via Procyrion

Aortix is a pump designed to be placed in the descending thoracic aorta of heart failure patients. Photo via Procyrion

Apple doubles down on Houston with new production facility, training center Photo courtesy Apple.

Apple doubles down on Houston with new production facility, training center Photo courtesy Apple.