This week was the beginning of the end for 2019. InnovationMap published its last curated list of business and innovation events for the year, WeWork opened its newest location in town, and a Houston startup founder shared her rollercoaster story of failure and next chapter.

Scroll through to see what Houston innovation stories trended this week.

3 Houston innovators to know this week

Get to know this week's Houston innovators to know — and the companies they've founded. Courtesy photos

This week's innovators to know are all Houston startup founders who have identified a need in their industries and created companies to provide solutions.

From blockchain and data to real estate and smart materials, these Houston entrepreneurs are making an impact across industries as well as the Houston innovation ecosystem. Continue reading.

Photos: WeWork opens 4th Houston location in Hines downtown trophy tower and plans expansion in the Galleria

WeWork opened the doors to its fourth Houston location. Courtesy of WeWork

WeWork has officially doubled down on its downtown presence in Houston. The coworking company has officially opened the doors of its space within Hines' trophy tower.

The coworking space makes up 50,000 square feet on two floors of 609 Main St. The 48-story building, which is owned and developed by Houston-based Hines, premiered on the downtown Houston skyline in 2017. Continue reading.

10+ can't-miss Houston business and innovation events for December

From startup competitions to thought-provoking panels, here's where you need to be in December. Getty Images

Before everyone checks out of 2019, Houston has a couple more weeks filled with exciting entrepreneurial networking opportunities. Scroll through the curated list of innovation events you can't miss. Continue reading.

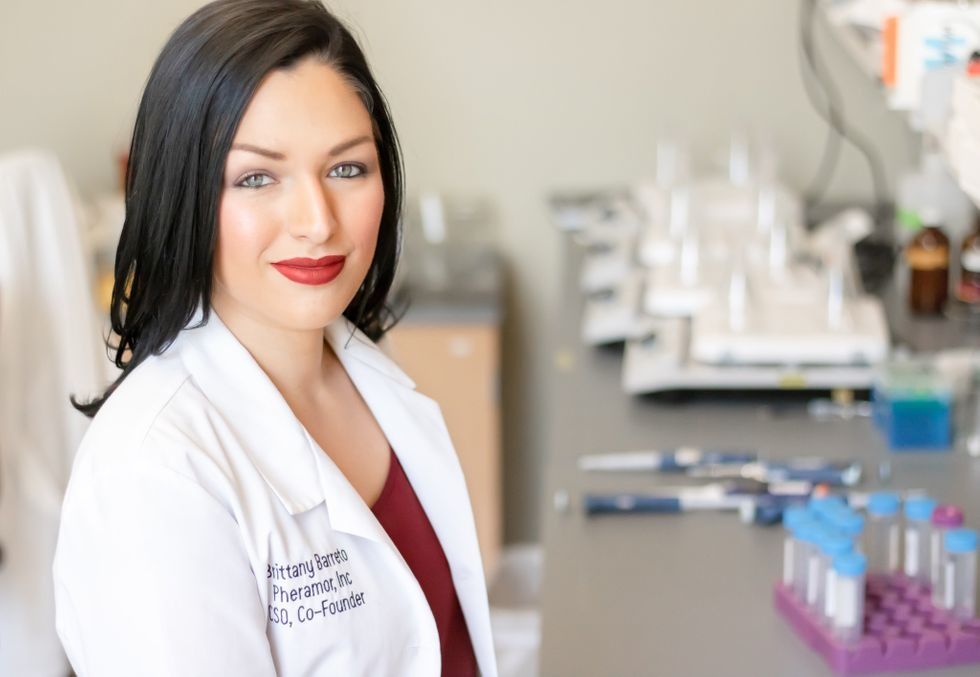

Exclusive: Promising Houston-born DNA dating startup shuts down; founder shares story

Brittany Barreto founded the first nationwide DNA-based dating app, and she shares her story of its unexpected, and unavoidable, downfall. Photo courtesy of Pheramor

When Brittany Baretto was 18 years old and sitting in an undergraduate genetics seminar, she raised her hand. She asked, to her professor's point, if particular DNA trait differences between two people can result in attraction, could she, based on that logic, make a DNA-based dating tool. With that question, she set in motion a series of events.

These events included teaming up with Bin Huang to start a dating app, called Pheramor, that factored in user DNA; raising millions for the company; hiring a team from across the country; and signing up users in all 50 states. Though, Pheramor's hockey stick growth came to a sudden stop this year when Apple pulled the app from its store, and there was nothing the founders or their investors could do about it. Continue reading.

TMC Innovation Institute leader breaks down how much the program has grown in Houston

From robots and accelerator programs to her favorite health tech startups, Emily Reiser of the TMC Innovation Institute joins the Houston Innovators Podcast. Photo courtesy of Emily Reiser

The Texas Medical Center's Innovation Institute has just celebrated five years of advancing new technologies within health care, and over the past year, the institute has evolved to set up the TMC for its next years of innovation.

"In 2019, we had a lot of big changes around our team and our leadership," says Emily Reiser, senior manager of innovation community engagement at TMC. "That enabled us to take a bigger breath and a bigger pause to say, 'How are we really doing? And how could we be doing better?'" Continue reading and listen to the episode.