Houston startups wrapped up the last few months of 2024 with big funding news — from several seeds and series As to series C rounds and extensions.

Here are 14 Houston startups that secured funding in the the last four months of last year, according to reporting by InnovationMap.

Citroniq Chemicals secures $12M series A (September)

Houston-based Citroniq Chemicals has secured its series A funding. Photo via Getty Images

A fresh $12 million round of funding will enable Houston-based Citroniq Chemicals to propel planning, design, and construction of its first decarbonization plant.

An unidentified multinational energy technology company led the series A round, with participation from Houston-based Lummus Technology Ventures and cooperation from the State of Nebraska. The Citroniq plant, which will produce green polypropylene, will be located in Nebraska.

“Lummus’ latest investment in Citroniq builds on this progress and strengthens our partnership, working together to lower carbon emissions in the plastics industry,” Leon de Bruyn, president and CEO of Lummus Technology, says in a news release. Read more.

MetOx raises $25M series B extension (September)

A Houston company has raised funding. Photo via Getty Images

A Houston company has closed its series B extension at $25 million.

MetOx International, which develops and manufactures high-temperature superconducting (HTS) wire, announced it closed a $25 million series B extension. Centaurus Capital, an energy-focused family office, and New System Ventures, a climate and energy transition-focused venture firm, led the round with participation from other investors.

"MetOx has developed a robust and highly scalable operation, and we are thrilled to partner with the Company as it enters this pivotal growth stage," says John Arnold, founder of Centaurus, in a news release. "The market for HTS is expanding at an unprecedented pace, with demand for HTS far outweighing supply. MetOx is poised to be the leading U.S. HTS producer, closing the supply gap and bringing dramatic capacity to high power innovations and applications. Their progress and potential are unmatched in the field, and we are proud to support their growth." Read more.

Utility Global's $53M series C investment (September)

Utility Global’s technology enables reduction of greenhouse gas emissions along with generation of low-carbon fuels and chemicals. Photo courtesy of Utility Global

Houston-based Utility Global, a maker of decarbonization-focused gas production technology, has raised $53 million in an ongoing series C round.

Among the participants in the round are Canada’s Ontario Power Generation Pension Plan, the XCarb Innovation Fund operated by Luxembourg-based steel company ArcelorMittal, Houston-based investment firm Ara Partners, and Saudi Aramco’s investment arm. Read more.

Bot Auto's $20M pre-series A (October)

The Investment is expected to help expand Bot Auto's tech development in autonomous trucking that will focus on safety and operation efficiency. Photo courtesy of Bot Auto

A Houston-based autonomous vehicle technology company has raised early funding.

Bot Auto has announced the completion of its pre-series A funding round which was oversubscribed and raised $20 million. The round was led by investments from Brightway Future Capital, Cherubic Ventures, EnvisionX Capital, First Star Ventures, Linear Capital, M31 Capital, Taihill Venture, Uphonest Capital, and Welight Capital.

“As true believers in autonomous trucking, we're thankful for our investors' shared vision,” Xiaodi Hou, founder and CEO of Bot Auto, says in a news release. “Our strong commitment, combined with recent AI advancements and a sharpened focus on operational efficiency, has created a clear path to commercialization.” Read more.

Mstack raises $40M series A (October)

Shreyans Chopra, founder of Mstack, is celebrating the close of his company's $40 million series A. Photo courtesy of Mstack

Houston-based Mstack, whose platform helps manufacturers source specialty chemicals, has raised $40 million in a series A funding round.

Lightspeed Venture Partners and Alpha Wave Incubation led the round, which includes a debt facility from HSBC Innovation Banking and money from several angel investors.

In a news release, Mstack says the infusion of cash will enable it to “double down on its mission to disrupt a historically flawed supply chain for specialty chemicals.” Read more.

DocJuris raises $8M series A (October)

DocJuris has raised a $8 million series A. Photo via Getty Images

Houston-based DocJuris, a leader in AI contract review, announced the successful closure of its series A funding round by raising $8 million in new capital. This brings the total capital raised to date to $11.2 million.

"DocJuris AI has become an industry-leading platform that empowers enterprise legal, procurement, and sales teams to close deals faster while reducing risk," DocJuris CEO and Founder Henal Patel says in a news release. "With this funding, we will continue scaffolding our platform around generative AI, expand our customer success team, and grow our user base." Read more.

Paladin lands $5.2M in seed funding (October)

Paladin’s AI-enhanced autonomous drones help public safety agencies, such as police and fire departments, respond to 911 calls. Photo via paladindrones.io

Houston-based Paladin, whose remotely controlled drones help first responders react quickly to emergencies, has collected $5.2 million in seed funding.

Gradient, a seed fund that backs AI-oriented startups, led the round. Also participating were Toyota Ventures, the early-stage VC arm of Japanese automaker Toyota; venture capital firm Khosla Ventures; and VC fund 1517.

“We believe Paladin will drive meaningful change in public safety and redefine how communities are served,” Gradient said in an announcement about the seed round. Read more.

March Biosciences' oversubscribed $28.4M series A (October)

March Biosciences' oversubscribed raise brought in $28.4 million of financing with Mission BioCapital and 4BIO Capital leading the pack of investors. Photo via Getty Images

An emerging biotech company in Houston has closed its series A with outsized success.

March Biosciences' oversubscribed raise brought in $28.4 million of financing with Mission BioCapital and 4BIO Capital leading the pack of investors. The company has now raised more than $51 million in total.

Last year, March Biosciences announced its strategic alliance with CTMC (Cell Therapy Manufacturing Center), a joint venture between MD Anderson Cancer Center and National Resilience. CEO Sarah Hein met her co-founder, Max Mamonkin, at the TMC Accelerator for Cancer Therapeutics. Along with fellow co-founder Malcolm Brenner, March Biosciences launched from the Center for Cell and Gene Therapy (Baylor College of Medicine, Houston Methodist Hospital and Texas Children’s Hospital). Its goal is to fight cancers that have been unresponsive to existing immunotherapies using its lead asset, MB-105. Read more.

CrossBridge Bio closes $10M seed round (November)

CrossBridge Bio, formed during the TMC Innovation’s Accelerator for Cancer Therapeutics program, closed a $10 million seed round led by TMC Venture Fund and CE-Ventures. Photo via Getty Images

A Houston biotech company based off research out of UTHealth Houston has raised seed funding to continue developing its cancer-fighting therapeutic.

CrossBridge Bio, formed during the TMC Innovation’s Accelerator for Cancer Therapeutics program, closed a $10 million seed round led by TMC Venture Fund and Crescent Enterprises' VC arm, CE-Ventures. The round also included participation from Portal Innovations, Alexandria Venture Investments, Linden Lake Labs, and several pre-seed investors.

“We are thrilled to have the support of such experienced investors who share our vision of bringing transformative cancer therapies to patients in need,” Michael Torres, CEO of CrossBridge Bio, says in a news release. Torres served as an entrepreneur in residence of ACT. Read more.

Helix Earth closes $5.6M in seed funding (November)

Helix Earth's technology is estimated to save up to half of the net energy used in commercial air conditioning, reducing both emissions and costs for operators. Photo via Getty Images

A Houston startup with clean tech originating out of NASA has secured millions in funding.

Helix Earth Technologies closed an oversubscribed $5.6 million seed funding led by Houston-based research and investment firm Veriten. Anthropocene Ventures, Semilla Capital, and others including individual investors also participated in the round.

“This investment will empower the Helix Earth team to accelerate the development and deployment of our first groundbreaking hardware technology designed to disrupt a significant portion of the commercial air conditioning market, an industry that is ready for innovation,” Rawand Rasheed, Helix Earth co-founder and CEO, says in a news release. Read more.

Fervo Energy's $255M in additional funding (December)

The deal brings Fervo's total funding secured this year to around $600 million. Photo courtesy of Fervo

A Houston company that's responding to rising energy demand by harnessing geothermal energy through its technology has again secured millions in funding. The deal brings Fervo's total funding secured this year to around $600 million.

Fervo Energy announced that it has raised $255 million in new funding and capital availability. The $135 million corporate equity round was led by Capricorn’s Technology Impact Fund II with participating investors including Breakthrough Energy Ventures, CalSTRS, Congruent Ventures, CPP Investments, DCVC, Devon Energy, Galvanize Climate Solutions, Liberty Mutual Investments, Mercuria, and Sabanci Climate Ventures.

Additionally, Fervo secured a $120 million letter of credit and term loan facility from Mercuria, an independent energy and commodity group that previously invested in the company.

The funding will go toward supporting Fervo's ongoing and future geothermal projects. Read more.

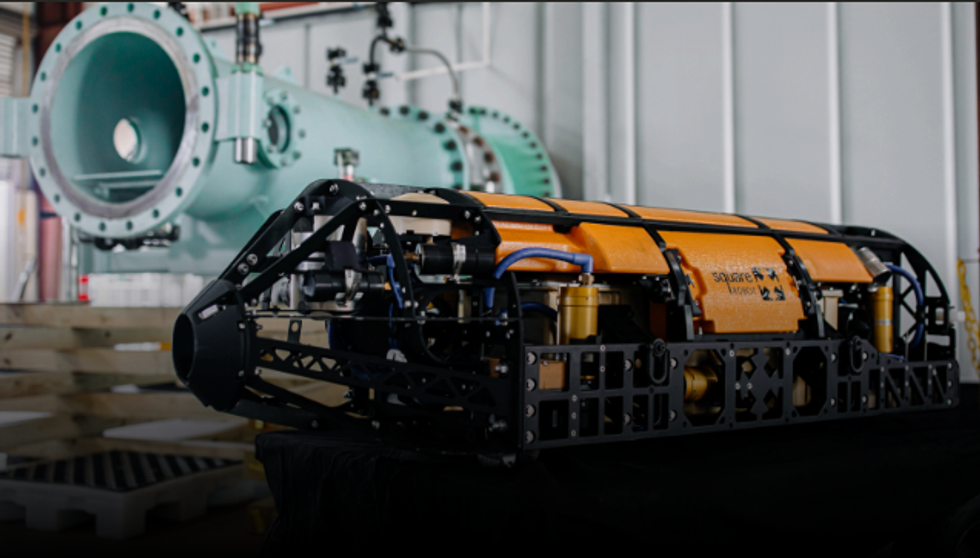

Square Robot closes series B after year of growth (December)

The advanced submersible robotics company will put the funds toward international expansion. Photo courtesy of Square Robot

Houston- and Boston-based Square Robot Inc. closed a series B round of funding last month.

The advanced submersible robotics company raised $13 million, according to Tracxn.com, and says it will put the funds toward international expansion.

"This Series B round, our largest to date, enables us to accelerate our growth plans and meet the surging global demand for our services,” David Lamont, CEO, said in a statement. Read more.

Indapta Therapeutics secures $22.5M (December)

Houston- and Seattle-based Indapta Therapeutics has fresh funding to grow its cancer-fighting cell therapy. Photo via Getty Images

A promising cell therapy company has raised its latest funding round — to the tune of $22.5 million.

Indapta Therapeutics, which has a dual headquarters in Houston and Seattle, is a clinical stage biotechnology and next-generation cell therapy company focused on the treatment of cancer and autoimmune diseases. The company announced it has closed a $22.5 million round of new financing to accelerate the clinical development of its differentiated allogeneic Natural Killer cell therapy.

"This funding will enable us to generate significant additional data in our ongoing trial of IDP-023 in cancer as well as initial data from our first trial in autoimmune disease," Mark Frohlich, Indapta’s CEO, says in a news release. Read more.

SmartAC.com's latest round (December)

Houston-based Mercury backed SmartAC.com in a follow-on round. Photo via of SmartAC.com

Houston-based SmartAC.com, which provides a customer loyalty management platform for contractors, has raised a follow-on round from Mercury Fund and other investors. The dollar amount of the round wasn’t disclosed.

An October filing with the U.S. Securities and Exchange Commission (SEC) indicates SmartAC.com planned to raise $8.2 million in venture capital. Of that sum, about $4 million had already been raised, the company reported, and nearly $4.2 million remained to be raised.

SmartAC.com's platform enables contractors in the HVAC and plumbing industries monitor, manage, and optimize their maintenance memberships through advanced sensors, AI-driven diagnostics, and proactive alerts. Read more.

Mark Frohlich is the CEO of the Houston- and Seattle-based company. Photo courtesy of Indapta Therapeutics

Mark Frohlich is the CEO of the Houston- and Seattle-based company. Photo courtesy of Indapta Therapeutics