short stories

Houston hospital doles out DEI funds, investors join prestigious programs, and more local innovation news

Houston's summer has been heating up in terms of innovation news, and there might be some headlines you may have missed.

In this roundup of short stories within Houston startups and tech, Houston investors were tapped for impressive roles, a local hospital system has invested in the city's diversity and inclusion, and more.

Houston Methodist awards more than $4.6 million for 2022 DEI Grant program

Ryane Jackson, vice-president, community benefits at Houston Methodist, oversees the grant program. Photo courtesy of Houston Methodist

Houston Methodist announced grants to 59 Houston-area nonprofit organizations totalling more than $4.6 million thanks to the Houston Methodist Diversity, Equity & Inclusion Grant Program. The program supports "community initiatives focused on addressing the social determinants of health that lead to health inequities within racial, ethnic and social minorities, including women, people experiencing homelessness, older adults, the LGBTQ+ community, immigrants and more," per a news release.

It's the second year for the DEI Grant Program, and the latest donations will support more than 100,000 people in the Houston area through 29 healthy neighborhood programs, 16 economic empowerment programs, and 17 educational empowerment programs.

“It’s incredibly encouraging to see so many local non-profit organizations working to close the health and social disparity gaps that exist among minority groups in the Houston area,” says Ryane Jackson, vice-president, community benefits at Houston Methodist, in the release. “The goal of the Houston Methodist DEI grant program is to enact meaningful change. For us, that change entails working together with local charity agencies in our collective pursuit to build a healthier Houston that reaffirms the value and worth of everyone. Entering our second year of funding, we’re pleased to support even more local organizations this year who are critical in shaping our community.”

The program has two types of grant funding — the Social Equity Grant for health equity programs targeting racial and ethnic minorities, and the DEI Grant, which provides resources for operating growing agencies serving broader minority communities.

Some examples of the grants are:

- DEI Grant to the The Montrose Center, which empowers the LGBTQ+ community and their families to live healthier, more fulfilling lives. DEI grant funds will benefit LGBTQ+ seniors and African American seniors from Third Ward in need of affordable and affirmative housing and will enable the hiring of a case manager to support the initiative.

- DEI Grant tp the Santa Maria Hostel, which offers a comprehensive continuum of care for women and their families including residential detoxification, substance use disorder treatment for women, and emergency and transitional housing. DEI Grant funding will support the Recovery Support Services Program that assists formerly incarcerated women with housing and economic stability through salary support for Peer Recovery Coaches. This agency is the only recovery agency that allows women to keep their children with them while going through the program.

- Social Equity Grant to Boat People SOS - Houston, a nonprofit social and legal services provider whose purpose is to empower, organize, and equip immigrant communities in their pursuit of liberty and dignity. The Houston Methodist Social Equity grant funding will support their senior services program designed to address social support needs and provide resources to Vietnamese seniors.

2 Mercury investors named to prestigious programs

Samantha Lewis and Aziz Gilani of Mercury have each received exciting appointments. Photos via Mercury

Houston-based venture capital firm has two employees to celebrate. Samantha Lewis, principal at Mercury, was announced as a member of the Class 27 of the Kauffman Fellows Program, a group of global innovation investors, just after Aziz Gilani, managing director at the firm, was appointed to the National Advisory Council on Innovation and Entrepreneurship, a Federal advisory committee that advises the United States Secretary of Commerce.

For Lewis, the appointment enrolls her in the two-year program, which is described as "a United Nations of venture investing," in a news release. She joins a network of 765 fellows — including 59 in the current cohort — spanning six continents and representing over 670 VC firms around the globe.

At NACIE, Gilani was one of 32 leaders appointed by U.S. Secretary of Commerce Gina M. Raimondo last month. The group, according to a news release, will be tasked with "developing a National Entrepreneurship Strategy that strengthens America’s ability to compete and win as the world’s leading startup nation and as the world’s leading innovator in critical emerging technologies."

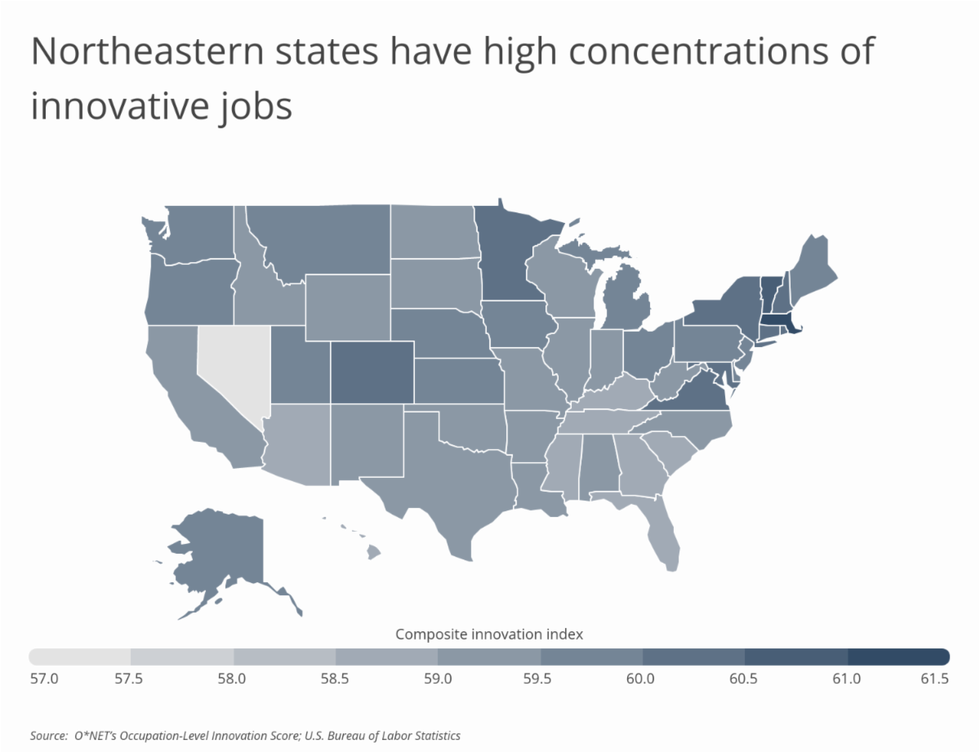

Texas ranks as middle of the pack when it comes to innovative states

Texas ranks in the lower half of the nation when it comes to innovation jobs. Chart via Smartest Dollar

The Lone Star State was named the 30th most innovative state, according to a new report from Smartest Dollar. The report evaluated data from 350 metros and all 50 states and sought to identify the locations with the most innovative workers. Researchers calculated a composite innovation index for each location and ranked states accordingly.

Here is a summary of the data for Texas, according to the report:

- Composite innovation index: 59.30

- Share of workers in the most innovative jobs: 2.6 percent

- Total workers in the most innovative jobs: 322,910

- Average annual wage for all workers: $54,230

- Average annual wage for workers in the most innovative jobs: $77,098

Here are the statistics for the entire United States:

- Composite innovation index: 59.53

- Share of workers in the most innovative jobs: 3.1 percent

- Total workers in the most innovative jobs: 4,428,790

- Average annual wage for all workers: $58,260

- Average annual wage for workers in the most innovative jobs: $86,562

Applications are open for pitch competition

A new pitch competition is looking for finalists. Photo via Getty Images

Applications are now open for the Black Girl Ventures x Omaze Houston pitch competition. The deadline to submit is July 1.

This fall, seven finalists will pitch their businesses to a panel of judges, and the first place winner will win $10,000. Second and third place winners will receive $6,000 and $2,000, respectively. Capital One will match funds, effectively doubling the prize money for the top three finalists.

Eligibility includes Black and Brown woman-identifying founders with revenue-generating (under $1 million) businesses. Founders can submit their applications online. Finalists will be notified on July 18.

Black Girl Ventures has been active in Houston since 2020. According to the organization, the region has six Change Agents, or fellows, who work to strengthen and expand the local entrepreneurial ecosystem.

Houston startup joins national 5G accelerator cohort

Houston startup joins a cohort of companies changing the future of 5G. Photo via Getty Images

A Houston company has been named to a new 5G-focused accelerator program. The gBETA 5G Technology Spring 2022 cohort includes Houston-based Ohana. Using advertising revenue, the company brings free access to information and connectivity to the world and is planning to roll out a 5G smartphone and data plan free to users across the globe later this year.

gBETA, which has an industry agnostic cohort ongoing in Houston, also has this 5G-focuset version that follows a similar structure. The five companies will go through the free, seven-week accelerator — that kicked off May 5 — and receive intensive and individualized coaching and access to gener8tor’s national network of mentors, customers, corporate partners, and investors.

The program will culminate with the gener8tor Showcase Day in the fall, which will highlight each of the five companies.

“We’re so fortunate to have such a diverse set of founders from across the country, with expertise across the internet technology and communications continuum,” says Doug Applegate, gBETA director for the 5G Technology program. “They highlight the capabilities and possibilities of what 5G Technology can bring to the world, and we’re excited to see how the companies grow.”

The other companies include Chicago-based Socian Technologies, Fishers, Indiana-based Qumulex Boston-based Mentore, and Dallas-based Taubyte.