what's trending

5 most popular innovation stories in Houston this week

Editor's note: Another week has come and gone, and it's time to round up the top headlines from the past few days. Trending Houston tech and startup news on InnovationMap included innovators to know, a guest column with startup cash flow tips, and more.

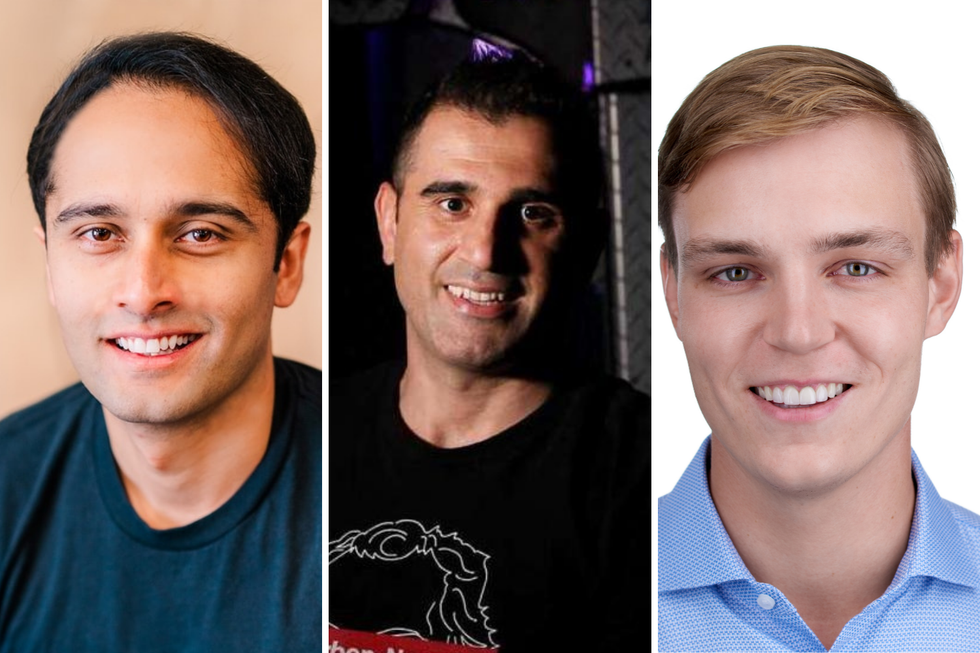

3 Houston innovators with fresh funds to know this week

This week's roundup of Houston innovators includes three founders celebrating recent funding — Omair Tariq of Cart.com, Moji Karimi of Cemvita Factory, and Moody Heard of Buildforce. Courtesy photos

In this week's roundup of Houston innovators to know, I'm introducing you to three local innovators across industries — who each recently announced new funding — recently making headlines in Houston innovation. Click here to continue reading.

Fortune 100 company moves materials tech biz HQ to Houston

Honeywell has once again bet on the Bayou City for business. Photo courtesy of Parkway

A nearly $10 billion division of Honeywell International that primarily caters to the oil and gas industry has moved its headquarters to Houston.

On August 11, Charlotte, North Carolina-based Honeywell announced its Performance Materials and Technologies (PMT) division had completed its relocation to the Westchase area's nearly 1.5 million-square-foot CityWestPlace office complex where the company already has operations.

PMT joins one its units, Honeywell's Process Solutions business, at CityWestPlace. The Process Solutions business and about 750 employees relocated there from 1250 Sam Houston Parkway South in 2019. Click here to continue reading.

4 ways Houston businesses can recover cash flow in a post-COVID world

There's no quick fix to getting back to where you were, but a keen eye and sensible decision-making will ensure you're more prepared than your competitors. Photo via Unsplash

The COVID-19 pandemic has been a cash flow disaster for many businesses, whether it's small restaurants forced to close their doors for months on end or commercial rental properties unable to fill their office space in light of widespread remote working.

Houston, much like many major US cities is facing a big recovery job as the country looks to move on from the worst of the pandemic. While much is to be determined when it comes to what the Delta varient's effect is, businesses are open and the time to think creatively about recovering cash flow is here.

In this article, we'll look at how Houston businesses can get over what was a huge shock and re-evaluate for a post-COVID world. Click here to continue reading.Houston construction tech company raises $4M round

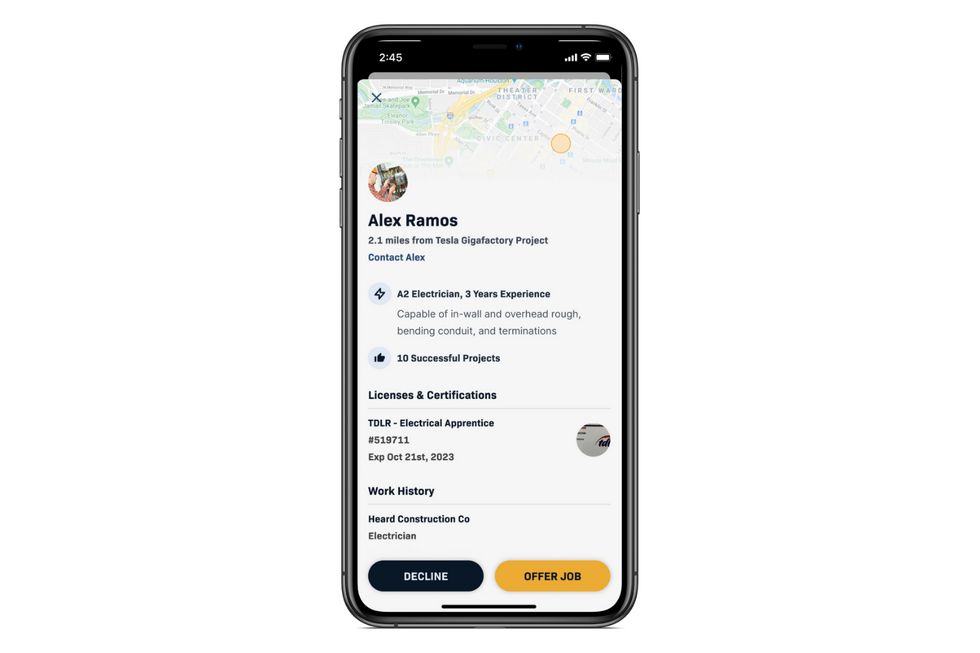

Buildforce is an app that can connect contractors with construction experts. Photo courtesy of Buildforce

A locally founded company that's focusing on changing the construction labor game has raised a round of institutional funding.

Buildforce, which splits its headquarters between Houston and Austin, closed its latest round of funding at $4 million. The round was led by Maryland-based TDF Ventures, with participation from existing investor Houston-based Mercury Fund and Austin-based S3 Ventures.

The company uses construction staffing and management software to more efficiently connect contractors to skilled workers across trades — electrical, mechanical, plumbing, flooring, concrete, painting, and more. Click here to continue reading.

Houston digital health platform raises $1.2M seed round

DocSpace was founded by Chief Product Officer Miles Montes (left) and CEO Mario Amaro, a physician and U.S. Navy Veteran. Photo courtesy of DocSpace

A Houston-based software company providing clinicians a turn-key platform for their practice has announced the close of its seed funding round.

DocSpace raised $1.2 million in seed funding led by Slauson & Co. with participation by Precursor Ventures, Acrew Capital's Scout Fund, and SputnikATX Ventures. The company's angel investors Nathan and Sonia Baschez, Nikhil Krishnan, and Eliana Murillo. The company was founded by CEO Mario Amaro, a physician and U.S. Navy Veteran, and Chief Product Officer Miles Montes, an expert in platform product management previously at ADP and ShopLatinx.

"Existing practice management software requires clinicians to manually self-navigate the expensive and complicated business formation process before they're able to utilize any of their product services," says Amaro in a news release. Click here to continue reading.