what's trending

5 most popular innovation stories in Houston this week

Editor's note: Another week has come and gone, and it's time to round up the top headlines from the past few days. Trending Houston tech and startup news on InnovationMap included innovators to know, a guest column about pitching to venture capital, virtual events not to miss, and more.

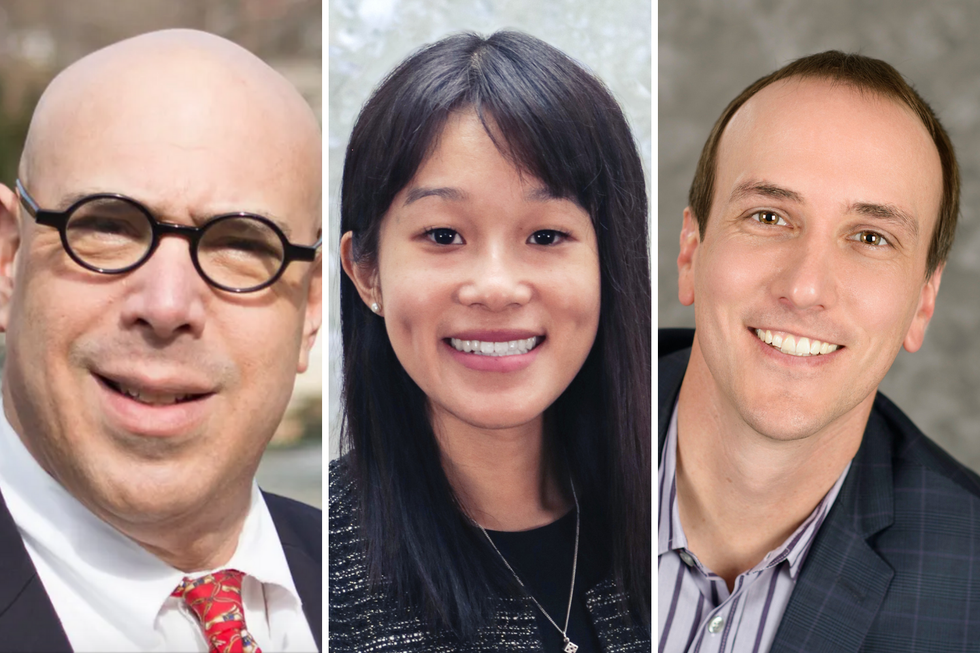

3 Houston innovators to know this week

This week's roundup of Houston innovators includes Richard Seline of the Resilience Innovation Hub, Deanna Zhang of Tudor, Pickering, and Holt, and Brad Hauser of Soliton. Courtesy photos

In the week's roundup of Houston innovators to know, I'm introducing you to three innovators across industries recently making headlines — from resilience technology to energy innovation. Click here to read more.

10+ can't-miss Houston business and innovation events online in March

Register for some of these informative online events happening throughout the month of March. Photo via Getty Images

March marks a full year of attending online events — from Zoom panels to virtual conferences. But, the shows must go on with another month full of online innovation and startup events that Houston innovators need to know about.

Here's a roundup of virtual events not to miss this month — from workshops and webinars to summits and pitch parties. Click here to read more.

Rice Alliance event identifies 4 most-promising energy tech companies at CERAWeek

CERAWeek attendees identified the four energy tech companies to watch. Photo via Getty Images

Wondering what energy tech companies you should keep an eye on? Wonder no more.

As a part of 2021 CERAWeek by IHS Markit, the Rice Alliance for Technology and Entrepreneurship hosted a virtual pitch competition today featuring 20 companies in four sessions. Each entrepreneur had four minutes to pitch, and then a few more to take questions from industry experts.

"Of the companies here today, we've intentionally selected a diverse group," says Brad Burke, managing director of the Rice Alliance at the start of the event. "They range from companies looking for their seed funding to companies that have raised $20 million or more." Click here to read more.

What Houston startup founders looking for funding need to know about working with VCs

Raising funds anytime soon? Take these tips from a venture capital insider into consideration. Photo via Getty Images

I have had the incredible opportunity to work with New Stack Ventures as a venture fellow, and after sourcing investment opportunities, shadowing calls with founders, and even leading a couple calls of my own, I have learned a few lessons that might resonate with startup founders who are raising capital.

So, be bold, be responsive, and tell your story to any and every VC who will listen. I'm all ears. Click here to read more.

Deloitte names new Houston-based O&G leader with focus on innovation and inclusion

Amy Chronis, who oversees the Houston office for Deloitte, has a new role she will be adding on to her plate. Photo courtesy Deloitte/AlexandersPortraits.com

Amy Chronis has had a big year. First, she took over as the Greater Houston Partnership's 2021 chair. And on February 25 she was named a vice chairman of Deloitte LLP and leader of its oil, gas, and chemicals sector.

In her new role, Chronis will lead the overall strategic direction of Deloitte's oil and gas arm while she continues to serve as managing partner of the company's Houston office. She succeeds Duane Dickson, who will be retiring from the leadership role in May.

Chronis is a licensed CPA and known to be a thought leader in aspects of the energy transition with a 30-year background in the oil and gas, technology, and manufacturing industries. Click here to read more.