Last week, the Rice Alliance for Technology and Entrepreneurship gathered over 1,000 life science experts and attendees virtually for thought leadership as well as 40 company presentations.

The three-day 2020 Virtual Texas Life Science Forum was made possible through a partnership with BioHouston and support from Texas Medical Center and Insperity. At the close of the summit, several companies were recognized with awards.

Houston-based Starling Medical won the Michael E. DeBakey Memorial Life Science Award, established by BioHouston in honor of the groundbreaking Houston cardiovascular surgeon. The digital health device company is revolutionizing severe bladder dysfunction management with artificial intelligence.

Every year at the forum, the Rice Alliance names its 10 most promising companies working on developing innovative solutions in medical devices, digital health, diagnostics, pharmaceuticals, and therapeutics. This year, Brad Burke, managing director of the Rice Alliance, says they had more applications to present than ever before. Additionally, the presenting companies — about half of which are Houston-based — have already raised more than $275 million in funding.

The 2020 most-promising life science companies, which were chosen by investors and presented by the Greater Houston Partnership, were:

Droice Labs

Image via droicelabs.com

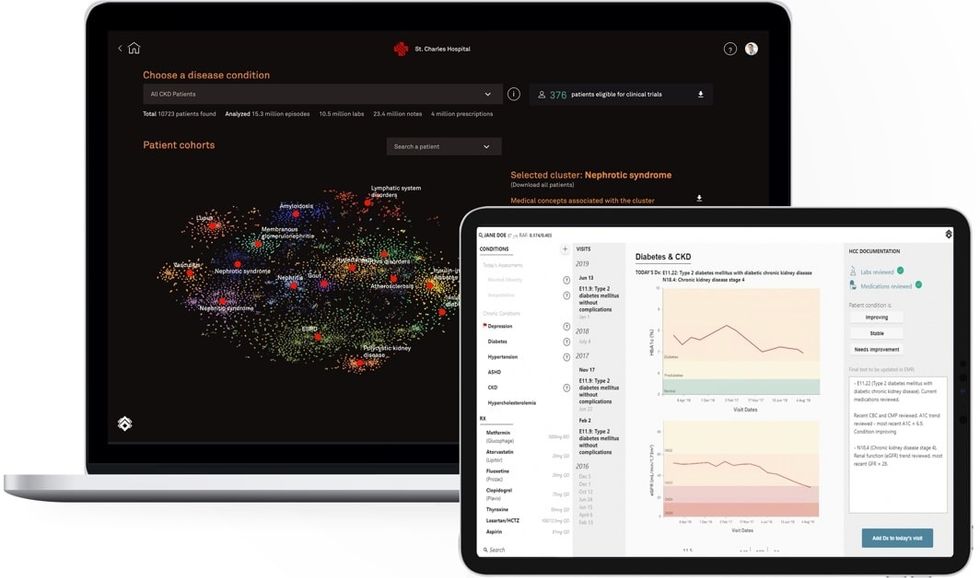

New York-based Droice Labs, is an artificial intelligence and big data company matches patients to therapies and delivers personalized medicine at scale while reducing costs.

"Our cutting-edge technology seamlessly integrates into clinical workflows, and we continue to evolve unique and powerful applications for our clients and the patients they serve," reads the company's website.

SFA Therapeutics

Image via sfatherapeutics.com

Based in Jenkintown, Pennsylvania, SFA Therapeutics is developing oral drugs for treating conditions of chronic inflammation that have the potential to change the practice of medicine. The company has treatments for Psoriasis, Liver Cancer (Hepatitis B, NASH and HCC), Ophthalmic Diseases, Cytokine Release Syndrome- a side effect in CAR-T, Prevention of Relapse/Recurrence in Leukemias, and other diseases.

Hummingbird Bioscience

![]()

Photo via jlabs.jnjinnovation.com

Hummingbird Bioscience, based in Houston's JLABS @ TMC, is tackling challenging targets that play a key role in disease yet have not been effectively drugged. The company has worked on 12 therapies in various stages of development, four of which have the potential to revolutionize their fields.

"At Hummingbird, we believe that modern approaches to systems biology and data science can overcome the challenges of classical methods of therapeutics discovery, and profoundly improve the way we deliver new transformative medicines," reads the company website.

CaseCTRL

Image via casectrl.com

Houston-based CaseCTRL is empowering surgeons with a management platform with software-as-a-service technology that uses AI and logistics to lower operational costs and simplify surgical planning.

"The surgical scheduling process is frustratingly stuck in the past: siloed, paper-based, and too dependent on single schedulers," reads the website. "Surgeons are stressed and overworked. They need a better way to communicate their complex surgical plans, timelines and resource needs."

Perimeter Medical

Image via perimetermed.com

Perimeter Medical, based in Dallas, is driven to transform cancer surgery with advanced, real-time, ultra high-resolution imaging tools including AI to address areas of unmet medical need.

"Perimeter is dedicated to providing solutions that drive better patient care and lower healthcare costs by providing critical information, during clinical procedures," reads the website.

Studio Bahria

Image via studiobahia.org

San Antonio-based Studio Bahia, is developing an accessible model for therapy in addressing mental health crises from the pandemic through virtual reality.

"We are in production of our first two therapies for release in the 4th quarter of 2020. Studio Bahia clients include corporate, retail, and institutional partners who purchase our headsets for $25 in providing mental health therapies and wellness tools to employees, executives, and patients," reads the company's website.

Tvardi Therapeutics

![]()

Photo via Getty Images

Tvardi Therapeutics, based in Houston, is a clinical-stage biopharmaceutical company focused on the development of a new class of breakthrough medicines for diverse cancers and chronic inflammatory and fibrotic diseases.

"Tvardi is focused on the development of orally delivered, small molecule inhibitors of STAT3, a key signaling molecule positioned at the intersection of many disease pathways," reads the website.

Koda Health

Image via kodahealthcare.com

Koda Health, Houston, uses AI to help guide difficult conversations in health care, starting with end-of-life care planning.

"You're entitled to protect the healthcare decisions that matter most to you and your family," the company's website promises. "Koda creates Care Plans to ensure that you get the medical care you want."

Immuno Genesis

![]()

Photo via Getty Images

Houston-based ImmunoGenesis is a clinical-stage biotechnology company developing therapeutics to catalyze effective immune responses in immunologically "cold" cancers such as prostate, colorectal, and pancreatic.

"Compared to existing immunotherapy drugs, we believe this antibody will both provide more consistent benefit for patients with immune-infiltrated tumors, and, for the first time, will also benefit patients with immune 'cold' cancers," says founder Dr. Michael A. Curran in a press release announcing the company's grant from the Cancer Prevention and Research Institute of Texas.

Ictero Medical

![]()

Image via Getty Images

Ictero Medical, based in Houston, is developing the first minimally invasive cryoablation solution to treat patients with gallstone disease. Ictero Medical has created a minimally invasive treatment, called The CholeSafe System, that uses cryoablation to defunctionize the gallbladder without having to remove it.