For nearly a decade, the Texas Medical Center and its partners have been working on the plans for Helix Park, a 37-acre campus expansion of TMC. As of this week, the first building has opened its doors to the public.

The TMC3 Collaborative Building officially opened today to a crowd of media, public officials, and health care executives. The institutional agnostic, 250,000-square-foot building will anchor Helix Park and house research initiatives from the four founding partners: Texas Medical Center, The University of Texas MD Anderson Cancer Center, Texas A&M University Health Science Center, and The University of Texas Health Science Center at Houston.

“Today, we lay the cornerstone of a new campus fully dedicated to streamlining the commercialization of life-changing innovations in medicine and technologies,” William McKeon, president and CEO of TMC, says at the event. “We are incredibly excited to both welcome our founding institutions and industry partners to the Collaborative Building and to invite the community to experience the Helix Park campus and its beautiful parks with a series of special events in the months ahead."

Established to be a place for academic institution collaboration, the building — designed by Boston-based Elkus Manfredi Architects — will have wet laboratories, office space, and event facilities. Two venture groups — Portal Innovations and the TMC Venture Fund — will also move into the building.

Each institution will bring in select programs and initiatives. MD Anderson will house two institutions within the new building, including the James P. Allison Institute focused on immunotherapy and the Institute for Data Science in Oncology.

"The future of life sciences in Houston is brighter than ever before as we come together to officially open the TMC3 Collaborative Building,” Dr. Peter WT Pisters, president of MD Anderson, says. “Our clinicians and scientists work daily to advance innovations in cancer research and care – all of which will be amplified in this new environment within Helix Park that further cultivates collaboration, connectivity, and creativity.”

UTHealth will move its Texas Therapeutics Institute into the facility.

“With a shared commitment to improving the health and well-being of individuals and communities, we are bringing together academics and industry to accelerate discovery and medical breakthroughs,” Dr. Giuseppe N. Colasurdo, president and Alkek-Williams Distinguished Chair at UTHealth Houston, says. “Through the Texas Therapeutics Institute — already a signature collaborative enterprise at UTHealth Houston — our world-renowned leaders in therapeutic antibody development will have the opportunity to work closely with other leading researchers in the Texas Medical Center, greatly enhancing our collective ability to translate discoveries and ideas into effective treatments.”

Texas A&M, which has worked with Houston Methodist to develop its engineering medical program, will operate its Texas A&M Health’s Institute of Biosciences and Technology in the new space.

“As we open this state-of-the-art facility, we’re opening the door to a new era of collaboration. This building signifies the dismantling of silos to deliver game-changing therapies for the toughest diseases impacting Texans and citizens worldwide,” said John Sharp, Chancellor of The Texas A&M University System. “Texas A&M Health’s Institute of Biosciences and Technology has long been a trailblazer in drug discovery, and now, in the heart of this resource-rich ecosystem of the Texas Medical Center, we’re taking it up a notch. By positioning our scientists near their peers and esteemed clinicians, we’re igniting a spark that will fuel innovation and forge dynamic research programs.”

The next aspect of Helix Park to deliver will be the Dynamic One, a 700,000-square-foot industry research facility. Several other buildings, including a hotel, residential tower, and mixed-use building, are expected to deliver over the next few years. The "spine" of the project is six linked green spaces, designed by landscape architect Mikyoung Kim, that form an 18.7-acre campus, which is shaped like a DNA helix, hence the project's name.

At the opening event, leaders discussed the annual impact of over $5.4 billion expected after the campus is completed, and the 23,000 permanent new jobs and 19,000 construction jobs anticipated from Helix Park.

"Texas truly is the home of innovation. Our energy innovations are legendary, as are our innovations in space," says Texas Governor Greg Abbott, naming several of the state's innovative accomplishments. "Long before all of this innovation we're seeing now, Texas was the home of the Texas Medical Center."

Mayor Sylvester Turner spoke to the importance of collaboration.

"Individually, you can do things very well. Collectively, you can be transformational," he says. "One thing about this city, collaboration is the key. When we play well together, and when we build an integrated, robust ecosystem, everyone wins. That's Houston, and that's the way we operate."

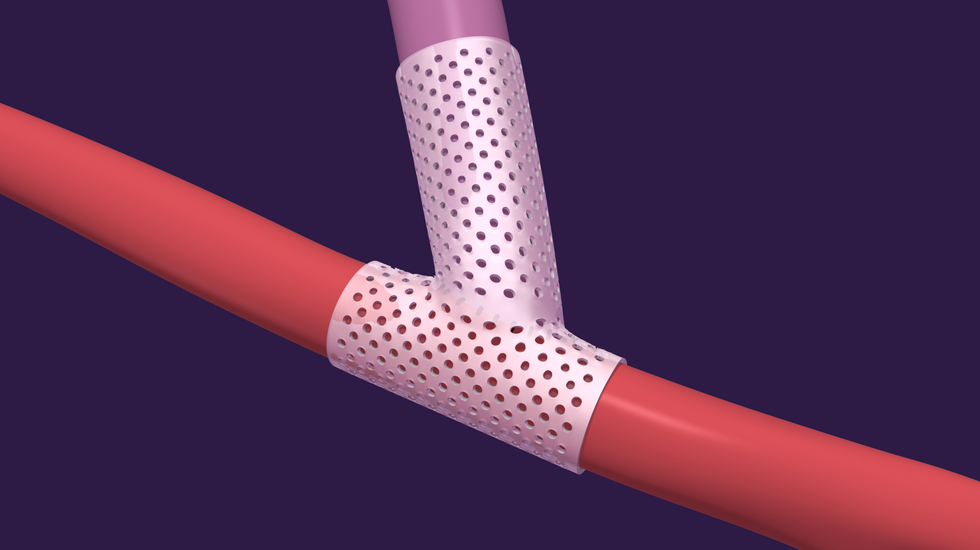

VenoStent's novel therapeutic medical device is a bioabsorbable wrap. Image courtesy of VenoStent

VenoStent's novel therapeutic medical device is a bioabsorbable wrap. Image courtesy of VenoStent Tim Boire is the CEO of VenoStent. Photo via LinkedIn

Tim Boire is the CEO of VenoStent. Photo via LinkedIn